COMFORTABLY UNCOMFORTABLE

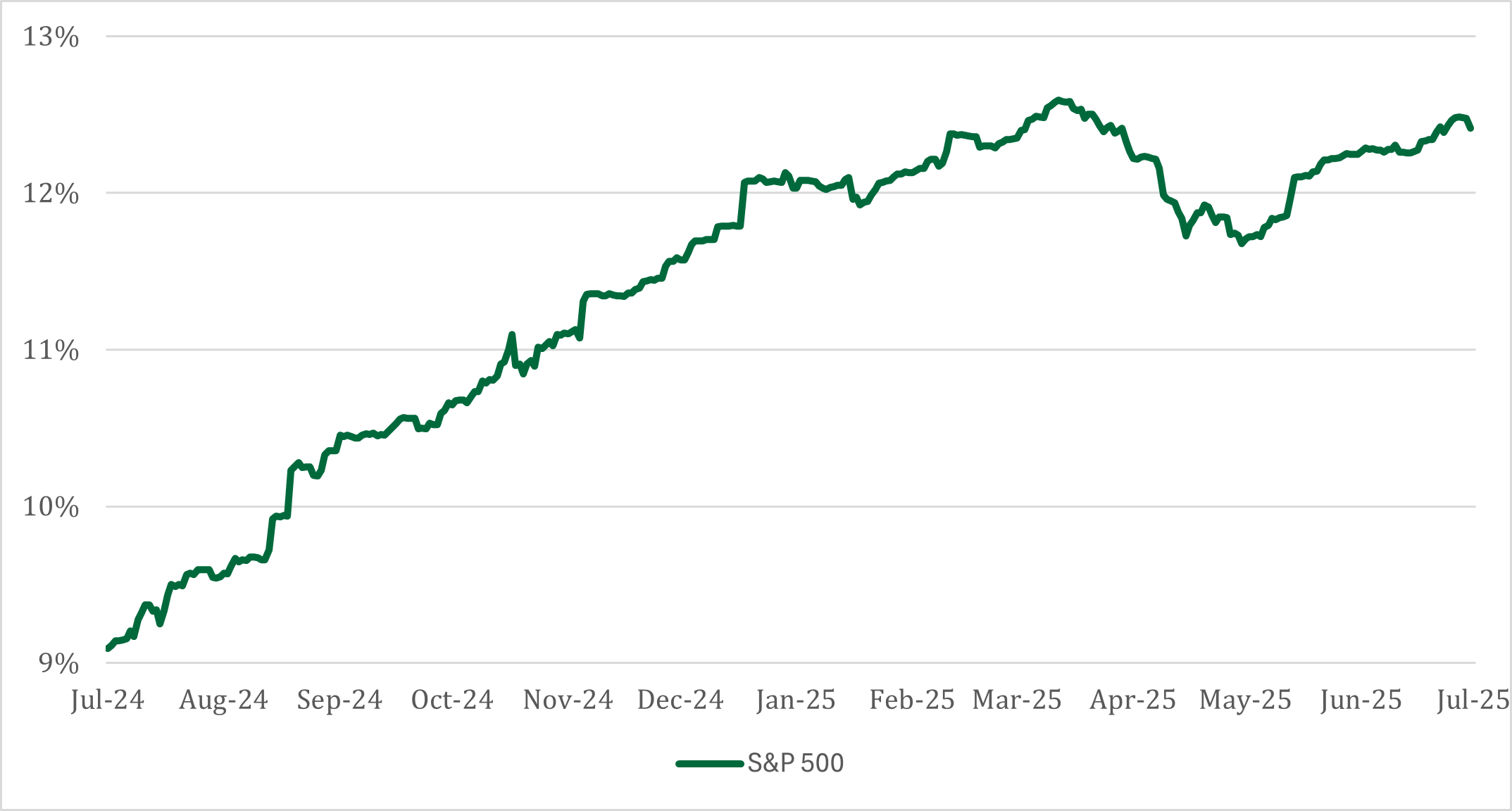

The exacerbation of the changed tariff policy could be felt by investors in the early stages of the second quarter. There was uncertainty about the impact of trade on consumers and businesses, whether the tariff level announced on “Liberation Day” was here to stay or if tariffs were being used as a negotiating tactic. Fast forward to June, the tariff rate was increased to an average level of ~17% from ~2% prior to “Liberation Day”, yet consumers have continued to spend despite the unknown impact to future economic activity. Investors too have ignored the impending impact of tariffs, sparking a risk-on environment in markets as the tariff worst-case scenario is unlikely.

U.S. stocks, as represented by the S&P 500 index, declined -12.1% from April 4 through April 8 in response to a widely encompassing tariff increase. As the Trump Administration pulled back on tariffs to settle investors’ anxiety, markets recovered. This was our base case expectation, as President Trump has shown in the past that he bases his success on the economy and the stock market. As a result, tariff policy has been more tactical and limited in scope, attempting to navigate the negative economic feedback that it associated with a wide scope of tariffs. This change in tactics sparked a rally in the stock market by 24.5% from April 8 through the end of the second quarter of 2025.

PROFIT LEADS MARKETS

Stocks are forward-looking voting mechanisms, in which they try to predict the future trajectory of the economy and thus corporate profits. Amidst the uncertainty surrounding tariffs in April, 2025 S&P 500 profit growth re-rated lower, falling from a 14.3% year-over-year growth late in September 2024 to a level of 9% at the end of March. This profit re-rating led to a decline of nearly 20% in the stock market. However, investors believe the effect of global tariffs will be concentrated in 2025, as the 2026 earnings growth expectation has remained near its peak of 12.4% and additionally, earnings growth expectation in 2025 has stabilized at a level of 6.8%.

Next Year’s Stock Market Earnings Growth Expected Over 12%

Supporting the profitability of the stock market remains in the technology sector, with only a small adjustment to its earnings growth in 2025 from 22% to 18.25% and an upward shift above 16% in 2026. No other segment has seen its earnings exhibit such little variability relative to a changing economic environment as technology. There are a few items to consider when examining the stock market’s ability to recover swiftly and reach new all-time highs: 1) S&P 500 is highly concentrated, with 33% of companies being technology, 2) as we just noted, technology is expected to grow 16-18% over the next couple of years, and 3) most importantly, technology earnings’ limited volatility because of its reoccurring and consistent nature, provides investor predictability that supports a higher valuation.

While these are all important factors and the technology earnings boon should not be ignored due to its persistency, the S&P 500 index is relying on a few members to carry its weight. The risk lies with rapid innovation. Technology quickly changes and today’s winners become tomorrow’s losers. This doesn’t mean the AI trend will slow, only that new winners will emerge. Remember, Netscape paved the way for Google and Intel paved the way for NVIDIA. It would be reckless to think that NVIDIA will continue to maintain its market capitalization lead indefinitely with developing the most sought-after artificial intelligence computing chips. This is especially relevant today, after the biggest names in the S&P 500 have once again contributed the most to returns since the low of April 8. The top 10 names in the S&P 500 contributed nearly 50% of the 25.7% of returns since the April 8th low. Two things can be true at the same time: 1) acknowledging NVIDIA’s dominance in the marketplace and 2) being overweight NVIDIA in portfolios comes with a substantial amount of company-specific risk. Any prolonged weakness in the biggest names of the S&P 500 would cause substantial losses. We prefer to balance our U.S. large-cap growth exposure with value (future artificial intelligence beneficiary) and small-cap companies.

TECHNOLOGY’S GAIN IS THE MARKET’S GAIN

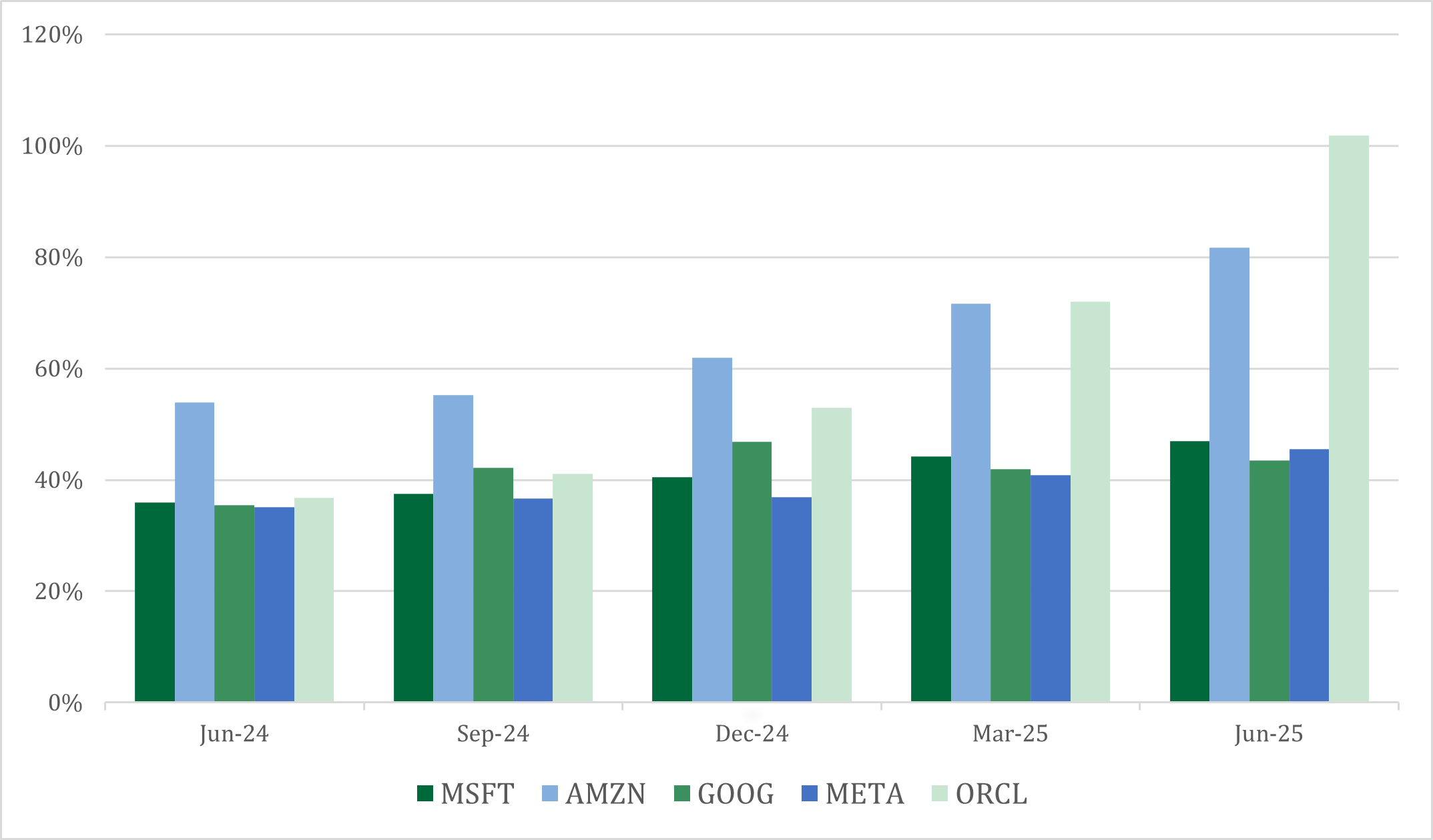

To keep up with the massive demand for technological advancements, the largest technology stocks must spend. These mega-cap technology stocks are contributing nearly 30% of S&P 500 capital expenditure, or at a level of more than $200 billion. On top of that, Microsoft, Amazon, Google, Meta, and Oracle are spending more than 40% of its operating cash flow on capital expenditure.

Technology Continues to Spend

Capital expenditures, relative to cash flows from operating activities, are increasing for the major hyperscalers

Anecdotally, there has been increased spending on power generation because of artificial intelligence usage. Monthly gas usage over the past couple of years has surpassed the 10-year average, power generation for data centers has continued to emerge and mergers & acquisitions activity for the utility sector has risen. Plus, expected earnings are backing up this breadth. Looking forward, mega-cap technology stocks will exhibit earnings growth on par with the rest of the market, a sign of market sustainability.

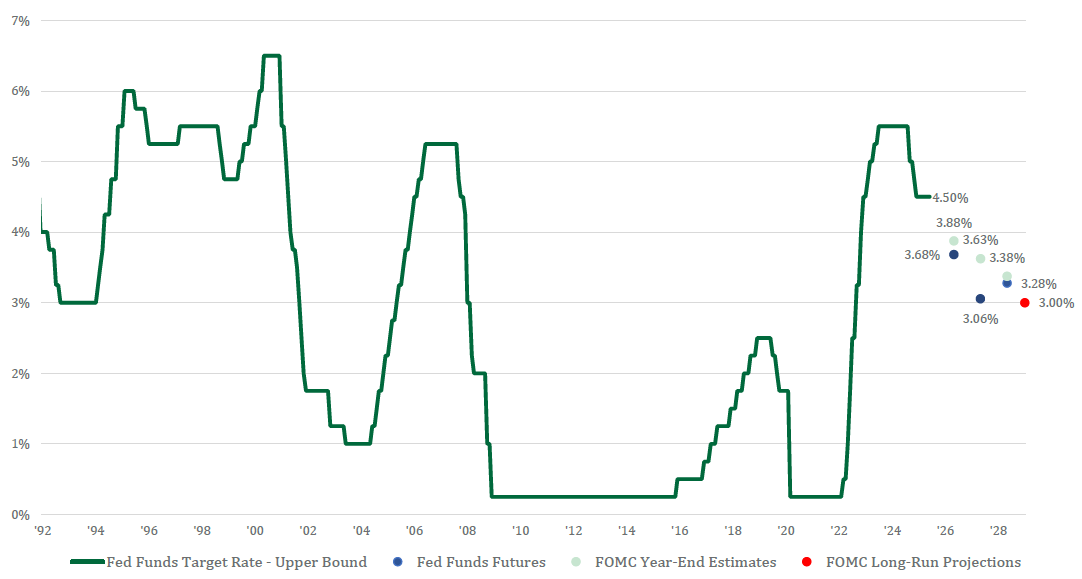

TARIFFS EFFECT ON INTEREST RATES, INFLATION, AND THE ECONOMY

Despite the markets remaining calm post “Liberation Day”, a great deal of uncertainty surrounds the direction of interest rates as we move through 2025 and enter 2026. As of the end of Q2 2025, the market expects the Federal Reserve to cut interest rates four-to-five times the next 12 months in 0.25% increments. For this to happen, two things would need to happen: Tariff rates come down closer to pre-liberation day levels or the economy suffers an imbalance between demand and supply, thus leading to less production. In addition, following the commentary from Federal Reserve chair Jay Powell and the Federal Open Market Committee voting members, controlling inflation remains its prime focus and lowering interest rates will only exacerbate prices. Interest rates across all maturities should remain higher for longer.

Fed Funds Rate Expectation: Market & FOMC

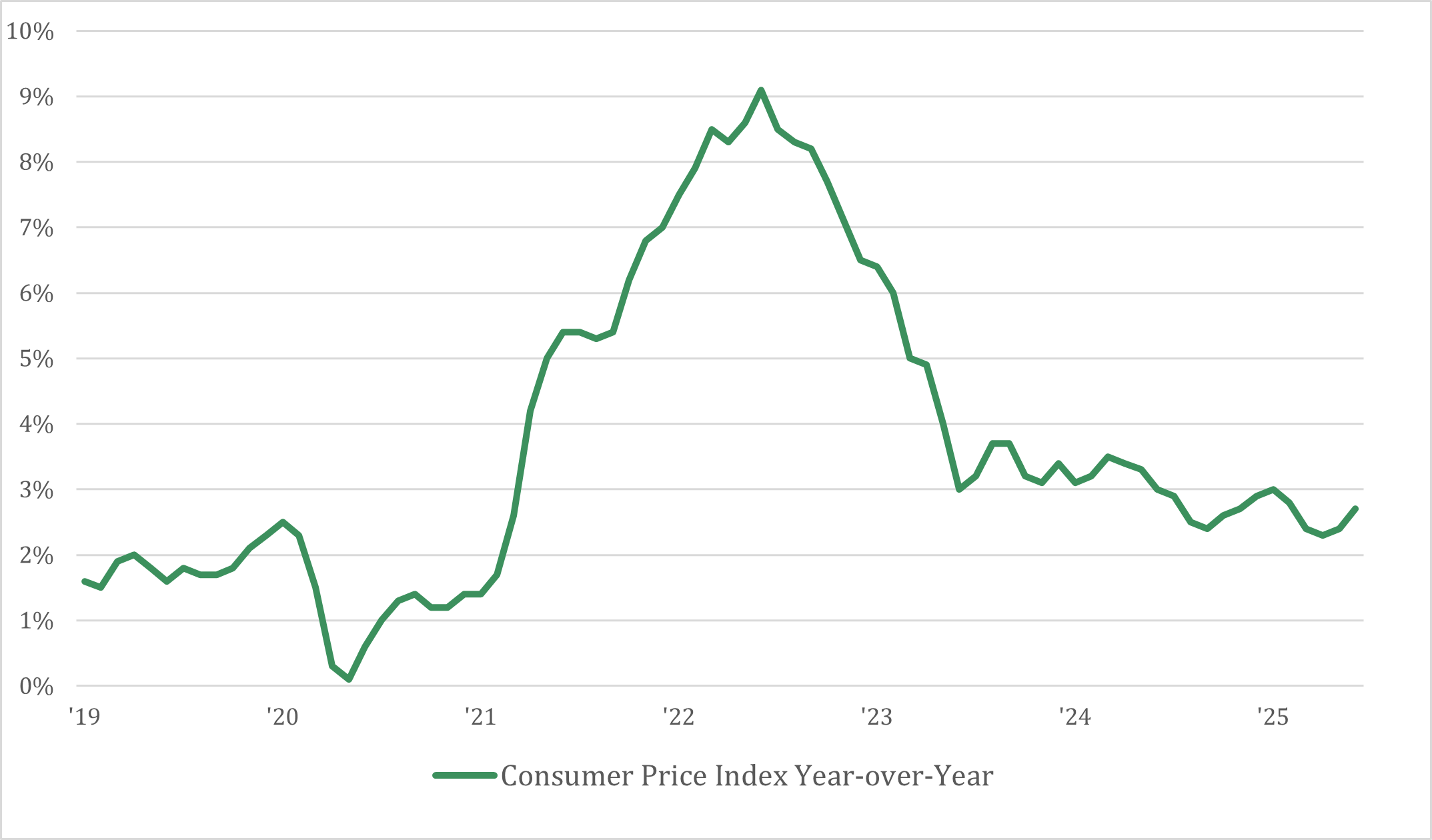

The cost of goods inputs going forward will likely be affected by tariffs. As a result, the cost consumers pay should be higher as we approach the end of the year. Consumers have shown resiliency to uncertainty centered around costs, but until the costs become real, the effect on spending is unknown. In recent months, there’s been an uptick in the annual inflation rate to 2.7% after starting the quarter at 2.3%. There’s been a few categories tied to tariffs exhibiting price increases, including toys, appliances, and furniture that are contributing to the annual inflation rate.

Inflation Expected to Cyclically Trend Higher

There are positive outcomes that can arise from protective economic policy, if done on the margins. Namely reshoring, which is defined as taking international production to the U.S. Reshoring is becoming possible again as manufacturing competitiveness swings back to the U.S.’s higher skilled and productive workforce, which negates international companies’ edge on pricing. Cheap and abundant domestic energy also contributes to manufacturing thriving in the U.S.

MARKET MELT-UP

It is sometimes hard to see the positives when the negativity of the day grabs the headlines. However, positives continue to outweigh the negatives. Labor market and as a result, consumption, is resilient, domestic manufacturing is expected to expand, productivity gains from technology are prevalent, and corporate profits are expected to expand 7-13% over the next three years. These factors support the U.S. business exceptionalism.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.