UNCERTAINTY ABOUNDS

Financial markets dislike the unknown, especially if uncertainty could have a meaningful impact on economic activity. The Trump Administration’s use of tariffs to “level the playing field” with trade could support U.S. economy in the long-term, however, the near-term impact is unsettling. For now, there is a disconnect between soft data (what economic participants feel and think) and hard data (what economic participants do). Equity markets are trying to digest this conflicting information, discounting earnings slightly and the valuation by a larger degree. The S&P 500 index declined -18.8% from the highest point on February 19 to the lowest point on April 8. Following this decline, market analysts revised their outlook for year-over-year earnings expectations downward by about 6%, from 14.4% to 8.7% in 2025. Looking forward to 2026, earnings estimates have changed very little with 14% year-over-year earnings growth expected. Unless there’s a material change to next year’s earnings and continued deterioration in 2025, the stock market should be able to withstand economic bumpiness brought on by uncertain trade policy. The earnings trajectory is dependent on hard data not following the extreme downward path of soft data and the Federal Reserve’s capacity to cut rates as the economy inevitably softens amid weaker global trade activity. To navigate these cloudy skies, investors should be focused on risk-adjusted returns now more than ever across the risk spectrum.

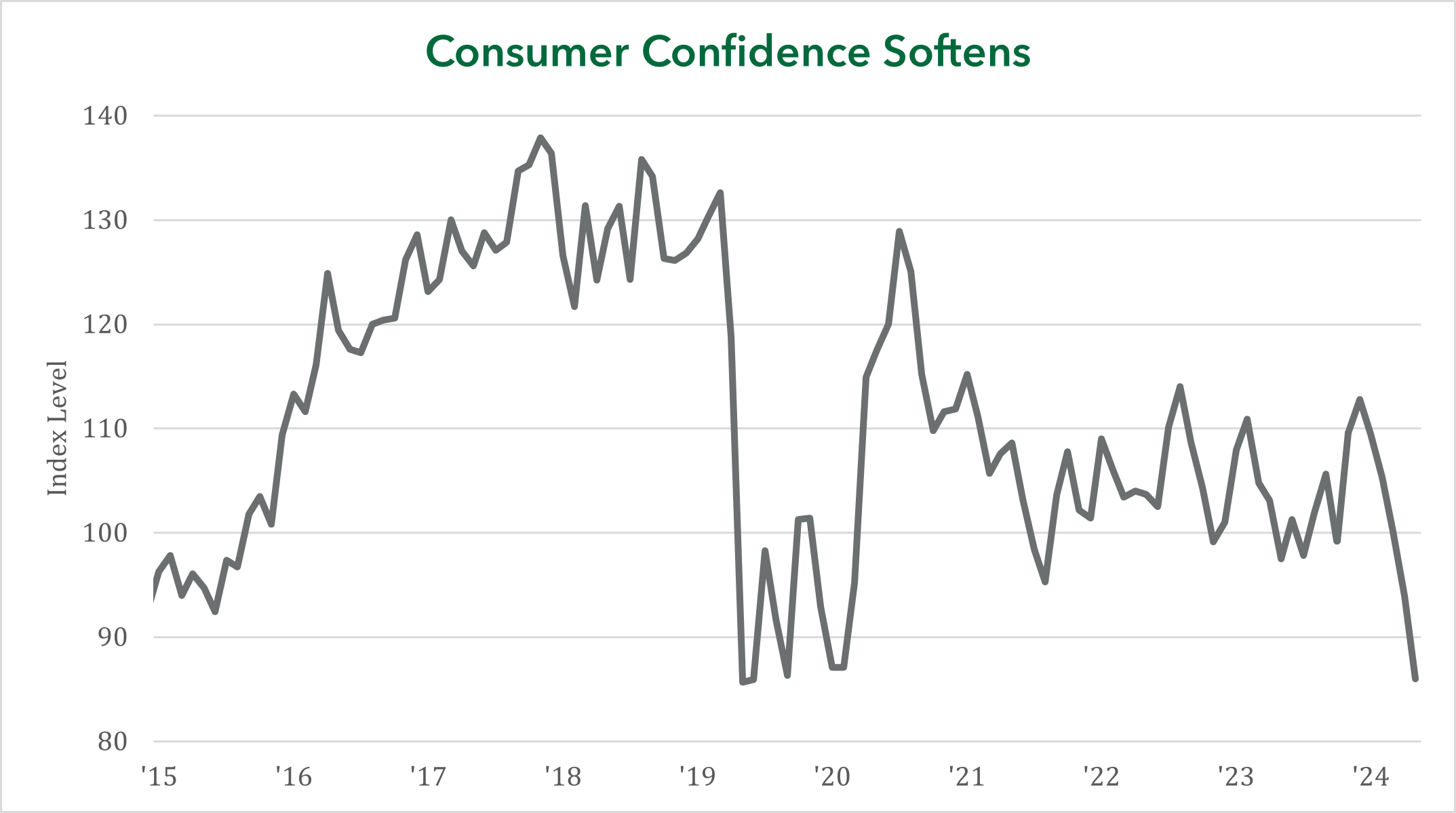

FOLLOW THE CONSUMER

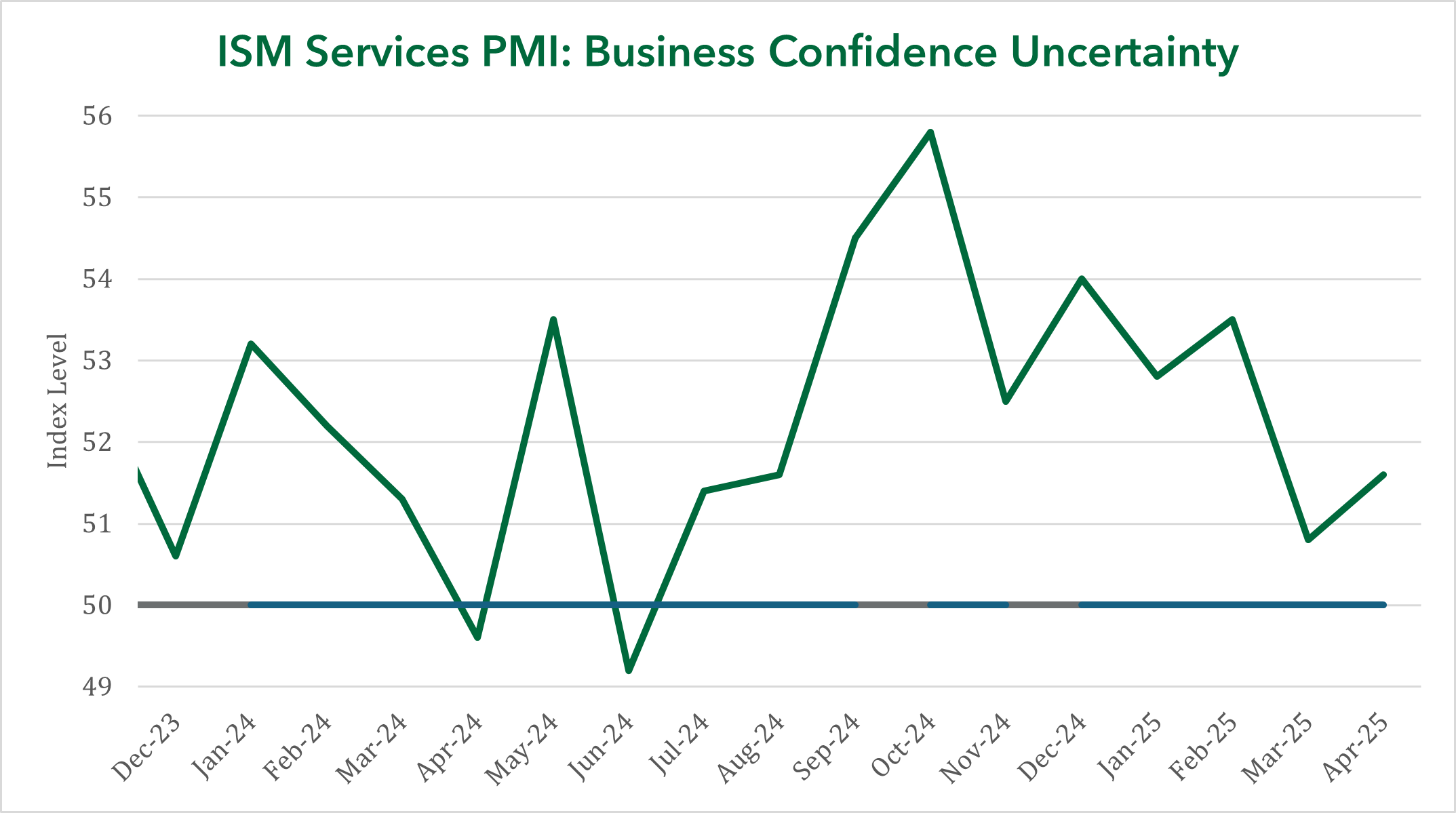

Weaker sentiment doesn’t always translate to negative economic activity, despite the grave concerns over trade. The Conference Board Consumer Confidence Index, a reflection of consumer feelings, has weakened considerably in the first quarter of 2025. The index has declined to the lowest point since early 2020, as consumer expectations are testing lows last seen in 2013. Weaker sentiment is being felt by businesses, too. The Institute for Supply Management Non-manufacturing PMI has declined from 55.8 in October 2024 to 51.6 in April 2025, while the Manufacturing PMI has returned to a contraction territory of below 50. Succinctly, consumers and businesses are not feeling positive, but that doesn’t necessarily have to translate into weaker real economic activity. If a resolution in tariff negotiations comes quickly, the negative feedback loop from sentiment to real economic decisions can be skipped.

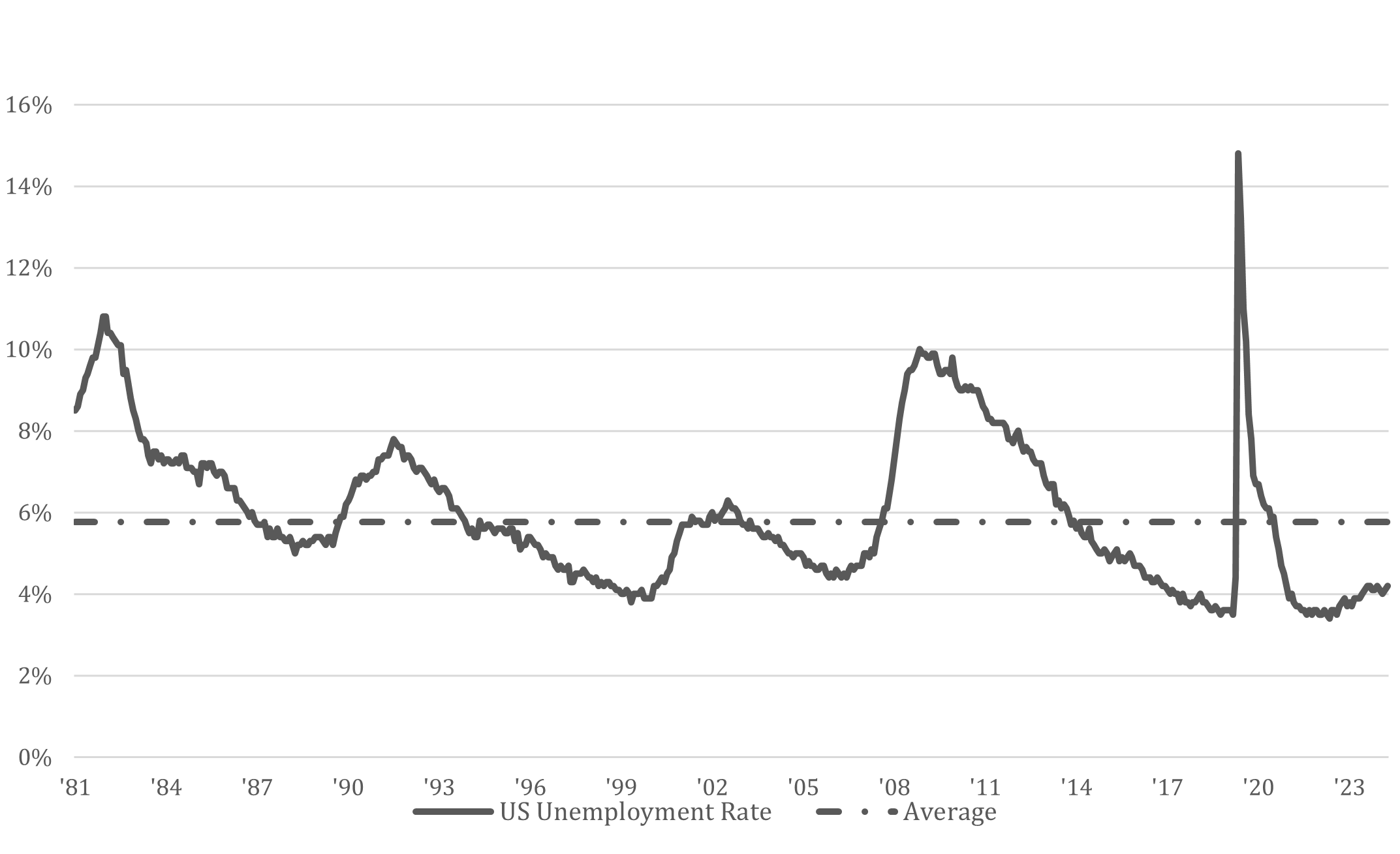

So far, the economy has been able to withstand uncertainty caused by tariffs. Most notably, the labor market has remained firm. Leading indicators of jobs are showing no signs of dramatically slowing. Initial jobless claims, a weekly indicator tracking the number of people filing jobless claims, totaled 228,000 on May 3, which is only slightly higher than the 3-year average of 219,000. On top of the few job cuts, hours worked in manufacturing accelerated from late last year to 40.2, only a tick lower than the 20-year average. Outside of leading labor indicators, the monthly tabulation of job additions is growing at an above-average rate over the past three years. In April 2025, 177,000 jobs were added to the economy and the unemployment rate is at historically low levels. The biggest component of the U.S. economy, consumption, should be spared, as a result. Retail sales have grown at a 0.8% clip for the last two months and payment company American Express affirmed its outlook based on affluent customers continuing to spend. Some of this spending can be attributed to a pull forward ahead of tariffs, but until there’s a meaningful decline in jobs, consumer spending should only be marginally affected.

Unemployment Rate

Unemployment rate has stabilized around 4%

FEDERAL RESERVE: WAIT AND SEE

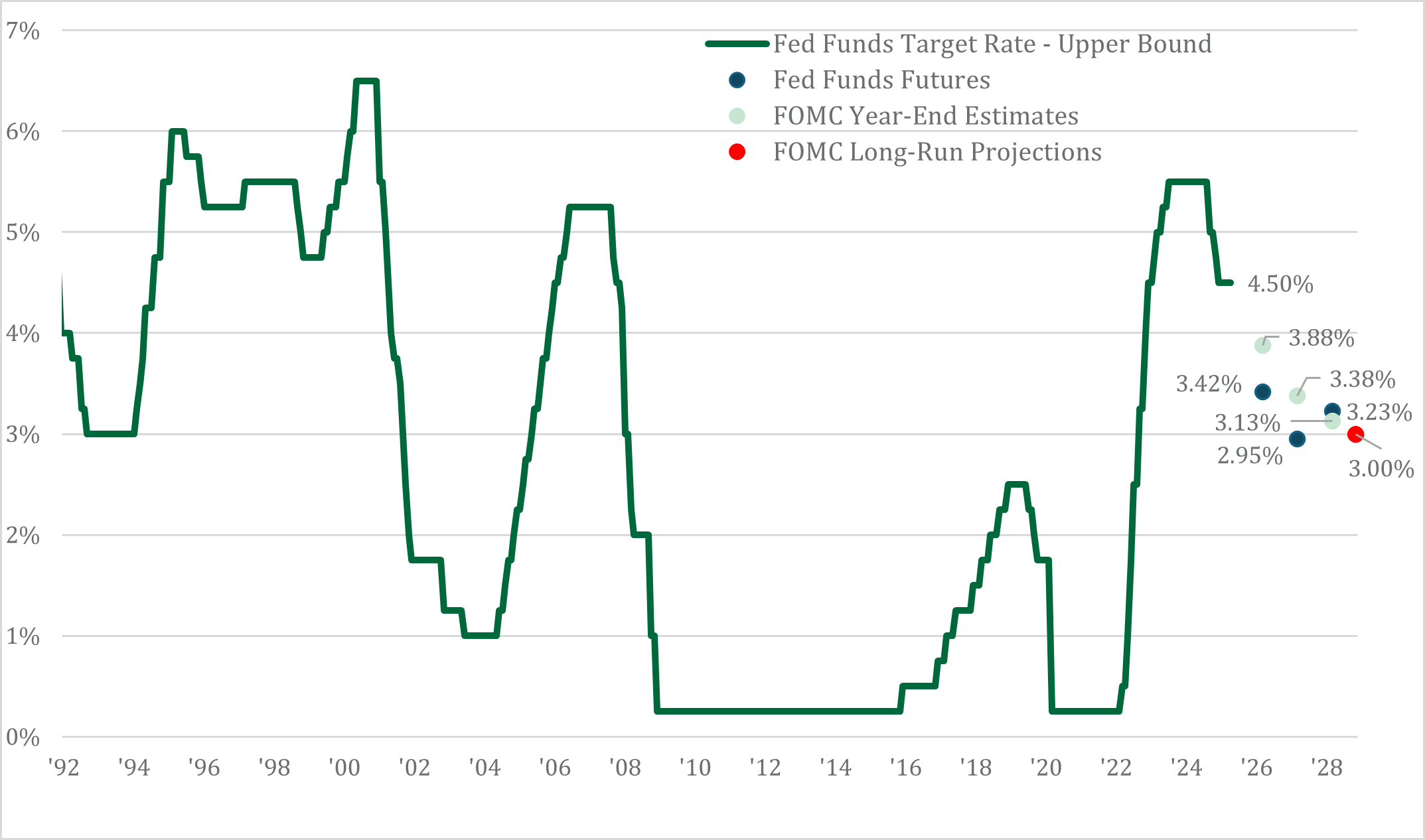

Despite the inflationary implications of tariffs, the Federal Reserve is expected to shift its attention from prices to economic growth. Federal Reserve chair Jay Powell acknowledged the inflationary impact of tariffs could be more persistent than expected. With that being said, the market is more concerned about economic activity than inflation. The Federal Reserve’s target rate, the interest rate set by the Federal Open Market Committee, stands at a level of 4.5% in April. To combat the potential slowing growth feedback from tariffs, the market expects two, 0.25% rate cuts the rest of 2025 and two, 0.25% rate cuts in 2026 (as of May 20). The number of rate cuts has fluctuated in the past couple of months on tariff headlines, which has sparked an increase in longer maturity rate volatility. The 10-year Treasury yield jumped to 4.8% in January, declined to 4% in early-April, then moved back up to just under 4.5% in mid-April. Uncertainty in interest rates typically changes the mindset of investors to demand higher quality assets. In fixed income markets, Treasury bond markets have outperformed investment grade corporate bonds and non-investment grade bonds through the end of April.

Fed Funds Rate Expectation: Market & FOMC

Expectation of two 0.25% cuts through 2025.

A VOTE FOR VALUE?

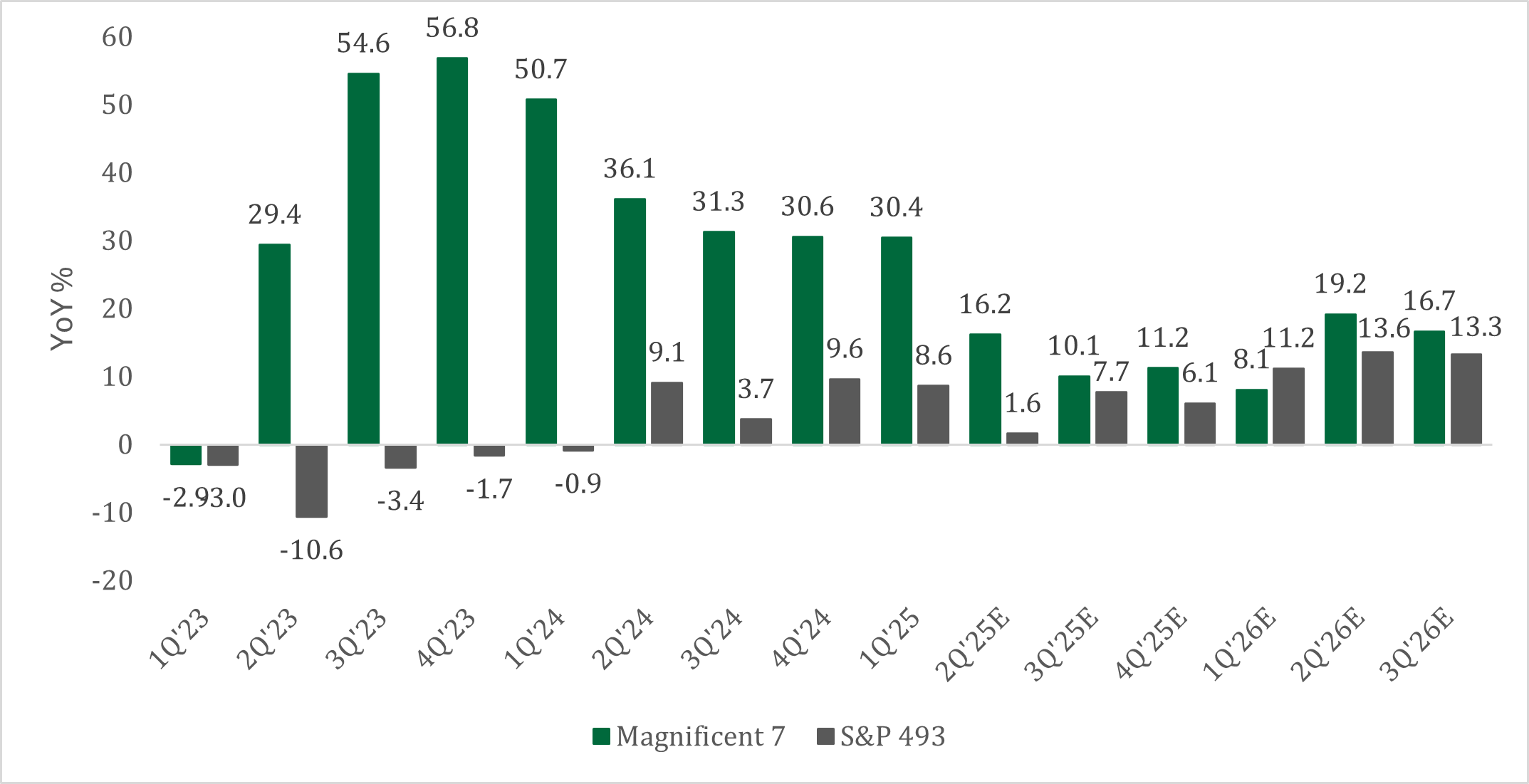

This shift in investor mentality has also played out in equity markets, as value stocks have outperformed growth stocks through the end of April. For much of the past two years, investors only gravitated toward mega-technology stocks, which are found in the growth segment of the market. The market capitalization of the top 10 stocks in the S&P 500 rose to a level of about 35%. Supporting this dislocation were fundamentals of growth relative to value stocks. This segment of the market exhibited a growth rate of ~36% in 2023 & 2024, compared to nearly 0% earnings growth for the rest of the stock market. This made mega-technology stocks susceptible to any change in market dynamics, especially since it was a crowded trade given its unique fundamental characteristics.

Two significant changes occurred to technology this year: tariffs and capital spending. Mega-technology stocks rely significantly on global trade. In addition to trade, capturing future earnings growth is reliant upon increased capital spending, which acts as a headwind for profit margins and growth. On the other hand, the value segment of the market has navigated the headwinds of the past two years and should exhibit earnings momentum this year into next year. Mega-technology stocks are only expected to deliver earnings growth of 14.6% in 2026, while the remaining members of the market are expected to grow 12.7%. Comparable earnings growth should support the lower price-multiple of the value segment going forward.

In addition to the fundamentals of the value segment improving, the qualities investors seek have changed, too. In times of economic uncertainty, income producing securities are in more demand as opposed to the promise of future growth that the growth segment offers. The S&P 500 Value index has a dividend yield of 2.2%, compared with the dividend yield of 1.3% for the overall S&P 500 index and the Magnificent 7 of 0.25%. This is especially important if interest rates were to decline as dividend-paying stocks are a substitute for lower interest rate bonds.

S&P 500 Index Earning Are Broadening

S&P 493 and Magnificent 7 fundamental picture converging

E: Estimated

S&P 493: The S&P 500 Index excluding Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta Platforms, and Tesla)

NICOLET’S INVESTMENT PHILOSOPHY

Our strict commitment to risk management has helped mitigate the extreme volatility in portfolios so far this year. In 2024, we decreased our position to high yield bonds, cut our interest rate risk as bond volatility has sustained, and kept a neutral equity position oriented to the lower volatility of value and global infrastructure stocks. These tactical moves limited our downside capture amidst stocks nearing bear market territory. By doing this, we have a greater ability to pivot when opportunities arise. The duration of the year will likely be challenging, but our investment philosophy focuses on constructing efficient portfolios by providing risk-adjusted returns.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.