Nicolet Wealth Management Market Update.

Thank you for your continued confidence and trust in Nicolet. In the first quarter of 2021, the capital markets witnessed a material increase in optimism driven by a combination of additional stimulus and increased availability of vaccines. Expectations for a strong 2021 continue to increase, and now include the $1.9 trillion American Rescue Plan Act stimulus package passed in March. This latest round of stimulus will likely help generate the strongest U.S. economic growth seen in decades.

The increase in investor optimism can be seen in the S&P 500 Equity Index appreciating by more than 6% in the first quarter. Roughly four out of every five companies in the S&P 500 reported financial results that exceeded market expectations, and forward looking earnings estimates have risen meaningfully. Every major economic sector experienced positive investment returns for the quarter. Additionally, companies that are more economically sensitive, and greater beneficiaries of the economic rebound significantly outperformed and appreciated by over 10%, while less cyclical secular growth companies were only up 2%.

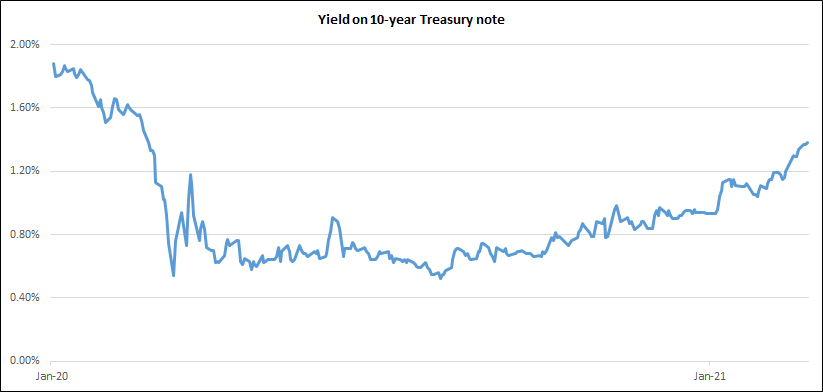

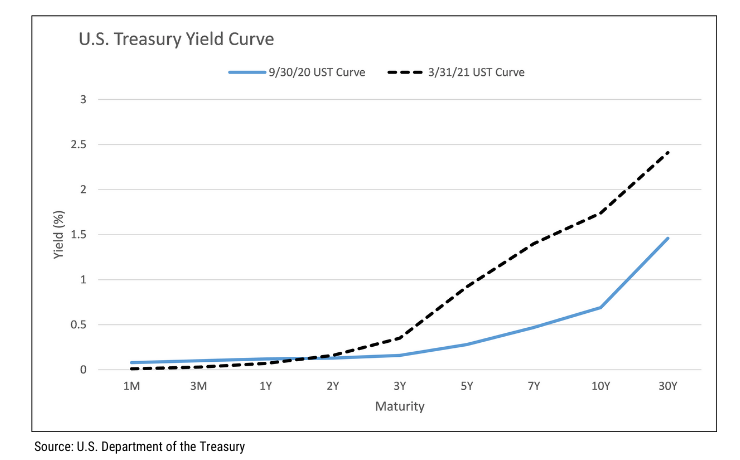

Second quarter growth is expected to surge, fueled by stimulus checks and pent-up demand for services. The ability to spend on travel, restaurants, and events should be a large driver of growth as the vaccines are distributed. However, the positive economic outlook has also driven inflation expectations higher. In turn, the combination of higher inflation and economic activity has pushed medium to long-term interest rates higher. Short-term interest rates with maturities of two years or less remain unchanged or even lower. However, since the August low, the yield on the benchmark U.S. 10-year Treasury note has tripled from 0.5% to briefly trading above 1.75%.

The increase in interest rates had a negative impact on fixed income investments during the quarter. The Bloomberg Barclays U.S. Aggregate Bond Index, which is often used as a proxy for the U.S. bond market, was down over 3% in the first quarter, erasing nearly two years’ worth of yield. In contrast, high yield bonds managed a modest positive total return during the quarter due to shorter maturities and larger coupon payments compared to investment-grade bonds. Additionally, high yield bonds carry more credit risk, and thus are more sensitive to the improving economy. Encouragingly, March was the third consecutive month that the bond rating agencies issued more upgrades than downgrades in the high yield debt market.

The outlook for the 2021 remains positive, based on a highly supportive monetary policy, aggressive fiscal stimulus, and a successful vaccination distribution effort. However, our optimism is tempered by the risk of Covid-19 variants, potential higher sustained inflation, and potentially adverse policy impacts on the financial markets. As a result, Nicolet Wealth Management continues to maintain a disciplined long-term approach and is prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products:

– Are Not FDIC Insured

– May Lose Value

– Are Not Bank Guaranteed

– Are Not Deposits

– Are Not Guaranteed by Any Federal Government Entity

– Are Not a Condition to Any Banking Service or Activity

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank.

Past market activity is not indicative of future results, and changes in any assumptions may have a material effect on projected outcomes. Investing in securities entails risk, and the potential for losing money always exists when investing in securities. Asset allocation, rebalancing, and asset diversification will not ensure account protection in a declining market, and cannot be relied upon to enhance gains in a rising market.

Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. Investors should consult with their legal and tax professionals before making investment decisions.