Market Update April 17, 2023.

The U.S. economy continues to be more resilient than most investors had expected. The year started with stronger than expected economic activity driving the equity market higher as valuation multiples expanded. Investors were willing to pay more for earnings until fears that the strong economic activity would turn into higher inflation and require the Federal Reserve to raise interest rates to a level even higher than expected as well as keep rates at elevated levels for a longer period of time. All of which would increase the risk of a recession. Then in March, the banking system unexpectedly witnessed two large bank failures, partly in response to the significant increase in interest rates experienced over the last year. Despite the volatility, the S&P 500 Equity Index generated a positive 7% total return in the first quarter, and the Bloomberg U.S. Aggregate Bond Index generated a 3% total return during the quarter.

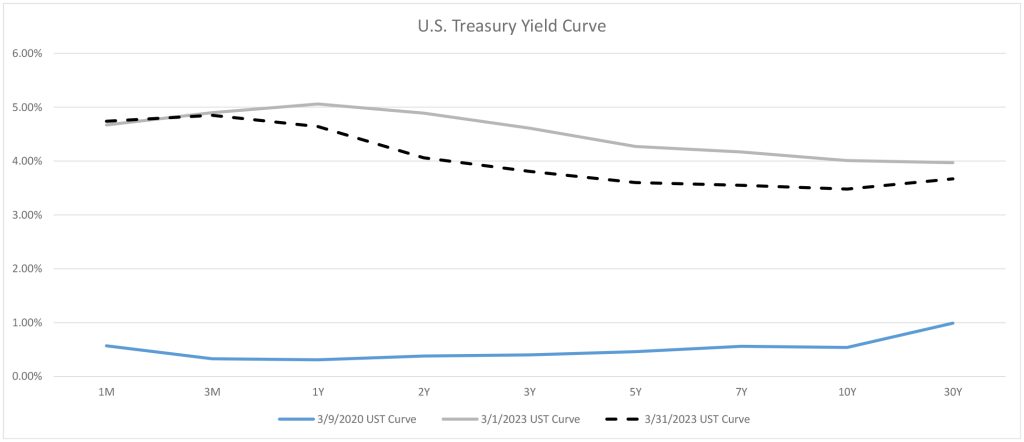

The current uncertainty in the capital markets can been witnessed in the change of the U.S. Treasury yield curve highlighted below. Interest rates bottomed in March 2020 when the entire yield curve traded below 1%. In less than three years, the entire yield curve had shifted higher with all rates above 4%, and Treasury bonds maturing between 6 and 18 months were yielding above 5%. A significant amount of the rate increase has come in the past 12 months as the Federal Reserve executed one of the fastest rate hiking cycles on record. More recently, Treasury rates have fallen in response to the banking system turmoil, leading many forecasters to declare that interest rates have peaked for this cycle. Before the banking industry turmoil, markets were assuming that the federal funds rate would end the year above 5%, but are now assuming that the federal funds rate ends the year below 4.0%.

Higher interest rates have worked to reduce inflationary pressures. Recently, the U.S. Labor Department reported that its consumer price index (CPI), which measures what Americans pay for goods and services, rose 5% in March from levels a year earlier. Encouragingly, this is down from February’s 6% increase and the peak 9% reported in June of 2022. Additionally, longer-term market-based inflation expectations remain well anchored and constructive at levels below 3%.

The U.S. labor market remains strong as demand for workers continues to exceed the supply of available workers as there are currently 1.7x job openings for every unemployed person seeking work. Further, the March unemployment rate was reported to be 3.5%, which is near the 50-year low of 3.4% set a few months ago in January, and well below the 50-year average of 6.2%. The current unemployment rate is also below the 4.5% rate of unemployment that the Federal Reserve is forecasting for later this year.

However, over the 110 year history of the Federal Reserve, the U.S. economy has never experienced a 100bps increase in the unemployment rate without also experiencing a recession. Consistent with history, the Federal Reserve staff is now forecasting that a mild recession will start later this year due in part to the fallout from the banking system turmoil. Recent stress in the U.S. banking system will likely have the equivalent effect of further Fed tightening as banks impose somewhat higher lending standards and reduce capital availability in response to the turmoil. The cumulative negative effect on GDP is estimated at 0.25-0.5%, or in terms of the amount of Fed tightening that would generate a similar growth drag, it is roughly equivalent to one or two 25bps Fed Funds rate increases.

Looking past the near-term headwinds of high expectations, elevated inflation, U.S. debt ceiling negotiations, and risk of a recession, our long-term view on equities remains positive. Additionally, following a two-year drawdown, the fixed income market now offers reasonable yields and potential upside if interest rates continue to decline.

Nicolet Wealth Management continues to maintain a disciplined long-term approach. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor. Securities offered through Private Client Services, LLC (“PCS”), member FINRA/SIPC. PCS is not affiliated with Nicolet National Bank or Nicolet Wealth Management.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.