Nicolet Wealth Management Market Update.

Thank you for your continued confidence in Nicolet. As the COVID-19 pandemic continues to create uncertainty in our lives, we will work hard to provide you with timely insights on market and economic conditions.

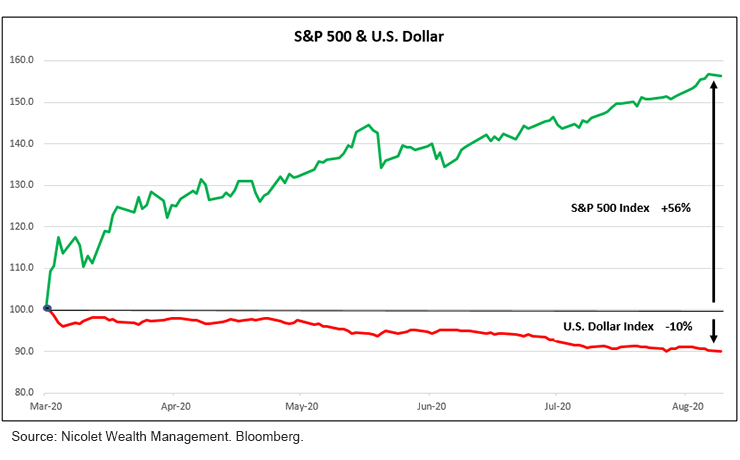

As the month of August ends and students return to school, the stock market has returned to all time high levels. The S&P 500 Equity Index, which includes nearly all of the largest publicly traded stocks in the U.S., has now rebounded more than 55% from the low point set in late March, and is now up 8% from the beginning of the year. August with its positive 7% return, marked the fifth consecutive month of gains, and was also the best August in over 30 years.

The strength seen in the equity markets has in part been driven by the unprecedented fiscal and monetary response to the COVID-19 pandemic. The CARES Act delivered over $2 trillion in economic relief, and interest rates have been forced significantly lower by the Fed in an effort to stimulate economic growth. Most recently, the Fed announced a new policy framework that shifts from targeting inflation at 2% to now targeting “inflation that averages 2% over time.” This subtle change in policy could allow the Fed to keep interest rates lower for longer.

While these factors have caused the equity market to appreciate, conversely they have caused the U.S. dollar to depreciate. Since late March, the value of the U.S. dollar relative to a basket of foreign currencies is down over 10%. Relative to the equity market, this may seem like a small move, but in the currency market this is a major move lower.

A weakening U.S. dollar impacts various parts of the capital markets differently. Large U.S. multinational corporations with significant global operations tend to benefit as American-made goods become relatively cheaper for foreigners to buy, in turn making these companies more globally competitive. Additionally, profits earned in foreign currencies when converted back will translate to more U.S. dollars of profit. Interestingly, one of the sectors with the highest foreign exposure is the technology sector, the same sector that has outperformed the rest of the market by 4x so far this year (+35% versus +8%).

Additional beneficiaries of a weak U.S. dollar include emerging market equities and commodities. Emerging markets often borrow U.S. dollars and rely heavily on commodity exports. Commodities are usually priced in U.S. dollars and when the U.S. dollar falls, commodity prices tend to rise, as can be seen by gold trading at all-time highs and oil trading up over 80% off the March lows.

As the global response to the COVID-19 pandemic continues to create winners and losers, we will continue to evaluate the capital markets for opportunities and risks. We remain committed to our disciplined long-term approach, and are prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products:

Are Not FDIC Insured

May Lose Value

Are Not Bank Guaranteed

Are Not Deposits

Are Not Guaranteed by Any Federal Government Entity

Are Not a Condition to Any Banking Service or Activity

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services.

Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank. Nicolet Advisory Services, LLC recommends the brokerage and custodial services of TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is not affiliated in any way with Nicolet National Bank or its affiliated companies.