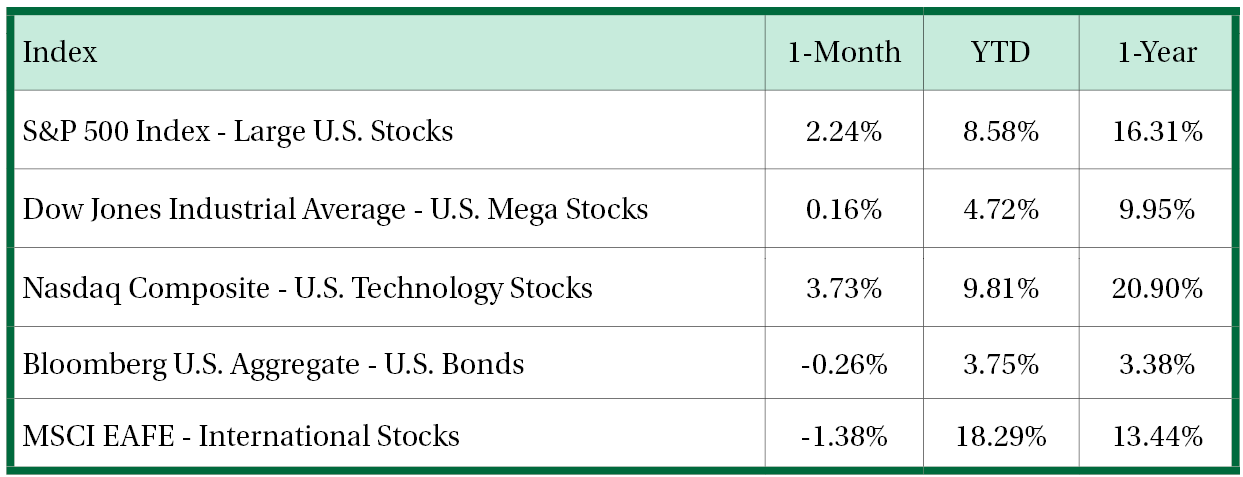

U.S. Stocks Preferred by Investors

The S&P 500 index advanced 2.3% in July, which extended its 3-month rally to 14.2%. Keeping pace with the large-cap rally, mid- and small-cap stocks, represented by the Russell Mid-cap index and Russell 2000 index advanced 11.7% and 13% in the last 3 months, respectively. Contrasting this performance to international stocks, international developed and emerging market stocks, represented by MSCI EAFE index and MSCI EM index, advanced 5.6% and 12.9%, respectively. This noticeable shift in investor preference is supported by earnings, with international earnings seeing a deterioration in profitability, while U.S. stocks are exhibiting a positive shift higher. Plus, investor sentiment is improving, as evidenced by an improving initial public offering (IPO) market, which has supported companies like Circle Internet Group, AIRO Group Holdings, and Figma Inc. for 100%+ gains on their first day of trading.

Growth Recovery

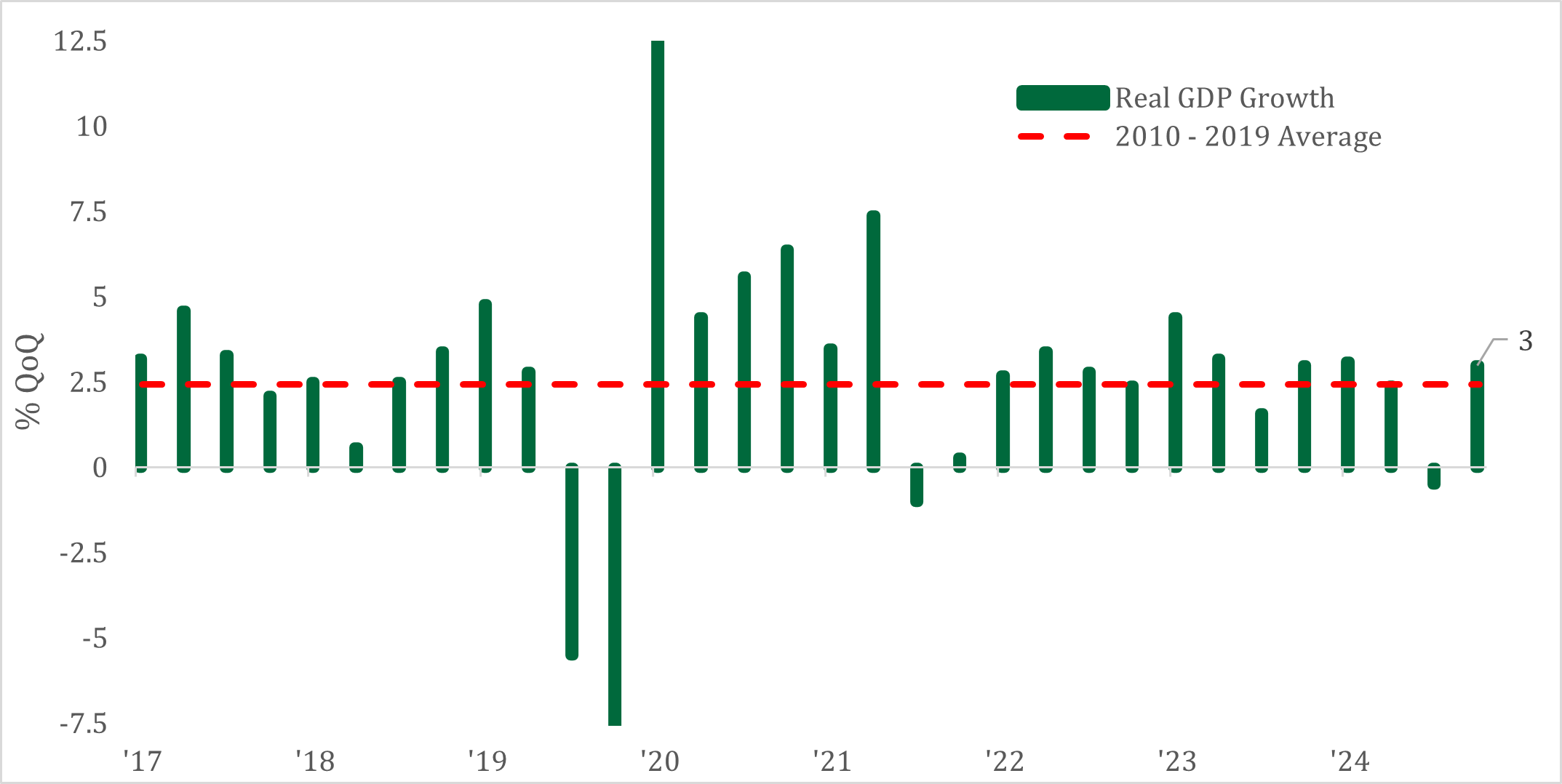

U.S. economic activity, adjusted for inflation, rebounded in the second quarter 2025 by 3% from the prior quarter, after exhibiting a -0.5% decline in the first quarter. For the first half of the year, the economy grew at an average rate of 1.3%, a slowdown from last year’s pace of 2.8%. Contrasting from the first quarter of 2025, net exports added 5% to the headline due to a drop in goods imports, while inventories were a massive drag, subtracting 3% from growth. Most importantly, consumer spending rebounded to an 1.4% annualized pace after only rising 0.5% the quarter prior and 3.1% last year. Residential housing remains a concern, as restrictive rates and overall affordability weighed on residential investment, which declined -4.6%.

U.S. Economic Activity Recovers in Q2

Consumption remains a key support of growth, rising 1.4% after only rising 0.5% – dependent upon the trajectory of jobs

Net exports and inventories flip from Q1, contributing to growth

Federal Reserve Growing Divide

The Federal Open Market Committee held rates steady at a 4.25% -4.5% range for a fifth straight meeting. Most meetings, committee members vote in line with the Federal Reserve Chair Jay Powell, but there were two dissenters to the decision for the first time since 1993. Given this notable divide within the Federal Reserve and inflation ticking higher because of tariffs, the path of interest rates is even more notable and uncertain. The FOMC statement noted economic growth “moderated in the first half of the year,” replacing the characterization of growth as continuing to “expand at a solid pace.” Over the next 12 months, the market expects four-to-five 0.25% target policy rate cuts.

Interest Rates Rise

A return to growth and an uptick in inflation led to higher rates. While interest rates were noticeably higher in the early part of July, the early month increase in rates normalized. Maturities 1-year and higher increased anywhere from 0.1% to 0.2% last month, with the 10-year Treasury yield increasing 0.13% to a level of 4.38%. As a result, the Bloomberg Aggregate declined by -0.3%, as the rise in interest rate risk more than offset the performance of bonds with corporate credit risk.

Consumers Feel Better

The July consumer sentiment index, a gauge of consumers’ feelings, rose to 61.8 from 60.7 a month earlier on expectations of a better economy and inflation. Consumers expect prices to rise at an annual rate of 4.4% over the next year, an improvement from 5% in the prior month. Also supporting sentiment were consumers’ views of their current personal finances on higher market returns. Although, looking back one year, business conditions, labor markets and incomes continue to weaken.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.