Nicolet Wealth Management Monthly Newsletter 12.5.23

Inflation Growth Inching Lower

Prices paid by consumers in October remained unchanged from a month earlier, but on a yearly basis, consumer inflation growth declined to 3.2% from September’s rate of 3.7%. Most important to the middle-class, gas pump and grocery store prices are stuck at a year-over-year growth rate of 4%. While consumers may focus on food and gas costs, investors are intently focused on prices entrenched in the economy, less driven by cyclicality and more supported by structural forces, such as insufficient labor, that leads to persistently high prices. Unless general price growth normalizes, a second inflation wave would likely be top of mind for investors.

All Eyes Remain on the Federal Reserve

The Federal Reserve’s (Fed) next move continues to be widely debated. Capital markets notably changed course in conjunction with the Fed’s last meeting early in November, after the likelihood of more rate increases were set aside. This is the second consecutive meeting that the Fed decided to hold rates at a target range of 5.25 – 5.5%. Equity and fixed income markets see any unexpected rate increases as an obstacle to clarity on the economy. The Fed noted that “economic activity expanded at a strong pace in the third quarter,” while employment gains “have moderated since earlier in the year but remain strong.” Fed Fund Futures, a collective marketplace insight on rates, reveal expectations for lower rates by the middle part of 2024 in large part due to slowing economic conditions.

Interest Rates Retrace from Upward Trend

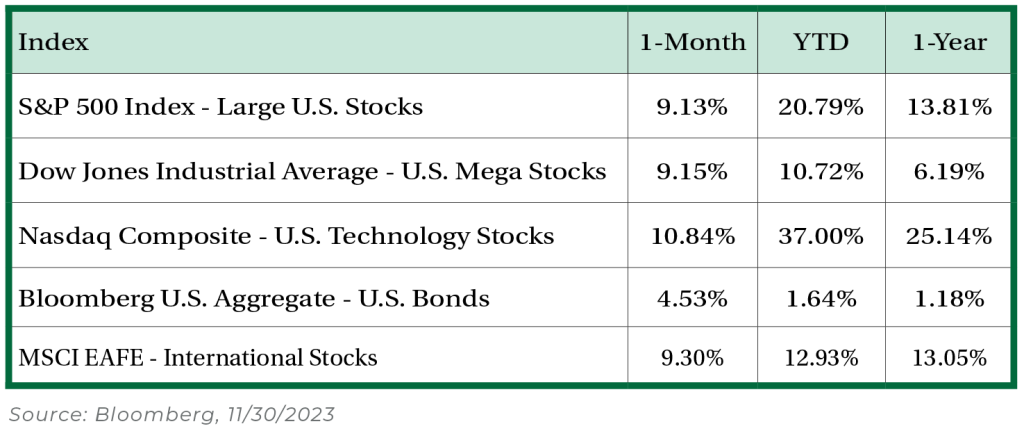

Longer maturity interest rates declined around 0.60% across the board, with the 10-year Treasury yield falling from 4.9% to about 4.3% in one month. While long maturity interest rates typically fluctuate amidst changes in growth, it would appear November’s turn lower was a result of looser monetary policy assumptions and a downturn in inflation expectations. As inflation growth slowly drifts lower, less rate compensation is necessary. In addition, high yield and investment grade corporate bonds rallied alongside equity markets, as general risk appetite increased.

Thanksgiving Rally Setting Up a Santa Rally?

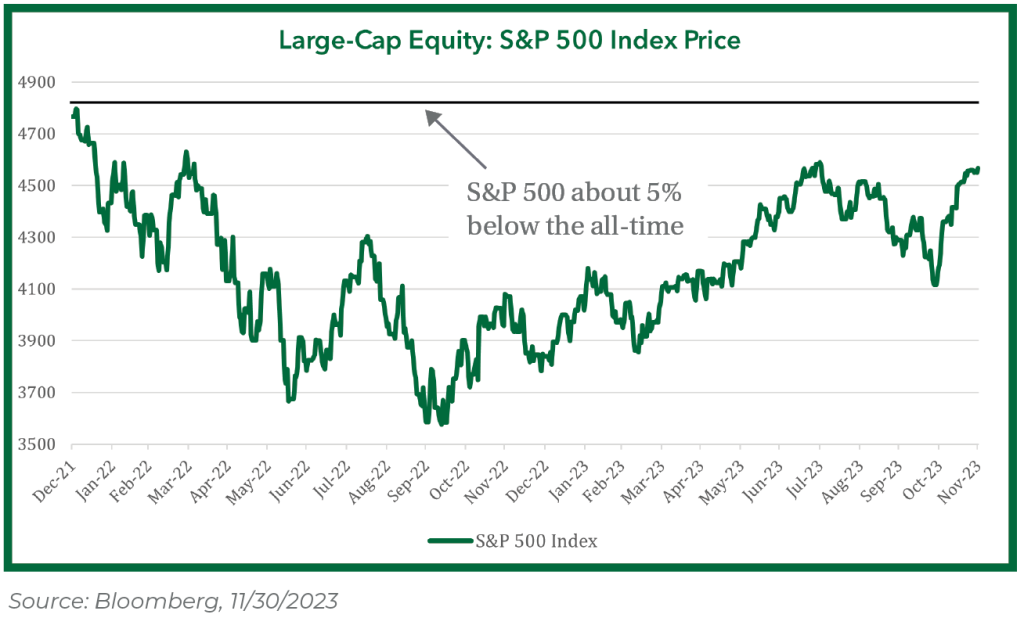

S&P 500 index (large-cap equities) rallied 9.13% in November, nearly recovering the market’s losses from August through October. Consistent with the drivers of return for the year, the largest weighted stocks in the S&P 500 drove performance once again, underlying the narrowness of market returns. Since the beginning of the year, only 7 stocks (Microsoft, Apple, Nvidia, Amazon, Meta (Facebook), Tesla, and Alphabet (Google)) have driven nearly 70% of returns for the market. The remaining 493 stocks in the S&P 500 index have returned just about 6.5%. This is the second largest relative performance difference since 1970, only to be surpassed by the unusual performance of the 2020 COVID affected year. While the rally has been unusual due to its catalysts, a strong November trade has set up for a strong end to the year. Last month’s return was the best month of November since 1999, when the market closed the year out up 4%.

Santa Claus is Coming to Town

Consumers are in a giving spirit yet again this holiday season, as the National Retail Federation (NRF) expects 2023 holiday sales to increase +3-4% year-over-year to about $950-960 billion. Most of the sales increase is expected to be driven by online sales, at a rate of +7-9% year-over-year. Reports indicated Black Friday foot traffic at brick-and-mortar stores were muted relative to years past, with light inventory levels. Interestingly, almost 50% of customers started shopping earlier than usual, but Black Friday spending still increased +7.5%, rising to almost $10 billion, according to Adobe Analytics. Data from Shopify’s Black Friday sales saw an increase of 22% year-over-year on a constant currency basis to $4.1 billion in 2023. Shoppers are spending earlier and more this holiday season!

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.