Rate Cuts Coming in September?

At the annual Jackson Hole Economic Policy Symposium where policymakers discuss economic and interest rate conditions, Federal Reserve (Fed) chair Jay Powell carefully stated the Fed’s willingness to cut rates at its upcoming meeting in September. Labor market risks were cited for this change in tune, given “policy being in restrictive territory” outweighing the growing risk on inflation from U.S. tariff policy. However, the unemployment rate and other labor market measures remain stable for now, which allows Federal Reserve policymakers to carefully manage rates and modify direction as the data change. Examining the market’s expectation on the path of interest rates, market participants are pricing in a rate cut in September, with a second 0.25% rate cut expected in December. The 10-year Treasury yield fell below 4.25% and the 2-year Treasury yield crossed 3.7% following Fed chair Jay Powell’s speech.

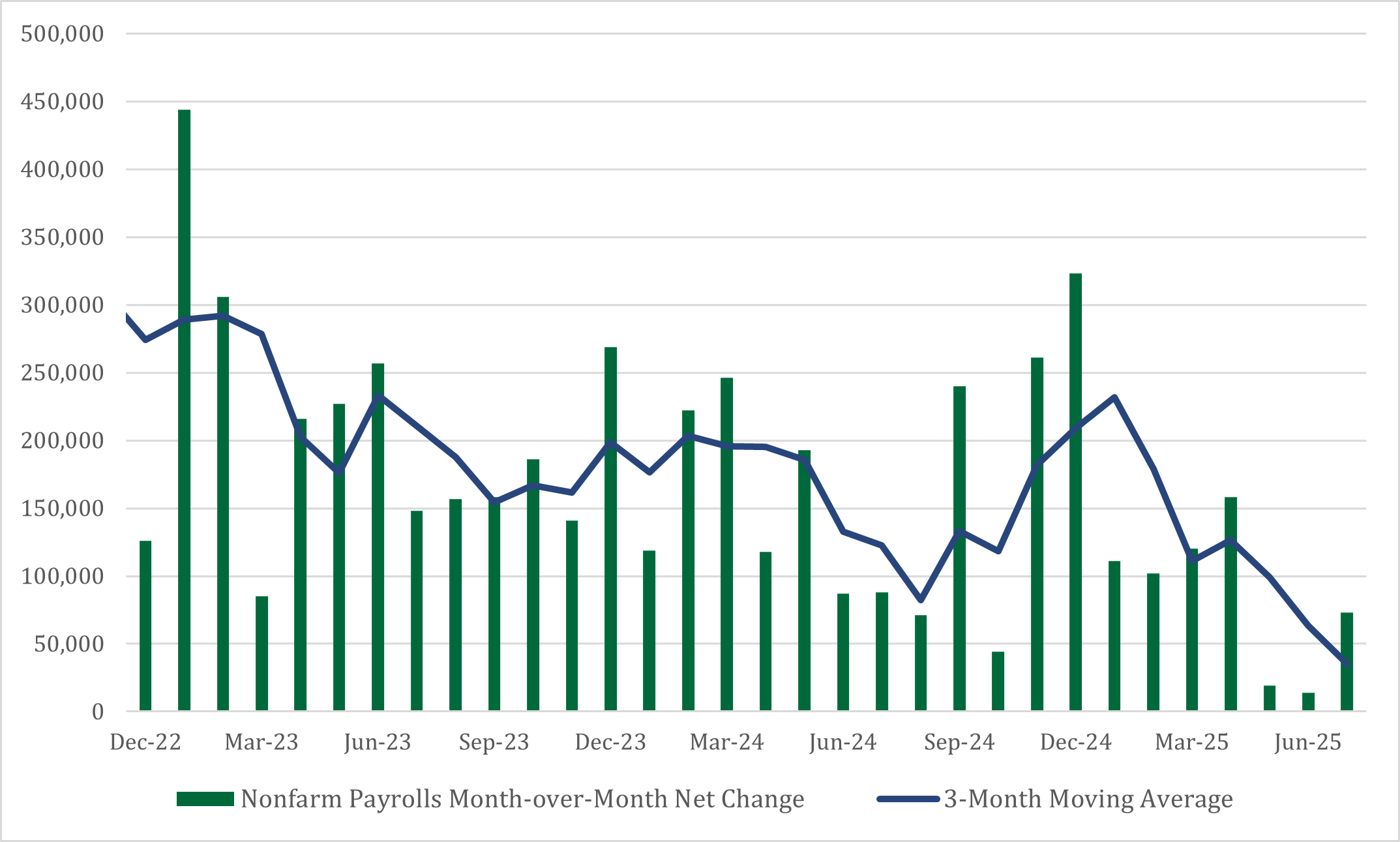

Job Growth Slows

U.S. payrolls have exhibited a notable decline in recent months, with only 73,000 jobs added in July after the prior two months were revised down by nearly 260,000. This is equivalent to nearly 1.5 months of job gains in 2024. In the last three months, employment growth has averaged about 35,000 jobs a month, the worst since the pandemic. The lower numbers have been reflected in the manufacturing, professional and business services, and government industries. From an optimistic viewpoint, U.S. job openings are near the pre-pandemic lows and initial applications for unemployment benefits remain near the 1-year average. With the percentage of the population that is working or looking for work falling to the lowest in nearly three years, some of the weakness is likely attributable to a lack of supply as opposed to demand.

Jobs Growth Remains Positive

Labor market is now in a soft patch, showing the effect of trade policy

U.S. Company Earnings Top Estimates

The largest U.S. stocks had another strong earnings season in the second quarter, topping depressed estimates resulting from uncertainty of tariffs. Earnings growth relative to the prior year ended up being about 7%, that is after three of the last four quarters being double digit growth. Eight of the eleven S&P 500 sectors delivered rising year-over-year earnings in the quarter, but only three (Information Technology, Communication Services, and Consumer Discretionary) beat the overall S&P 500 index’s growth – stock market earnings remain concentrated with a few larger names, or the Magnificent Seven. These stocks reported earnings growth of 23.1%, more than tripling the earnings growth of the overall stock market.

Longer Maturity Bonds See Rates Gradually Decline

Over the last four months, market participants have become increasingly confident the Federal Reserve will restart its rate cut regime, which has caused longer maturity rates to fall. The 10-year Treasury yield declined from 4.6% in May to 4.21% at the end of August. On top of longer maturity rates gradually falling, there was an appetite for risk that was made apparent in equity markets. As a result, high yield bonds advanced 1.3%, while treasuries on the other side of the spectrum for risk advanced only 1.1%. Based on the performance of these two indexes, most of the bond performance was a result of changes in interest rates.

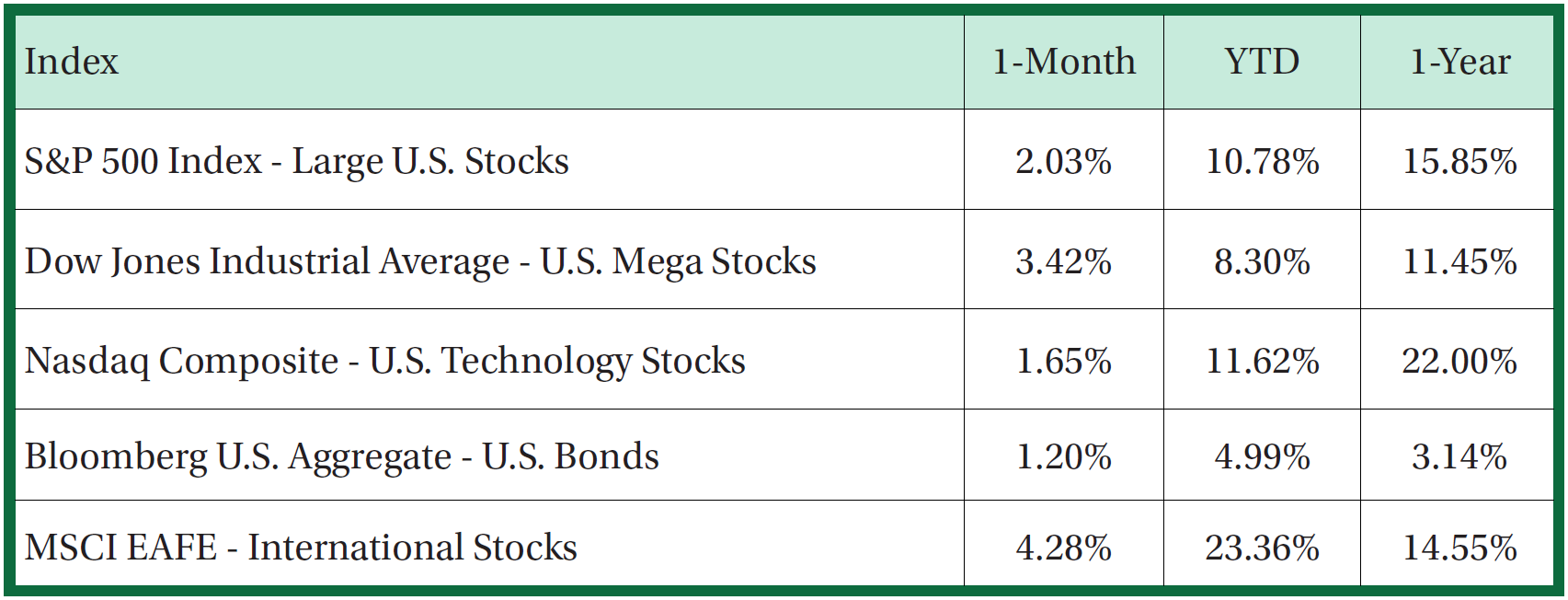

Small Companies Lead the Way

The increased likelihood of the Federal Reserve cutting interest rates in September supported global equities, particularly small-cap stocks. The Russell 2000 index, a representation of the smallest companies in the U.S., advanced 7.1% in August, relative to their large company counterparts of the S&P 500 that only rose 2%. Explaining the relative performance difference is small-cap stocks’ reliance on lower interest rates. A lower interest rate environment is positive for small-cap stock, as they have an increased reliance on bank lending, which tends to adjust to the market rate environment and has a shorter maturity.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.