Nicolet Wealth Management Monthly Newsletter

Investors Turn Defensive

The S&P 500 index, a representation of the 500 biggest companies in the U.S., declined 5.6% in March. The market was dragged lower by technology stocks, as their sky-high prices were questioned amidst increasing economic uncertainty. Despite the market succumbing to a correction (a 10% decline from its peak), not every stock segment saw declines so far in 2025. Sectors with defensive earnings and high dividend yields have exhibited gains. Consumer Staples, Healthcare, and Utilities sectors each have had gains of more than 4% in the first quarter of 2025.

Interest Rates Rangebound in March

Economic uncertainty arising from government spending cuts, tariffs, and stubborn inflation kept the 10-year Treasury bond yield at a range of 4.20% – 4.35% in March, with the yield ending the month near the bottom of that range. This came after the 10-year Treasury bond yield declined from 4.6% to start the year. In this environment, bonds with top credit ratings have benefited the most, as they typically have longer maturities and are less susceptible to risk-off market environments. Investment grade bonds have returned 2.5% in 2025, exceeding returns of bonds with lower credit ratings by 1.5%.

Tariffs Don’t Alter the Federal Reserve’s Rate Outlook – “Economy’s in a very good place”

As expected, the Fed’s target policy rate was kept unchanged at a range of 4.25% - 4.5%, while rate expectations continue to show two 0.25% cuts in 2025, two 0.25% cuts in 2026, and one 0.25% cut in 2027, roughly in line with the last meeting. Although, the Fed’s concern was expressed through its economic projections. Inflation expectations were revised higher at a 2.8% year-over-year rate and economic growth was revised lower to 1.7% in 2025. This is a relatively pessimistic forecast given the current strength of the labor market and productivity. During the post-meeting press conference, Federal Reserve chair Jay Powell reiterated patience, noting further progress on inflation and little evidence necessitating further adjustments in monetary policy.

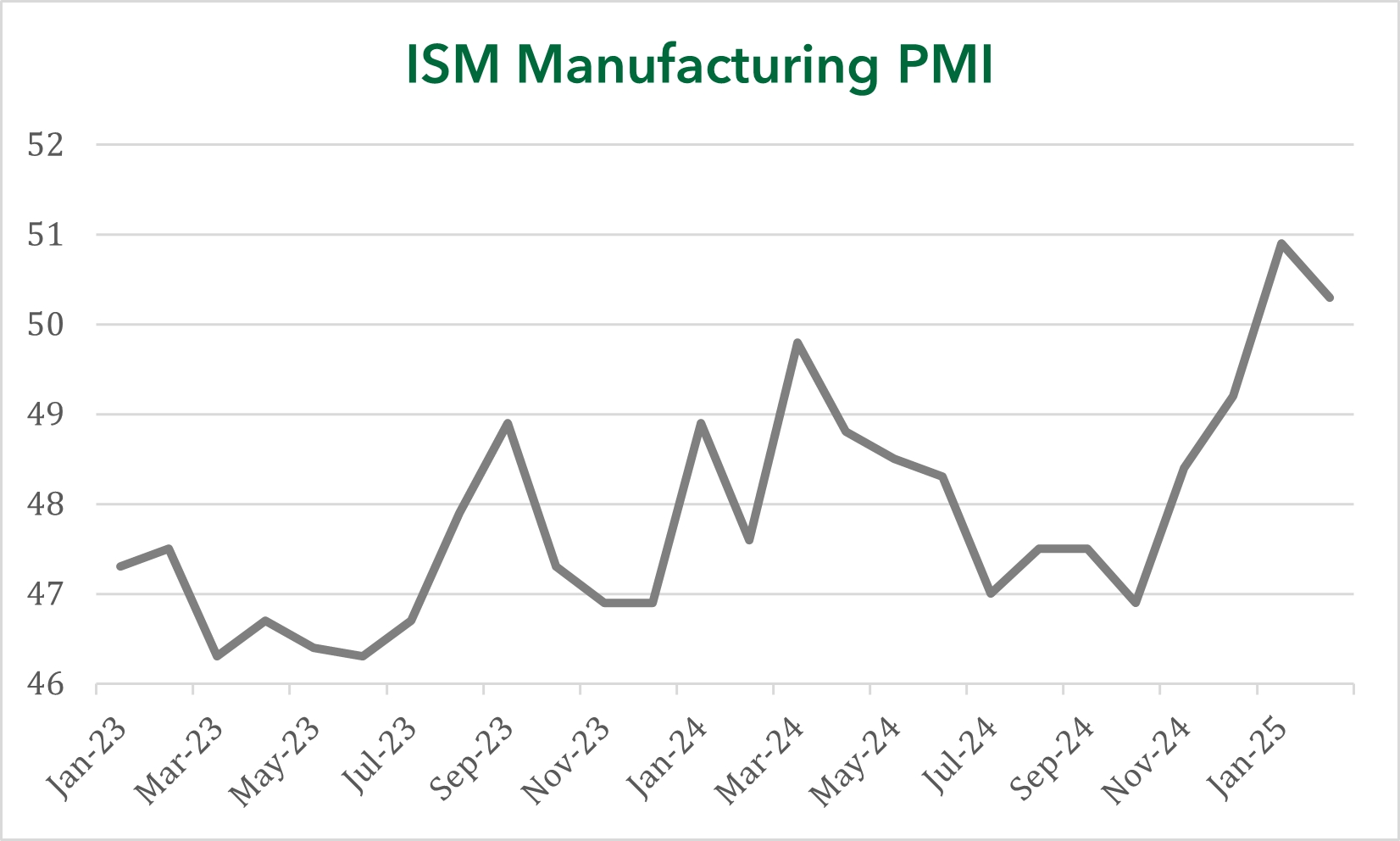

Business Surveys Slip

The Institute for Supply Management’s (ISM) U.S. manufacturing index, a survey of purchasing managers in the U.S. that gauges factory activity, dropped in February to a level nearing a decline in manufacturing activity (any level below 50). The price component of the survey surged to the highest level since June 2022 as manufacturers weigh rising costs’ impact on demand. So far, new orders retreated, reflecting the uncertain global economic environment with supplier deliveries slowing more significantly. It is too early to determine the real implications of tariffs on the economy, however leading indicators of economic activity have weakened.

International Stocks in the Pole Position, Closing out Q1

As investors assess the effect of tariffs on U.S. economic activity, international stocks were rewarded in the 1st quarter. The MSCI EAFE index (international developed) and MSCI Emerging Markets Index (emerging markets) have returned 7% and 3%, respectively. Earnings of international stocks have been revised higher in light of fiscal spending on defense, on top of a strong dividend yield that is in demand amidst investors seeking safety. Earnings growth estimates for international stocks in 2025 are expected to grow at a rate of 8.5%, while U.S. stocks have seen a considerable earnings revision this year. Amid uncertainty, investors have taken a preference for stocks with dividend yield and particularly international stocks with an average dividend yield of 2.8%, nearly double that of U.S. stocks.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.