NAVIGATING UNCERTAINTY

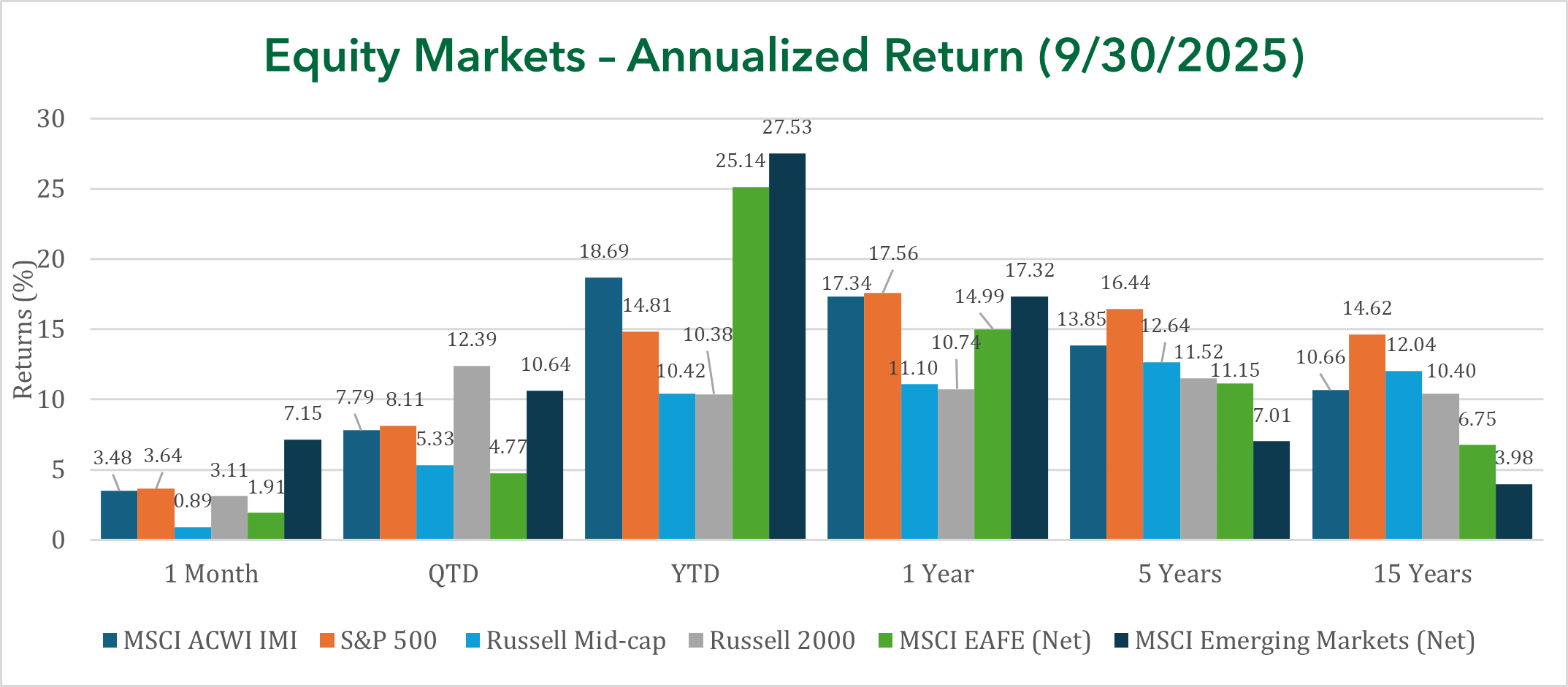

Markets have come accustomed to the “Wall of Worry”, whether it is a change in global trade dynamics, a government shutdown, softening economic activity or the path of interest rates. Through the end of the 3rd quarter in 2025, global equity markets have returned 18.7%, with an outsized contribution from emerging markets, followed by international developed and U.S. markets, in that order. The 3rd quarter was especially prosperous for global equity market investors, with about 40% of this year’s return coming in that quarter alone. While the global economy has expressed warning signs, U.S. companies have delivered robust profit growth, the impetus of stock market returns. As the year inches to a close, there are a few important factors to follow:

- Slowing Job Growth

- Restart of Rate Cuts

- Technology Spending

HELP WANTED?

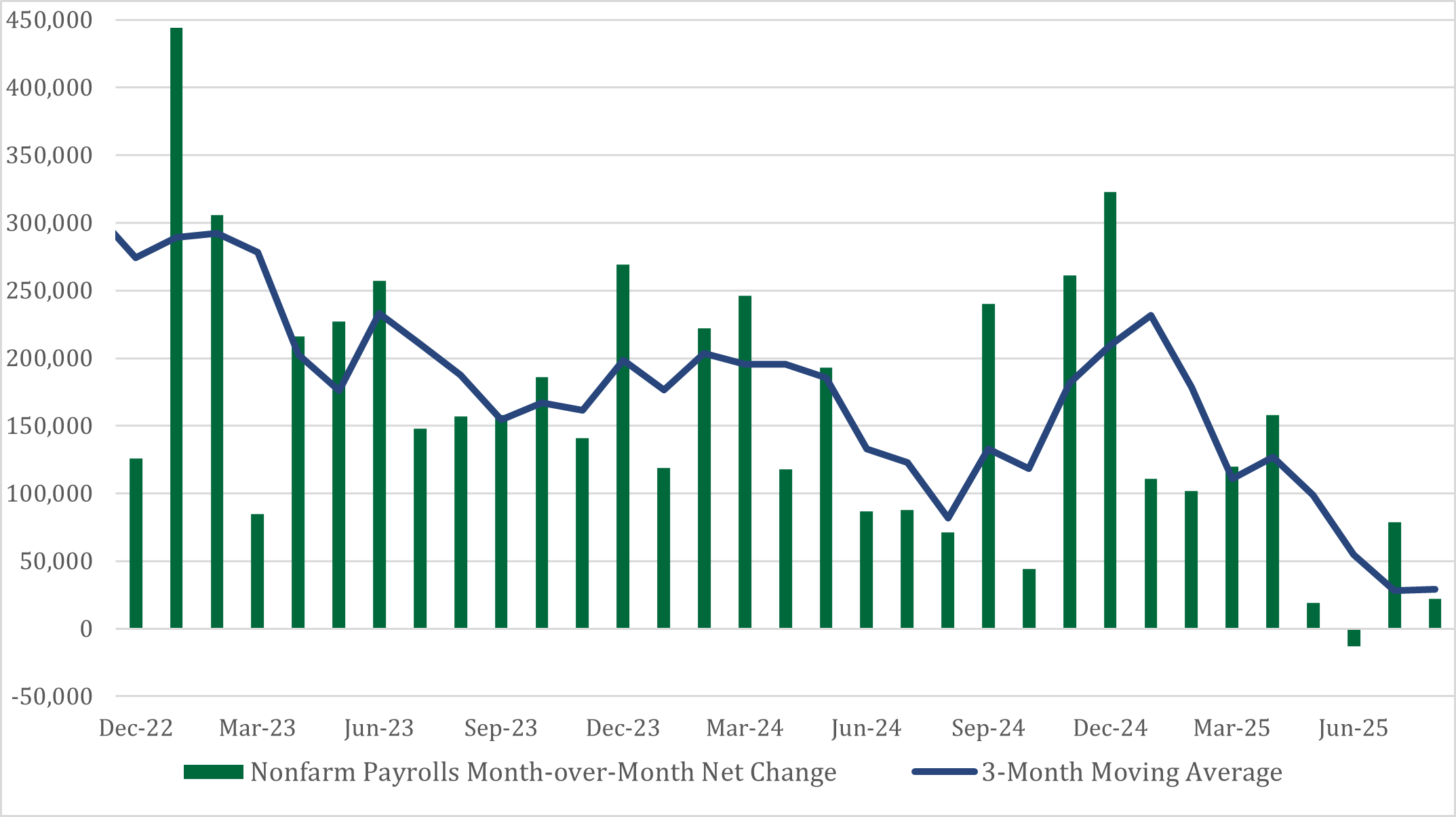

The trajectory of job gains in 2025 has decelerated from prior years. As a result of data revisions, the U.S. economy experienced job losses in June, the first time since 2022. Through data collected by the Bureau of Labor Statistics through August 2025, the average job growth by each month totaled 102,000 in 2025, down from 175,000 in 2024. The easy explanation for the slowdown in job growth is global trade policy uncertainty, but the reason is far more complex than companies’ declining willingness to hire. Based on Federal Reserve surveys, companies have noted a hiring reduction as one of several cost-saving strategies. However, goods-producing companies in the U.S. economy most negatively affected by tariffs have only seen a slight decrease in job growth. Demand inconsistencies express only one part of the story.

Payrolls Gains Decelerating

The other considerations include a slowdown in immigration. Based on estimates, the monthly contribution of immigration to the labor force has fallen from 90,000 at the start of the year to 40,000 in August, while industries most reliant on immigration have seen a decline of 30,000 jobs on a monthly average since the start of the year. Government hiring weakness is another headwind to job growth. The pullback in government hiring has subtracted 30,000 from payroll growth this year. Finally, and probably hardest to measure, is the effect of Artificial Intelligence (AI) technology on the economy. Industries most challenged by a replacement of jobs because of AI, such as marketing, call centers, and graphic design, has been falling over the past few years.

FEDERAL RESERVE: BETWEEN A ROCK AND A HARD PLACE

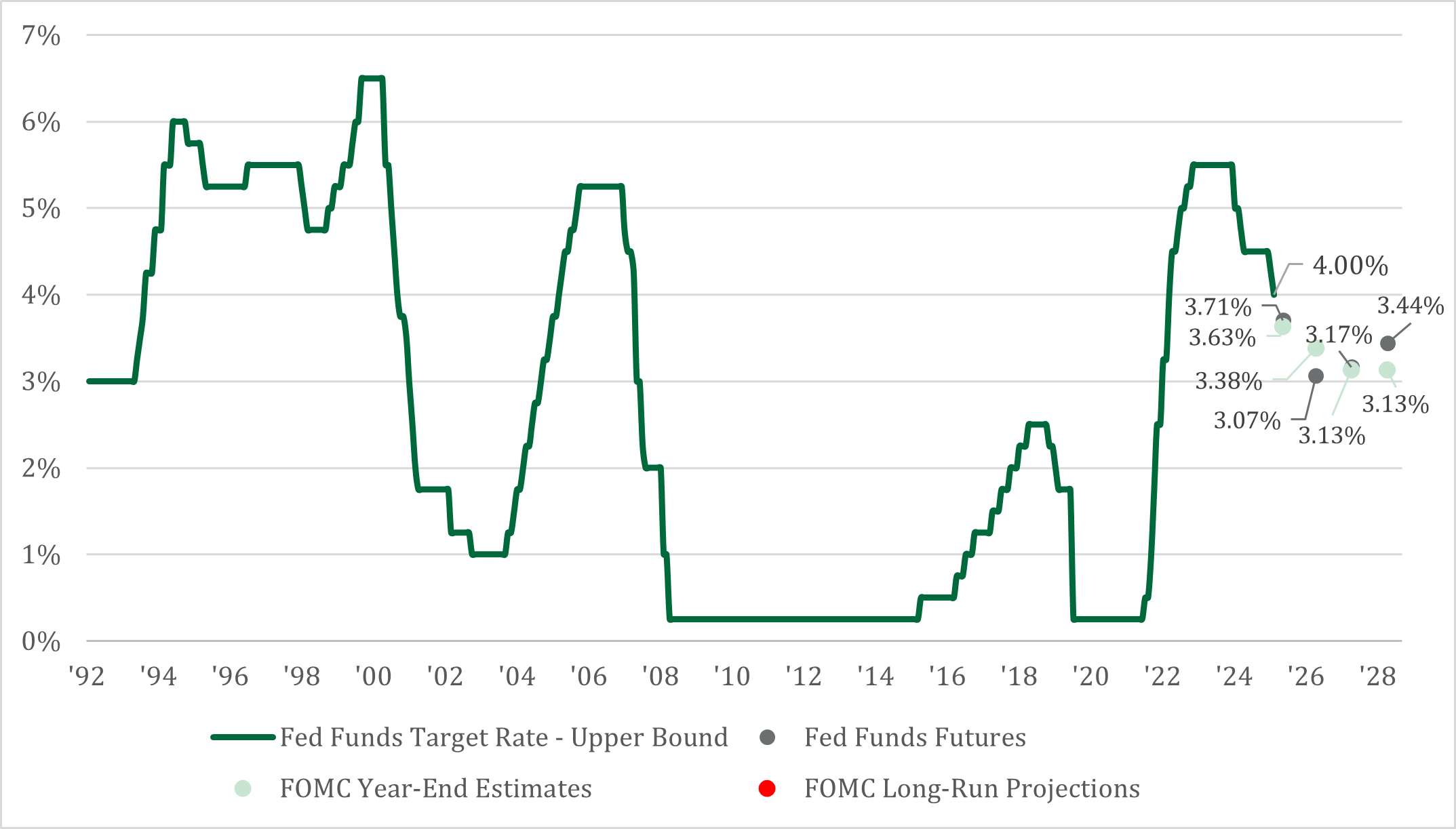

The Federal Reserve (Fed) restarted its rate cut regime in September by cutting its target policy rate by 0.25%, followed by another rate cut in October by 0.25%, leaving the target range at 3.75%-4.00%. Since markets trade on expectations, it is appropriate to examine the Fed Funds Futures, which estimates the target policy rate’s forward path. The Fed Funds Futures estimates that the target policy rate will be about 3% at the conclusion of 2026, which is about three to four 0.25% rate cuts. Relative to the Federal Reserve’s own median estimate, the Fed Funds Futures rate estimates about 1-2 more 0.25% rate cuts by the end of 2026.

Fed Funds Rate Expectation: Market & FOMC

- One more 0.25% rate cut is expected to close out 2025 in December

- No longer a certainty, based on Fed chair Jay Powell’s comments

This divergence in opinion of market expectations and the Federal Reserve’s guidance tells us a few things. Fed chair Jay Powell has acknowledged that supporting the labor market currently takes precedence, however the risks of inflation and jobs are likely more balanced. It can be argued that labor market weakness is unlikely to be solved by minor adjustments in monetary policy. Cutting interest rates significantly as inflation accelerates might be unpalatable for the Fed. For example, the last inflation data point released by the Bureau of Labor Statistics showed that consumer prices advanced 3% year-over-year in September, well above the preferred level of 2%. Looking under the hood of inflation, the internals were not as worrisome, such as core sticky inflation (dropped 0.2%) and core goods inflation declined 0.2%. Inflation growth doesn’t make setting interest rates any easier considering opaque signals in jobs. Going forward, the Federal Reserve will likely lean into being data dependent, changing as the economic data change, which should lead to more interest rate volatility to close out 2025 into 2026.

The 10-year Treasury yield has fluctuated from 3.78% more than one-year ago, to 4.57% at the start of 2025, while dropping to 4.15% at the end of the 3rd quarter in 2025. This type of interest rate volatility underscores the importance of bonds that have a lower duration across the credit spectrum. Once economic activity exhibits more signs of uncertainty, purchasing bonds with longer maturities will be a more prudent approach.

U.S. Treasury Yield Curve

- Rate yield curve has turned positive over the past year on the expectation of rate cuts and sustained inflation

- Volatility will likely remain persistent, as this year concludes

RATIONAL EXUBERANCE?

Global equity markets advanced 18.7% through the first three quarters of the year, as represented by the MSCI ACWI IMI index. International returns were the predominant contributors to global returns, while U.S. stock markets have lagged. Interestingly, international returns were driven primarily by valuation upside, whereas the U.S. stock market was supported by earnings. Market rallies, led by profitability, are a positive development, as it underscores investors’ increased rationality. This isn’t to say the high valuation of U.S. markets shouldn’t normalize, rather at these valuation levels, investors prefer to reward companies with a strong earnings profile.

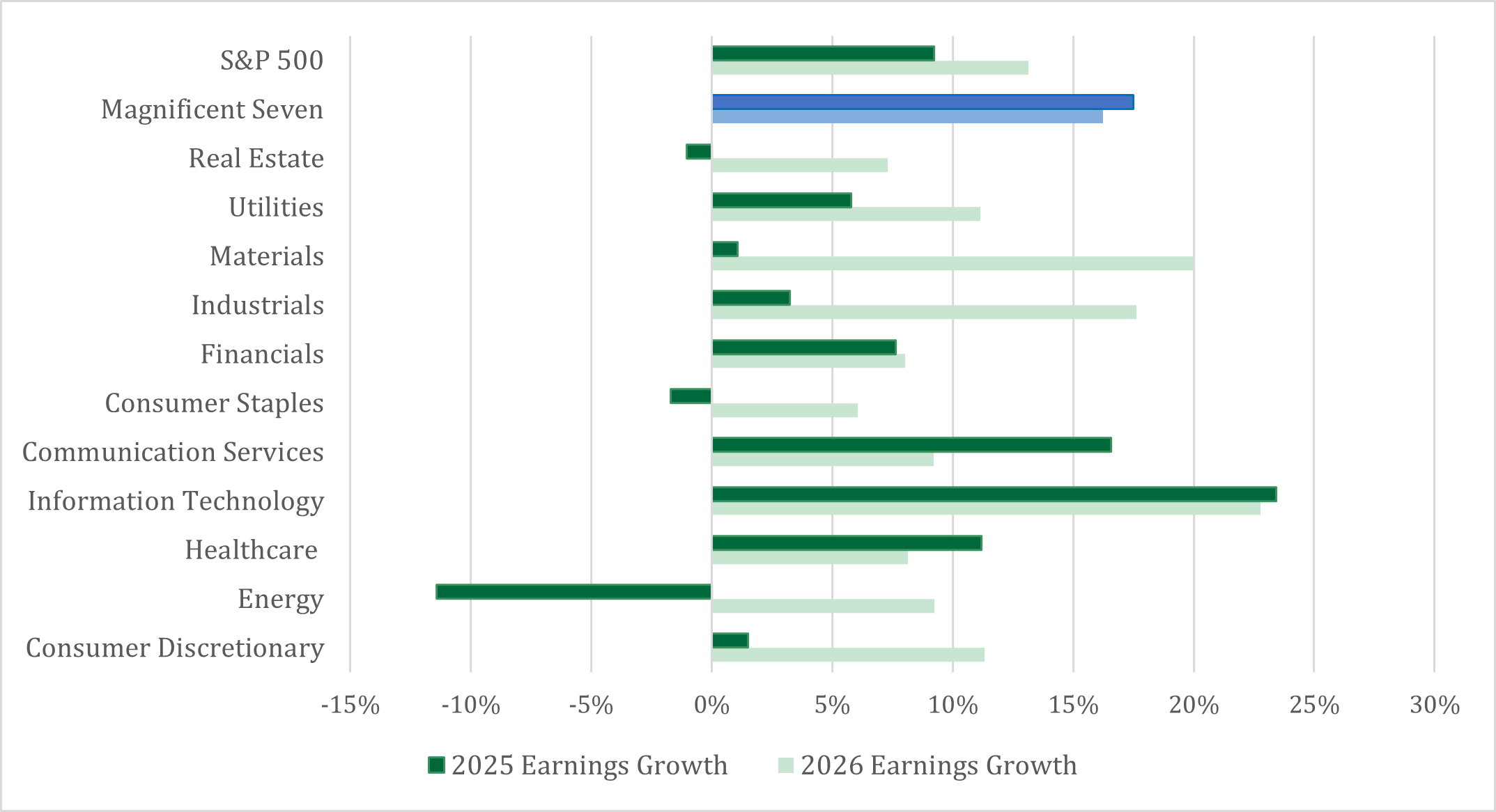

The market outlook has changed very little from previous quarters: technology exhibits an earnings growth rate of 23% in 2025 and 2026, and the seven largest stocks in the S&P 500 index or the “Magnificent Seven” is expected to grow more than 15%, surpassing the overall market’s growth rate of 13% in 2026. A reliance on the stocks that have been carrying the load in previous years would be worrisome, given that the earnings concentration topped 40% for the ten biggest companies in the U.S. However, participation amongst sectors other than technology and the “Magnificent Seven” is beginning to rise. Sectors such as Utilities, Materials, and Industrials are expected to grow as fast or faster than the stock market.

2025 Earnings Growth Being Led by Magnificent 7

Growth expected to be driven by Mag. 7 sectors – Information Technology, but signs of broadening into other segments of the market

Value Segment: Utilities, Consumer Staples, Healthcare, Financials

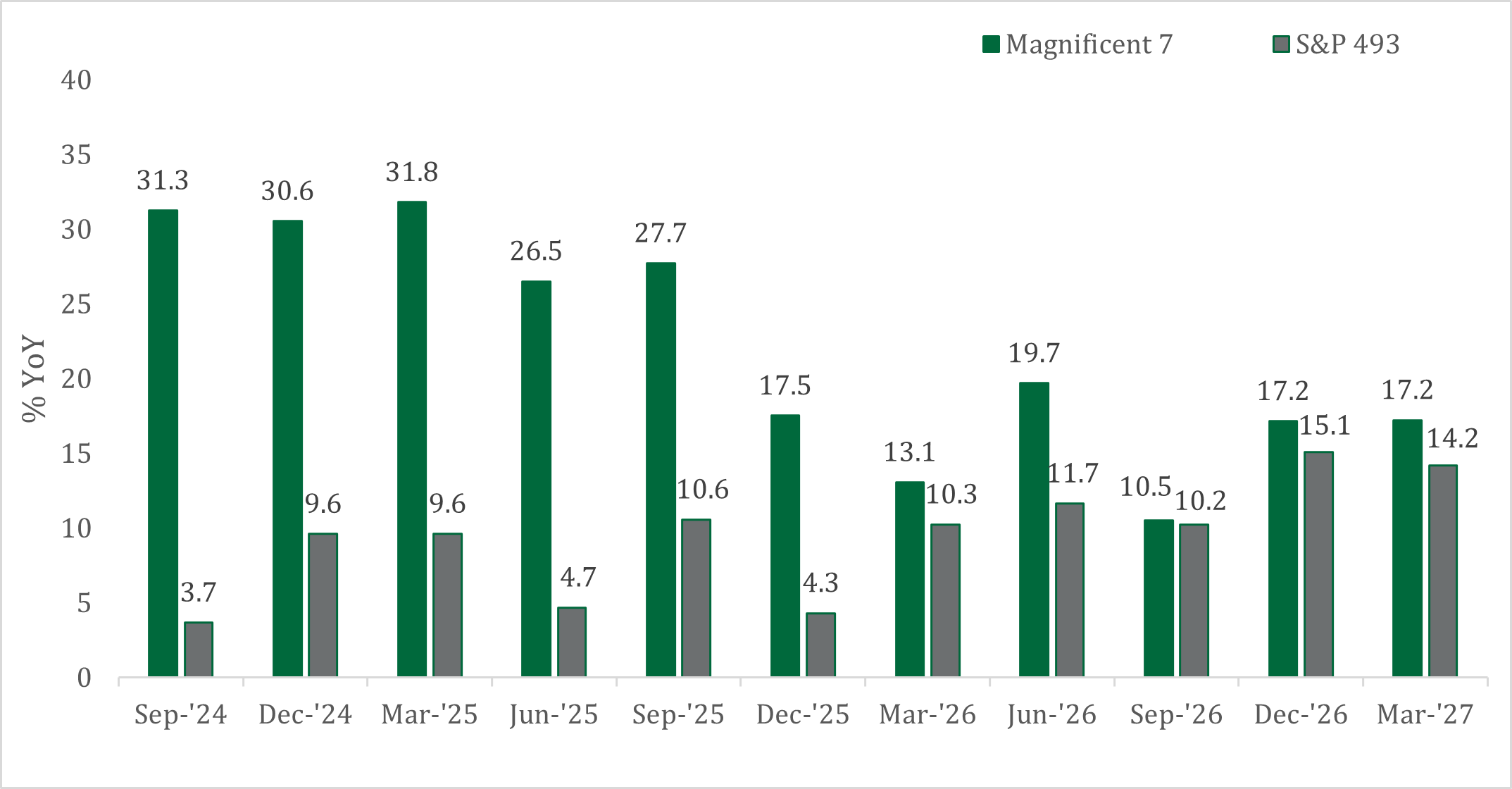

If investors continue to seek out market segments that have better earnings prospects, better relative performance should be expected. Examining this prospect with a wider lens than at the sector level, comparing the earnings growth expectation of the Magnificent Seven and the S&P 493 shows a gradual shift. Beginning in the first quarter of 2026, the earnings growth is expected to only have a 1% dispersion between these two segments and with this trend continuing throughout 2026 and into 2027.

S&P 500 Index Earnings Are Broadening

S&P 493 and Magnificent 7 fundamental picture converging

The catalyst for broader earnings growth in the U.S. market coincides with technology companies needing to spend for expanded capacity. Effectively, the largest operators of AI technology have seen a 50% increase in cash flow spending, and this trend is unlikely to slow unless the market turns away from AI. Historically, those companies who spent the most typically have a declining return expectation. Companies who benefit from increased expenditure include power generators, real estate, industrials, and materials.

STAY AT HOME

The return of international stocks is a reminder that diversification is still extremely important. Although, investors shouldn’t ignore leadership position, the U.S. stock market still holds from a margin perspective (stable earnings) and earnings growth (double-digit growth), driven by the backdrop of the U.S. economy’s resilience. Until this dynamic changes, the U.S. stock market should retain its pole position.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.