Markets Take a Breather

US Equity Markets Climb Back from a Rough Start in August

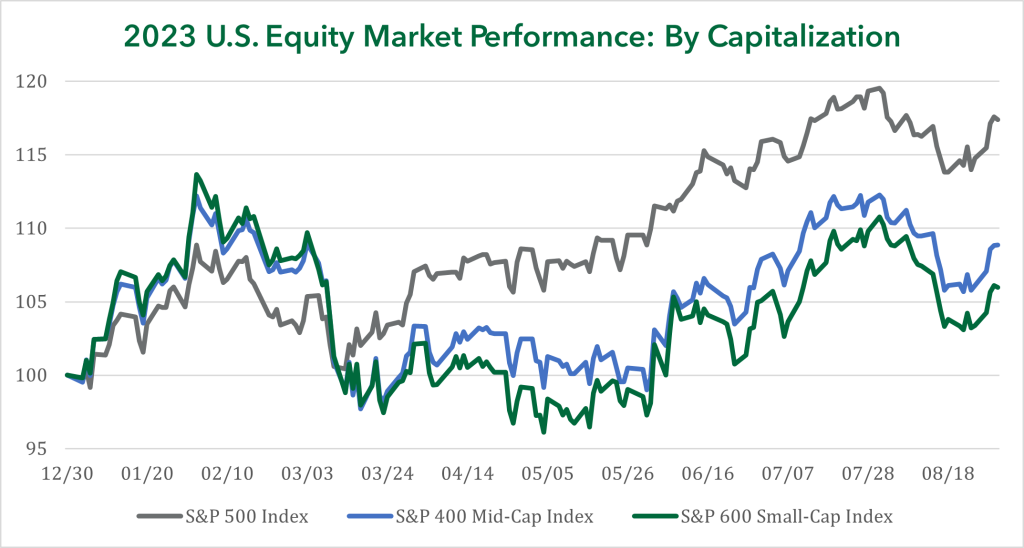

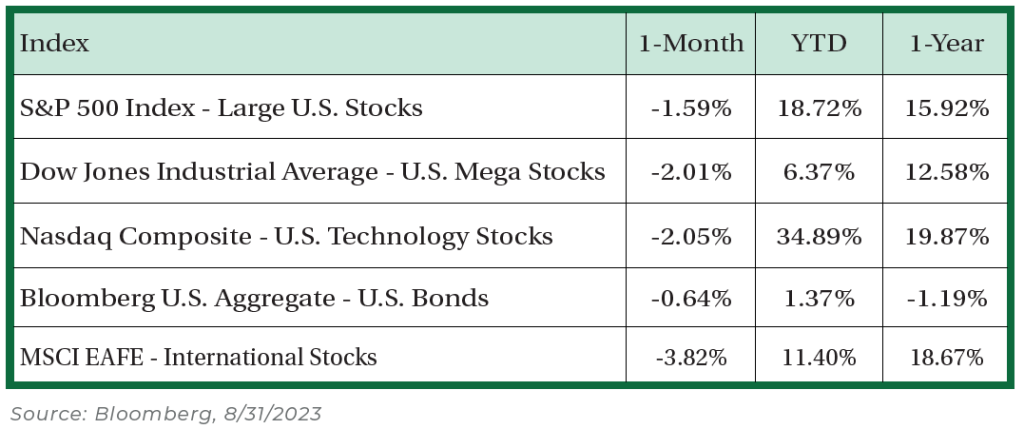

Equity markets took a breather in August after 5 consecutive months of gains. Better economic data is being balanced with a tighter economy that resulted from higher interest rates. The more cyclical components of the market tend to perform worst in this scenario and acted as a relative drag to equity performance during the month. Large- and small-cap value stocks, which are concentrated in the economically sensitive Financials and Industrials sectors, underperformed their respective broad equity indices. Also, the narrower margins and little business diversity of small-cap equities underperformed its large-cap counterparts. In addition, the adage “buy the rumor, sell the news” was notable, as 3-month earnings revisions increased to the highest level since August 2021. Much of the good news was already priced in during early summer trading.

Source: Bloomberg, 8/31/2023

Turbulent Markets in China

August turned into a month to forget for China stock investors, with the overall equity market (Shanghai Composite) declining nearly -5%. Much like previous months, China’s economic data continue to deteriorate. The trade activity trajectory remains weak with exports declining -14.5% and imports falling -12.4% in July, both worse-than-expected. China’s policymakers have tried supporting the economy at the margins with tactical moves, such as modest interest rate cuts, government support of infrastructure projects and measures to boost capital markets (decreasing levies charged on stock trades). Thus far, any supportive policy has lacked size and coordination to improve investor sentiment that remains fixated on China’s ailing property sector.

Better-than-expected 2nd Quarter S&P 500 Earnings Season

The earnings trajectory shifted for the largest companies in the US last quarter, marking positive quarterly sequential earnings growth for the first time in a year. Nearly 80% of companies reported earnings above expectation, which is more than the 5- and 10-year average, a signal that investors have been overly pessimistic on corporate earnings this year. In addition to profit trending in a positive direction, management sentiment supports an optimistic outlook. Corporate management commentary suggests dividends and capital expenditures could continue to rise, which have been a harbinger to economic growth. Artificial Intelligence (AI), a segment of capital expenditures, had the most ever mentions during a quarterly earnings season. Companies see AI improving productivity and enhancing business profitability.

Jackson Hole: Monetary Policy Par for the Course

The annual Jackson Hole Economic Symposium hosted by the Federal Reserve Bank of Kansas City is typically the venue for setting future monetary policy by global central bankers. This year, Federal Reserve (Fed) Chair Jay Powell remained consistent with commentary from July’s Federal Open Market Committee meeting. He repeated the Fed’s plan to “proceed carefully” as “the economy may not be cooling as expected” to bring inflation back to its long-term goal of 2%. The length of time that it takes to cool inflation by hiking interest rates was noted as a reason for a more constructive approach moving forward.

Interest Rates Spike

Bonds with longer maturities saw rates move higher, with the 10-year Treasury yield rising 0.38% and the 30-year Treasury yield increasing 0.44% from the start of the month to the peak. The significant move in yields has varying implications on fixed income asset classes, as bond prices move in an opposite direction of yields. Despite the first risk-off move in assets since March 2023, higher-risk corporate bonds outperformed lower-risk corporate bonds in August. There are two reasons for this performance difference. First, equity market weakness did not trickle into the bond market. There isn’t an immediate concern for a substantial decline in economic growth. Second, higher-risk bonds tend to have shorter maturities. Less-risky, long-maturity bonds were repriced more to reflect higher Treasury bond yields.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.