Frequently Asked Questions

Credit Cards

How can I monitor the charges on my credit card?

Visit your app store to download the Nicolet Bank Digital app. Through the app, select Cards. This will allow you to monitor charges on any Nicolet Bank card you have in one spot.

or

Log onto Nicolet Bank Digital via a web browser (Google Chrome, Microsoft Edge, etc.). Hover over cards select either personal or business depending on the card type. Select the correct card, you will be able to view your Nicolet credit card activity.

How do I make a credit card payment?

There are several different options for making a credit card payment.

1. Log onto Nicolet Bank Digital via a web browser (Google Chrome, Microsoft Edge, etc.). Hover over cards select either personal or business depending on the card type. Select the correct card, locate the Make a Payment button, then follow the instructions to complete a credit card payment.

2. Log onto the Nicolet Bank Digital mobile app and select Cards. Next, swipe to your credit card, select the Pay Balance options and follow the instructions.

3. Visit or call your local branch OR call 1-800-369-0226 to make a credit card payment over the phone.

How do I set up recurring/automated credit card payments?

There are several different options for setting up recurring credit card payments.

- Log onto online banking via a web browser (Google Chrome, Microsoft Edge, etc.). Click on the last four digits of your credit card at the bottom of the screen that shows all your accounts. After selecting the correct card, locate the Payments tab, select Manage under the autopay section and follow the instructions.

- Log onto the personal BankNOW mobile app and select Cards. Once in My Cards, swipe to your credit card, select the Pay Balance options and follow the instructions.

- Visit or call your local branch OR call 1-800-369-0226 to set up reoccurring credit card payments.

How do I redeem my credit card reward points?

1. Log onto Nicolet Bank Digital via a web browser (Google Chrome, Microsoft Edge, etc.). Hover over cards select either personal or business depending on the card type. Select the correct card, click on the Rewards icon and click Continue. On the top of the uChoose Rewards page, select Redeem Points to use your accrued credit card points.

2. Log onto the Nicolet Bank Digital mobile app and select Cards. Once in Cards, swipe to your credit card, tap on Rewards under Card Details and click Continue. On the top of the uChoose Rewards page, select Redeem Points to use your accrued credit card points.

How do I report my card lost or stolen?

1. If your card is stolen or lost, please call your banker or our Customer Service number at 1-800-369-0226, Monday – Friday, before 6:00 p.m. CT. You may also stop into your local branch and speak with a banker to turn off your card and get a new one.

2. If you need to report your card lost or stolen on a weekend or evening, call Card Services at 1-877-864-6525. Then contact your local branch during regular business hours to request a new card.

3. Log onto Nicolet Bank Digital via a web browser (Google Chrome, Microsoft Edge, etc.). Hover over cards select either personal or business depending on the card type. Select the correct card, Toggle Card to off

4. Log onto the Nicolet Bank Digital mobile app and select Cards. Once in Cards, swipe to your credit card, toggle Card to Off.

How do I apply for a credit card?

To apply for a credit card, stop in your local branch, or apply online.

Debit Cards

How can I monitor the charges on my debit card?

Visit your app store to download the Nicolet Bank Digital app. Login to the Nicolet Bank Digital app, select Cards. This will allow you to monitor charges on any Nicolet Bank card you have, all in one spot. Additionally, you can view all account transactions by selecting the account through your Nicolet Bank Digital mobile app.

How do I add a travel notice on my debit card?

To let us know that you’ll be traveling and may have unusual activity on your card, please call Customer Service at 1-800-369-0226 or stop in to your local branch.

You can also open your debit card for travel via the Nicolet Bank Digital app. To add a travel notice via Nicolet Bank Digital, select Cards, swipe to your debit card, select Manage Travel Plans and enter your Travel dates & location(s).

How do I report my card lost or stolen?

If your card is stolen or lost, please visit your local branch or call Nicolet Customer Service at 1-800-369-0226. You may also stop into your local branch and speak with a banker to have a new card printed and activated.

You can also turn off your card via the personal Nicolet Bank Digital app. Login to Nicolet Bank Digital, select Cards. Swipe to your debit card and turn your card off. You may stop at your local branch to pick up a new instant issue debit card during normal business hours.

How do I activate my debit card or set up/reset my debit card PIN?

You can activate your debit card or establish and/or reset your debit card PIN by calling 1-800-992-3808.

You can also Activate card via the personal Nicolet Bank Digital app. Login to Nicolet Bank Digital, and select Cards. Swipe to your debit card and tap “Activate Card”. Enter requested Card information to complete Activation.

How do I raise the limit on my debit card?

To raise the limit on your debit card, please call 1-800-369-0226 or stop in your local branch.

Why isn’t my debit card working?

Please call Customer Service at 1-800-369-0226 or stop in your local branch for card assistance.

Loans

How do I apply for a loan?

You can apply for any type of loan we offer by stopping in your local branch. Mortgage loans can be applied for online.

How do I make a loan payment?

Please call Customer Service at 1-800-369-0226 or stop in to your local branch to process a loan payment. You may also pay online under the "transfer" tab in online banking (excluding construction loan payments).

How do I know if my escrow is being paid?

Please call your mortgage lender, stop in at your local branch or call Customer Service at 1-800-369-0226.

Online/Mobile Banking

This is my first time logging into online banking...where do I start?

Once you have accessed NicoletBank.com, click the "login" box in the upper right corner of the page.

Click the "Enroll now" link underneath the "login" button. You will then be walked through the remaining enrollment steps.

If you have any questions or need assistance, call Customer Service at 1-800-369-0226.

How do I make a mobile deposit?

Open the Nicolet Bank Digital app and click on the Deposit tab. You will be prompted through the remaining steps to make a deposit. If you have any questions or need assistance, call Customer Service at 1-800-369-0226.

Deposits made via the Nicolet Bank Digital app may take 24 hours to process. We do not process transactions Saturday and Sunday. To review your mobile deposit history or check the status of a new mobile deposit, select “History” under the Deposit tab.

What are the cutoff times for making a mobile deposit/ATM deposit?

Any deposit made at the ATM after 8 p.m. Monday-Friday or on Saturday or Sunday will be processed the next available business day. Deposits made via the Nicolet Bank Digital app may take 24 hours to process. We do not process transactions Saturday and Sunday.

How do I make internal or external account transfers?

Log onto your Nicolet Bank Digital app or desktop online banking, click "Transfer" (top of the webpage or bottom of the mobile app), distinguish whether it’s an internal or external transfer, and follow the steps given.

Internal transfers are used to transfer money between your accounts at Nicolet and can be instant, future dated, or reoccurring.

External transfers via the Nicolet Bank Digital app must be transferred to an account with your name on it, at another institution. External transfers can take 3 business days to be complete. You can also call Customer Service at 1-800-369-0226 to make an internal transfer between Nicolet accounts.

How do I set up alerts for my accounts?

You can set up alerts by logging onto your online banking on a web browser, and clicking "alerts". Push notifications can be set up via the Nicolet Bank Digital mobile app.

How do I switch to eStatements?

Log onto your online banking, locate "Additional Services" at the top of the page, select "Documents". Follow the enrollment instructions to complete the setup. If you are unable to edit the electronic statements, please call Customer Service at 1-800-369-0226.

Having trouble logging into your online banking?

If you are a current user and are having trouble accessing your account, call or stop in your local branch, and a personal banker will assist. You can also call Customer Service at 1-800-369-0226.

General Bank Information

What is the Nicolet National Bank routing number?

075917937

What are the branch locations/hours/other info?

Please visit NicoletBank.com and click on Locations & ATM's.

How do I open a new account?

You can open a new account by stopping in your local branch, by visiting the Nicolet National Bank website, or by logging into Nicolet Bank Digital.

Nicolet National Bank Website: Click the tab near the top that says "personal," then click on the type of account that you wish to open. Once you are on the product page, click the "open account" tab and follow the steps.

Nicolet Bank Digital: Login, then clock on the “Open Account” tab. Select the product you wish to open and click submit. Follow the steps to complete the process.

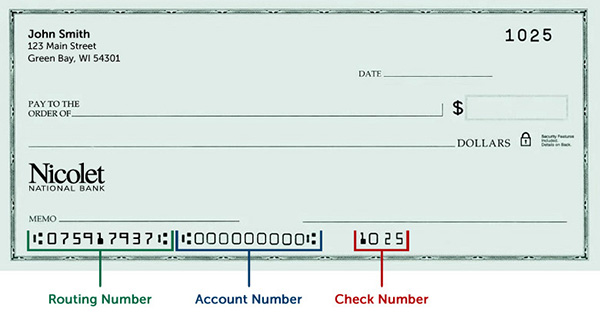

Where do I find my account number?

1. Stop in your local branch, or call Customer Service at 1-800-369-0226 to request your account number.

2. If you have checks, your account number is the second set of numbers on your check. It is usually a seven digit number.

3. Your account number can be found in the Nicolet Bank Digital app or web browser by clicking into the account, expand the details to see the full account number.

How do I order checks online?

You can order checks online by visiting the Deluxe Checks website, logging into Nicolet Bank Digital, stopping in at your local branch, or by calling Customer Service at 1-800-369-0226.

Does Nicolet provide blank checks (cashier’s checks) for their customers?

Nicolet does allow three free cashier’s checks per month for customers. We do not provide money orders.

How can I make a deposit into my account after bank hours?

1. You can make a cash or check deposit to any account(s) linked to a debit card at Nicolet from select ATMs. Any deposit made after 8:30 p.m. CT will be processed the next business day. Please view our branch/ATM locations to locate the nearest deposit accepting ATM.

2. You can deposit a check into your account(s) via the Nicolet Bank Digital app. Log onto the Nicolet Bank Digital app, and click "Deposit" at the bottom. Deposits made via the Nicolet Bank Digital app may take 24 hours to process. We do not process transactions Saturday and Sunday.

Where are the Nicolet ATM’s located, and when would I be charged a fee?

Visit our Nicolet National Bank locations & ATM’s page to locate the closest Nicolet ATM near you or log in to the Nicolet Bank Digital Mobile app and select "Location" under "More". You can find a list of non-Nicolet ATM’s that will not charge a fee on the app or by clicking the “MoneyPass ATM” option on the Nicolet ATM page.

How do I add or change beneficiaries on my accounts?

You can add or change beneficiaries on your accounts by stopping by your local branch to speak with a banker. To schedule an appointment, call Customer Service at 1-800-369-0226, or schedule on the website.

How can I update my personal information?

You can update your personal information by stopping in at your local branch, or through the profile tab in online banking.

How do I get a copy of my statement?

You can obtain a copy of your statement by stopping into your local branch, or through online banking. Click on the desired account within online banking and click "Online Statments" at the top of the page.

Online statements are only available for accounts enrolled in electronic statements.

Can I cash in my savings bonds or purchase savings bonds at Nicolet?

Savings bonds can be cashed in at any Nicolet location by Nicolet Bank customers only.

Savings bonds can only be purchased at https://www.treasurydirect.gov/

Can I continue to use my former bank's routing number?

Important Update for Routing Number Retirements for our Personal Customers

Business customers: Learn more

Nicolet National Bank will be retiring the following former bank routing numbers in 2024 and 2025. If you are using a former bank’s routing number on direct deposits, automatic payments or paper checks, those items will need to be updated to Nicolet Bank’s Routing Number 075917937.

After these retirement dates, the payments, deposits or checks cannot be processed with the retired routing number:

| Bank | Routing Number | Year Acquired | Retirement Date |

| Choice Bank | 075918075 | 2019 | April 19, 2024 |

| First National Bank of Niagara | 075909589 | 2016 | May 6, 2024 |

| Peninsula Bank | 091101316 | 2014 | May 6, 2024 |

| The First National Bank of Eagle River | 091505093 | 2016 | May 13, 2024 |

| First Federal of Northern Michigan | 272471085 | 2018 | May 13, 2024 |

| Bank of Alpena | 072414051 | 2018 | May 13, 2024 |

| Lincoln Community Bank | 091501411 | 2018 | May 20, 2024 |

| Advantage Community Bank | 075905059 | 2020 | June 3, 2024 |

| Baylake Bank | 075902104 | 2016 | October 7, 2024 |

| mBank | 091102807 | 2021 | November 4, 2024 |

| Investors Community Bank | 075912864 | 2021 | February 10, 2025 |

| Charter Bank | 091812430 | 2022 | April 28, 2025 |

If you have outdated checks, it’s time to order new with the Nicolet National Bank Routing Number, to prevent delays in your payments being processed. Your account number is not affected and will not change.

Routing numbers are also used in ACH payments and deposits. ACH stands for Automated Clearing House, which is a network that coordinates electronic payments and automated money transfers. Routing Numbers are a nine-digit code that’s based on the bank location where your account was opened. When banks merge, routing numbers are kept on the system to help the customer transition.

What do I need to do now to prepare for this change?

Revise the routing number on direct deposits, automatic payments or paper checks. Update auto payments you have set up to pay bills like utilities, subscriptions, or annual tax payments. This also affects incoming ACH or tax refunds.

Please talk to a banker to order new checks, or reorder online at www.nicoletbank.com.

Why is Nicolet Bank retiring these routing numbers?

At acquisition, Nicolet National Bank does not retire routing numbers out of convenience for our new customers. We understand a banking change can be stressful, and we like to ensure checks, deposits, and payments continue to post seamlessly at acquisition and retire after the customer has had more time to update and transition.

Who can I contact if I have questions about these changes?

Please stop by your local branch, call your local banker or 800-369-0226, or email us at [email protected] for assistance in updating this information.

You are now leaving NicoletBank.com

You will be directed to a website that Nicolet Bank does not manage. We are not responsible for the content, links, privacy policy, or security policy of that website.

Leave Now Stay HereEmail is not a secure method to send confidential information.

Please do not include your account number, social security number or other sensitive information through email.

Continue to Email Stay Here