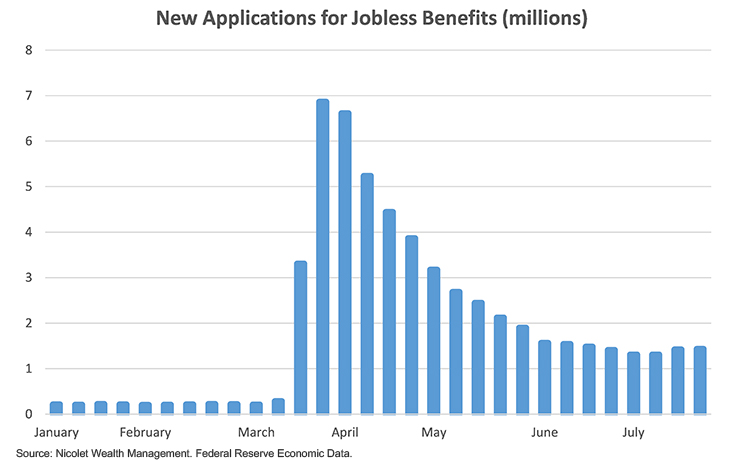

Recently announced economic data also showed that the U.S. economy contracted at a record rate last quarter. Reported 2Q GDP contracted at an adjusted annual rate of -32.9% or down -9.5% from the first quarter. As the economic recovery stalls, and previous fiscal stimulus programs are exhausted, focus once again turns to Washington. Congressional leaders and White House officials are currently negotiating the next relief package. An estimated $1.5 trillion focused on funding for states, municipalities, employment insurance, and more support for small businesses.

Continued aggressive monetary and fiscal support, a strong housing market, lack of inflation, and the potential for medical breakthroughs should provide support for the capital markets and a gradual improvement in economic activity absent a major second wave of infections. We continue to evaluate the capital markets for opportunities and risks. We will continue to maintain our disciplined long-term approach, and are prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Recently announced economic data also showed that the U.S. economy contracted at a record rate last quarter. Reported 2Q GDP contracted at an adjusted annual rate of -32.9% or down -9.5% from the first quarter. As the economic recovery stalls, and previous fiscal stimulus programs are exhausted, focus once again turns to Washington. Congressional leaders and White House officials are currently negotiating the next relief package. An estimated $1.5 trillion focused on funding for states, municipalities, employment insurance, and more support for small businesses.

Continued aggressive monetary and fiscal support, a strong housing market, lack of inflation, and the potential for medical breakthroughs should provide support for the capital markets and a gradual improvement in economic activity absent a major second wave of infections. We continue to evaluate the capital markets for opportunities and risks. We will continue to maintain our disciplined long-term approach, and are prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products: Are Not FDIC Insured May Lose Value Are Not Bank Guaranteed Are Not Deposits Are Not Guaranteed by Any Federal Government Entity Are Not a Condition to Any Banking Service or Activity Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank. Nicolet Advisory Services, LLC recommends the brokerage and custodial services of TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is not affiliated in any way with Nicolet National Bank or its affiliated companies. Trust services are offered through Nicolet National Bank, a national bank with trust powers. Trust services utilizes SEI Private Trust Company (SPTC) as its custody provider. SPTC is not affiliated in any way with Nicolet National Bank or its affiliated companies.