Rate Cut Regime Resumed

The Federal Reserve cut its target policy rate by 0.25%, while also confirming two more 0.25% cuts by the end of the year via its dot plot that graphs voting members’ expectations of the rate path over the next couple of years. The current range of the target policy is 4%-4.25%. Weakness in the labor market was given as an explanation for the additional rate cuts in 2025: “Labor demand has softened, and the recent pace of job creation appears to be running below the break-even rate needed to hold the unemployment rate constant,” Chair Jerome Powell said. Additionally, “I can no longer say” the labor market is “very solid.” Despite the Fed’s dot plot penciling in 2 more cuts this year, future rate cuts remain a “meeting-by-meeting situation” as concerns shift from inflation to employment.

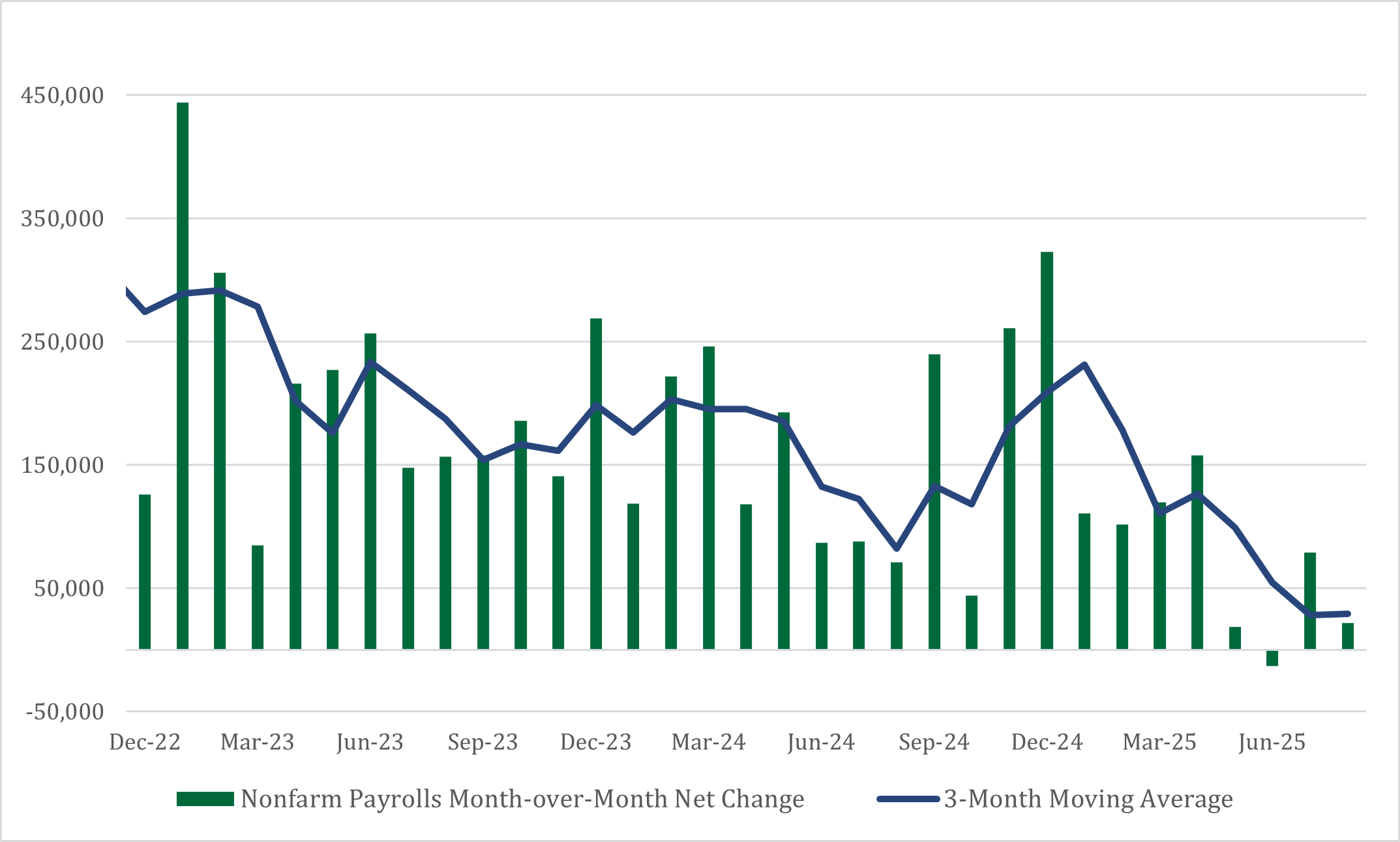

Labor Market on Shaky Ground

Payrolls only increased by 22,000 in August, while revisions from the previous months showed employment declining in June for the first time since 2020. Examining trends in the labor market, employment growth in the last three months has only averaged 29,000 and have come in under 100,000 for four consecutive months. Most sectors saw a decline in payrolls, with the exception of trade, transportation, and utilities, while service jobs were able to offset the decline in goods production employment. Confirming this slowdown was the increase in the unemployment rate, which showed that labor demand fell faster than labor supply.

Prices Still Rising

The consumer price index, which tracks overall prices in the U.S. economy, advanced 2.9% in August (up from 2.7% the previous month). Good prices increased at the highest pace since May 2023, which reflected price increases in new and used cars, apparel and appliance, likely due to tariffs. Household expenses rose too, which includes groceries, gasoline, electricity, and car repairs. Excluding shelter costs, which increased the most since the start of the year, overall services stepped down slightly on declines in medical care, recreation, and car rentals. While inflation is stepping higher month by month, most of the increases appear to be tariff related.

Bond Yields Settle Lower

The 10-year Treasury yield declined from 4.26% to start the month to a low of 4.02% on September 11, ultimately settling at a level of 4.15% at month’s end. Market participants have been trying to weigh the weakness in the labor market with the rate path expected from the Federal Reserve. The slowdown in hiring has shifted expectations for two, 0.25% rate cuts from the market to three, 0.25% rate cuts to close out the year (a rate cut in October and December is expected). The shift lower in rates supported higher rated credit, with the high yield index trailing the overall corporate bond index by 0.75% during the month – higher rated credit typically has longer-term maturities and more sensitivity to shifts in longer-term rates. The broader bond index, Bloomberg Aggregate index, is going on 62 consecutive months since last reaching its own all-time high as interest rates have remained elevated.

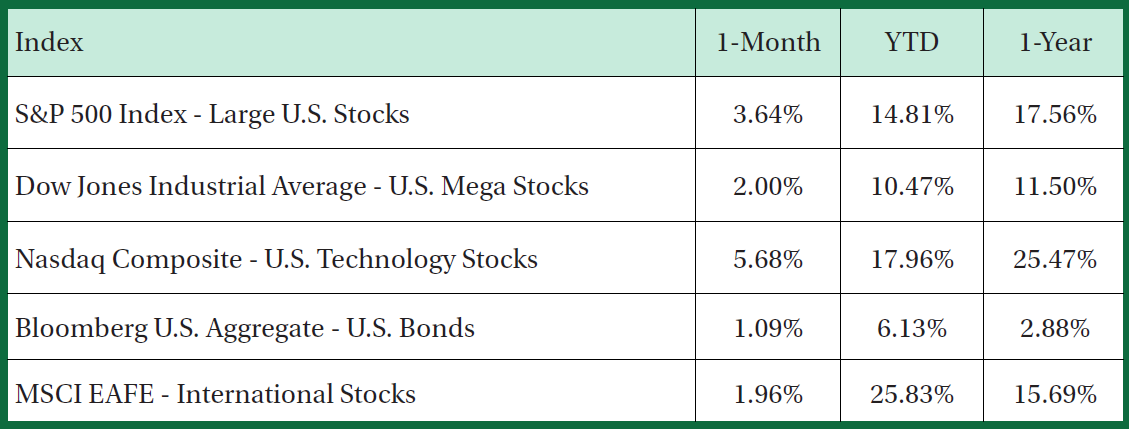

Market Participation Continues to Broaden

The stock market’s momentum continued in September, as large-company stocks represented by the S&P 500 index, advanced by 3.6% in September. But gains were not solely concentrated in the largest stocks as the smallest stocks in the U.S. gained 3.1%, continuing its strong rally of 12.4% over the last 3 months. In fact, the Russell 2000 index closed at an all-time high for the first time since March 15, 2021, ending a streak of 967 trading days without closing at a new high (second longest streak in the index’s history). Wider participation of returns across the U.S. stock universe is a strong indicator of sustainability for future returns.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.