Nicolet Wealth Management Market Update.

Thank you for your continued confidence and trust in Nicolet. The financial markets continued to be resilient in May despite mixed economic data.

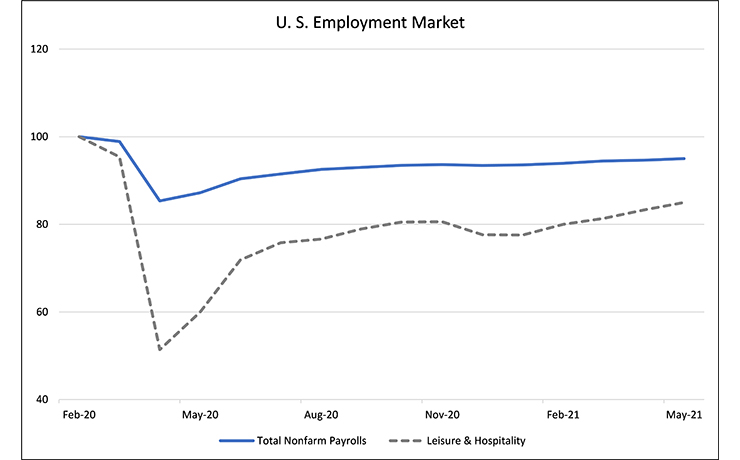

The employment market continues to improve with the most recent May report showing twice as much hiring as the previous month. Recent hiring continues to be driven primarily by the leisure and hospitality sector with restaurants and bars accounting for about a third of all hiring. However, the pace of hiring and the recovery back to pre-COVID levels continues to be slower than expected. Since April of 2020, the labor market has added 15 million jobs, but that still leaves around 7.5 million fewer workers than previously. A number of factors continue to constrain the labor market, including generous unemployment benefits, COVID fears, and child-care issues. However, with a record high, 9.3 million job openings, and at least 25 states ending extended federal benefits early, the pace of employment gains could improve.

Source: U.S. Bureau of Labor Statistics. Seasonally adjusted and indexed to 100.

U.S. manufacturing data in May continued to show robust results with new orders at levels not seen in nearly two decades. However, delivery times have increased to lengths not seen since the mid-1970s as the industry struggles with shipping delays, labor shortfalls, and raw material shortages. Business inventory levels relative to sales are now at a post-war low point. These issues will likely continue to cause manufacturers to lag behind their full potential, despite the strength of the overall economy.

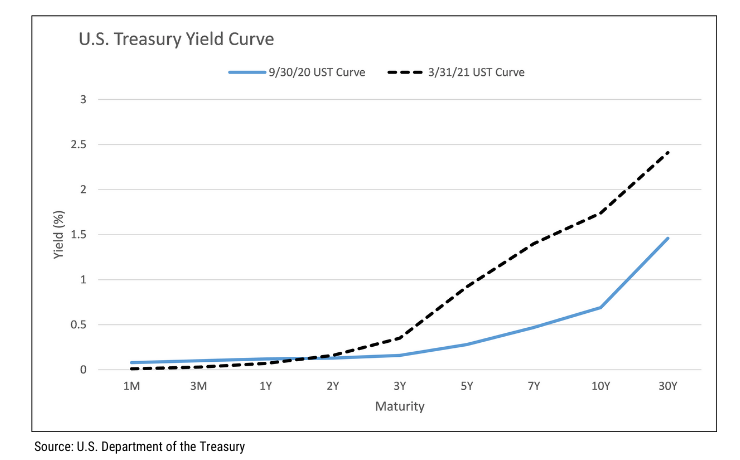

The rapid pace of reopening, and constrained supply chains have both in part caused inflation, as measured by the Consumer Price Index, to increase by 5% year-over-year in May. Certain sectors are experiencing even higher prices such as housing, used cars, hotels, car rentals, and airfare. However, the Fed has continued to indicate that it will look past temporary underlying inflationary pressures, and remain accommodative until the labor market rebounds.

The S&P 500 Equity Index largely traded sideways during the month of May. However, the trend of more economically sensitive companies that are greater beneficiaries of the economy reopening, continued to perform better than less cyclical companies. Year-to-date, through the end of May, the S&P 500 is up nearly 13% with value stocks outperforming growth stocks by nearly 3x. The U.S. bond market, as measured by the Bloomberg Barclays Aggregate Bond Index remains down around 2%.

The outlook for the second half of 2021 remains positive, based on continued aggressive fiscal stimulus, highly supportive monetary policy, and a successful vaccination distribution effort. However, our optimism is tempered by the potential for higher sustained inflation, continued risk of Covid-19 variants, and potentially adverse policy impacts on the financial markets. As a result, Nicolet Wealth Management continues to maintain a disciplined long-term approach and is prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products:

– Are Not FDIC Insured

– May Lose Value

– Are Not Bank Guaranteed

– Are Not Deposits

– Are Not Guaranteed by Any Federal Government Entity

– Are Not a Condition to Any Banking Service or Activity

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank.

Past market activity is not indicative of future results, and changes in any assumptions may have a material effect on projected outcomes. Investing in securities entails risk, and the potential for losing money always exists when investing in securities. Asset allocation, rebalancing, and asset diversification will not ensure account protection in a declining market, and cannot be relied upon to enhance gains in a rising market.

Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. Investors should consult with their legal and tax professionals before making investment decisions.