Nicolet Wealth Management Monthly Newsletter

Bonds Assess the Impact of Tariffs

The 10-year Treasury yield declined only slightly to 4.16%, despite trading a wide band in April at a high of 4.49% and a low of 3.99%. Investors weighed whether the tariff announcement would lessen interest in U.S. Treasury assets, support sustained inflation, or weaken growth. This uncertainty revived volatility in bond interest rates.

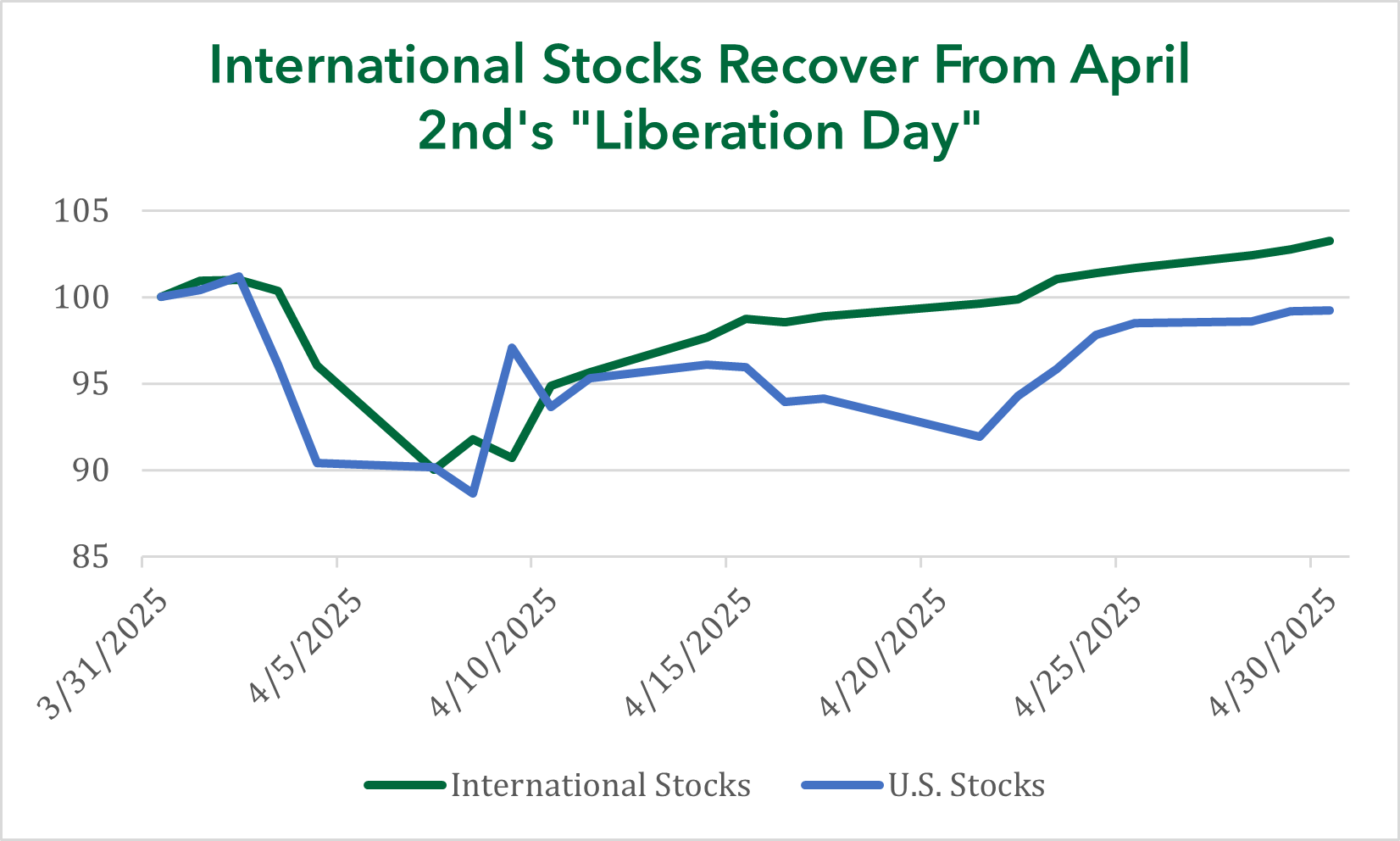

International Outperforms Domestic Stocks

Investors pursued safety in international stocks last month, extending the shift from U.S. based assets. International stocks, represented by the MSCI ACWI ex USA index, returned 3.7% in April, outperforming the U.S. total market index, represented by the Russell 3000 index, by nearly 4.4%. The main catalyst for this performance dispersion was the U.S. dollar weakening 4.6%. In addition, international stocks have a higher dividend yield than its U.S. counterparts, which tends to be favored amidst stock market volatility.

Imports Weigh on U.S. Growth

Economic growth in the 1st quarter of 2025, measured by real gross domestic product, declined -0.3% annualized on a surge in imports prior to April’s tariff announcement. The first quarter exhibited the largest growth drag by net imports on record, a decrease of -4.8%. Since imports are not produced in the U.S., these goods detract from U.S. economic growth. Partially offsetting imports, personal consumption expenditures increased 1.8%, a slowdown from 4.4% to end 2024.

U.S. Housing Starts Drop Sharply

New residential construction declined 11.4% to an annualized rate of 1.32 million in March, the most in a year. Builders are weighing high building costs and mortgage rates to decide whether to increase new residential inventory. The decline in construction centered on new single-family homes, which dropped by 14.2% to an annualized 9.4 million rate, the biggest decline since 2020. Building in southern states decreased nearly 18%, followed by more modest declines in the Northeast and West. A leading indicator of construction, building permits, fell to the slowest pace in four months for single family homes. Stable interest rates and more clarity on costs should be a catalyst for this high-volatility economic sector.

Consumers Remain Pessimistic

The Conference Board’s Consumer Confidence index, a gauge of consumer confidence, declined about 8 points to a level of 86, the lowest level since May 2020. This is the 5th straight monthly decline, making the longest stretch of declines since 2008. Driving the index lower was the measure of consumer expectations for the next six months, which fell to the lowest level since 2011. Both expectations on business conditions and jobs deteriorated to the worst levels in 16 years. While consumers feel more pessimistic, it hasn’t yet turned into a comparable deterioration in consumer spending.

Retail Sales Surge Ahead of Tariff Announcement

Consumer spending in March 2025 increased by the most in two years, advancing 1.4% on a jump in auto sales, as consumers tried to get ahead of tariff announcements. If auto sales were excluded, sales advanced 0.5%. Gains were concentrated with auto sales, however, 11 of the report’s 13 categories posted increases, led by sales of building materials, sporting goods and electronics. These figures suggest that consumption gained momentum to close the 1st quarter of 2025. As long as the labor market remains robust, consumers should continue to spend.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.