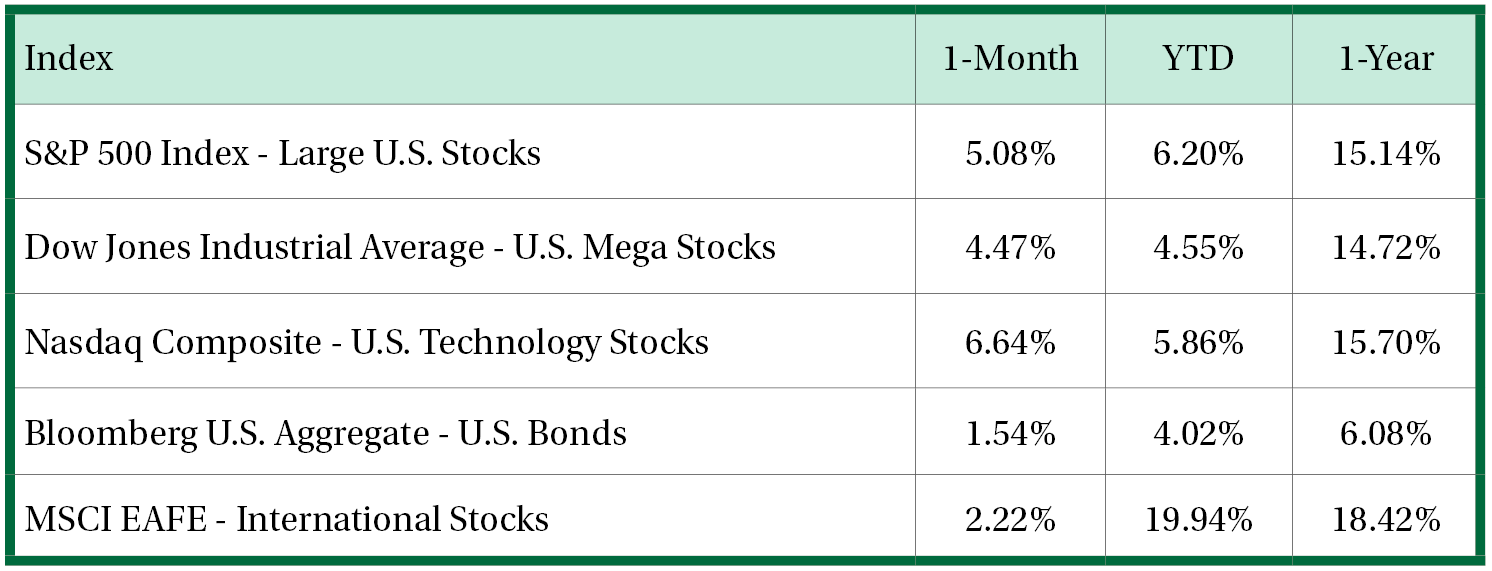

U.S. Stocks Look Past Tariffs

Enthusiasm for risk continued through June as investors put the threat of tariffs in the rear-view mirror. The Russell 3000 index, a broad representation of U.S. stocks, outpaced international stocks or the MSCI ACWI ex U.S. Index by 1.6%. Leading U.S. markets in June were companies with the highest growth rates, like technology and communication services sectors, while the defensive sectors of utilities and consumer staples underperformed. Investors have gravitated toward sectors supported by strong earnings growth. For example, technology stocks have a 17% earnings growth rate this year that has changed very little, while the consumer discretionary sector saw its earnings growth turn negative.

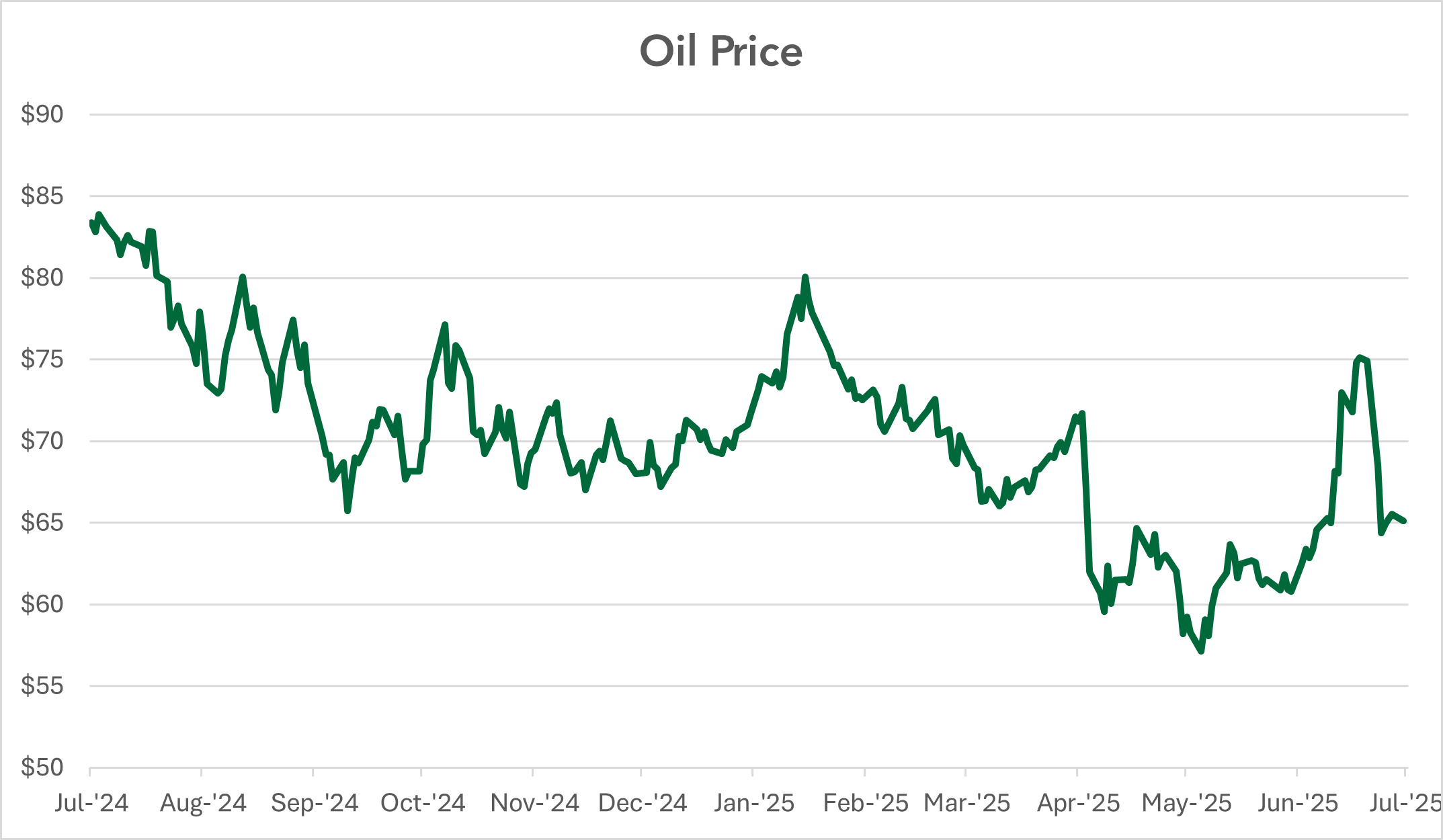

Middle East Tensions Support Oil Prices

The price of oil traded in the U.S. spiked to a level of $75 a barrel in June at the height of tensions between Iran and Israel. As a truce was agreed upon by the two countries, oil eventually settled at a price of $65 a barrel, which was 7% higher than the close on May 30. Adding to the uncertainty, members of the oil cartel, Organization of the Petroleum Exporting Countries (OPEC), have hinted at increasing the supply of oil by a 411,000 barrel-a-day rate. This would be the fourth month in a row that OPEC has agreed to a hike, tripling the initially planned volumes. Higher supply typically weighs on prices.

Federal Reserve Still on Hold

For a fourth straight meeting, the Federal Reserve left the policy rate unchanged at 4.25% - 4.5% despite hinting at recent labor-market softening. The Fed also updated its projections, showing higher inflation and unemployment forecasts this year and next. Federal Open Market Committee (FOMC) members expect inflation to annually increase 3.1% by the end of 2025 and 2.4% at the end of 2026, both of which being higher than the preferred rate of 2%. The unemployment rate expected by FOMC members is 4.4% in 2025 and 4.5% in 2026, still historically low.

Sentiment Improves

Consumers were more confident at the end of June, as fears over an inflationary event from tariffs continued to soften. The University of Michigan Consumer Sentiment Index ticked higher to 60.7 in June, driven by a rising assessment of current conditions and year-ahead inflation expectations dropping. According to this survey, 57% of consumers expect unemployment to rise in the year ahead, down from 66% in March. Continued improvement in the economy and stable inflation should result in improving sentiment through the duration of the year.

Rates Decline in February

The 10-year Treasury yield declined from 4.4% to 4.23% last month, with the Treasury market posting its best monthly performance since this February. The Bloomberg Treasury index posted a monthly return of 1.3%, as the market expects more rate cuts. Over the next 12 months, the market expects five 0.25% Fed target policy rate cuts, up from four in May. As a result, bonds with longer maturities outperformed. In addition to interest rates, bonds with greater credit risk had a strong month, following the lead of equity markets.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.