Stocks Extend 2023 Gains

Federal Reserve taking a break.

After 10 straight meetings of raising the Federal Funds rate, the Federal Reserve (Fed) opted to pause and assess the lagged impact of rates on the economy. Fed Chairman Jay Powell made a distinction during the June press conference that a pause does not signal the end of rate hikes, but a time to gather information. The current reason for gathering information pertains to inflation, which in some pockets of the U.S. economy remains stubbornly high. Sticky inflation can erode purchasing power of consumers or become a headwind to corporate profitability, both a negative for economic growth. However, inflation is not a U.S. phenomenon, the Bank of England and the European Central Bank continue to hike interest rates in the face of elevated inflation.

Stock Market Fatigue?

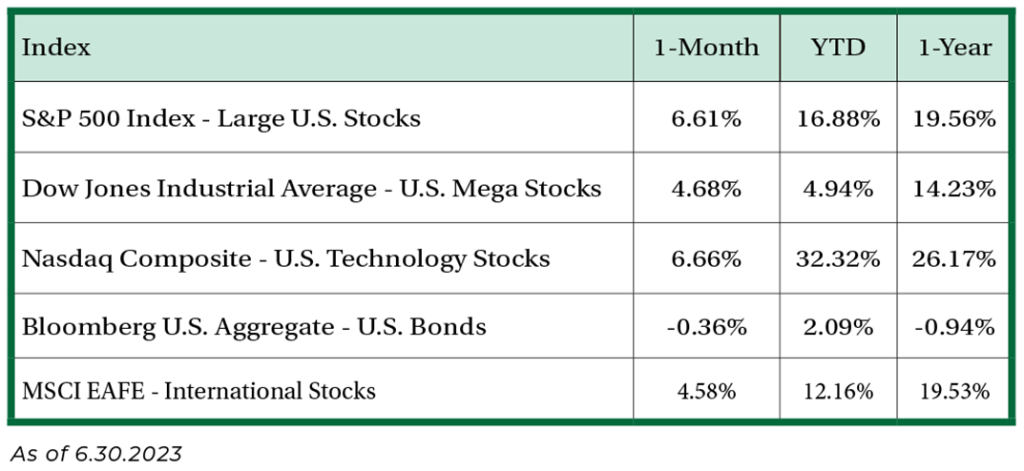

U.S. equities continue to defy the wall of worry for investors, advancing about 6% for the month. Positive performance last month can be broadly explained by steadying and recovering corporate profitability. Confidence in profitability and headline risks not turning into a panic can have a calming effect on investors. Is there a let up in sight? History tells us that July is usually a good month for U.S. equities. The market has advanced in the month of July for eight years in a row.

What’s behind the Technology rally?

Outside of calming equity markets, the real driver behind technology outperformance was enthusiasm for the potential mainstream adoption of Artificial Intelligence (A.I.). It initially started with the fascination of user-friendly A.I. software that answered dense questions instantly. Then companies like Nvidia, who make processing chips that power A.I., exhibited actual growth from this development. According to Goldman Sachs, A.I. adoption could drive almost $7 trillion in global economic growth over a 10-year period. Most importantly, the effect on productivity is immense. Goldman Sachs also expects productivity to grow 1.5% faster annually over the same timeframe. Productivity is one of the key factors to long-term corporate growth and profitability.

Rates March Higher.

Investors’ reaction to Fed Chairman Jay Powell’s hard stance on inflation was to sell bonds, thus demand higher interest rates. The 10-year Treasury yield advanced 0.19%, while the 2-year Treasury yield increased 0.49% in one month, reflecting the market’s belief that the Federal Reserve will raise rates at least one more time this year by 0.25%. U.S. Treasury Bond Index performance declined 0.75% in June after rising 1.59% year-to-date. Despite Treasury weakness, municipals performed well in June, advancing 1%. Municipals offer an attractive opportunity relative to U.S. Treasuries even without accounting for tax benefits. Plus, state & local government balance sheets remain solid from federal transfers and stronger tax revenue.

Summer Driving Season Heating Up.

The U.S. consumer is saying one thing but doing another. Consumer sentiment has been pessimistic for some time, especially since interest rates started rising in 2022. Poor sentiment has not stopped consumers from spending on goods and services. Goods consumption is growing at a positive rate after a brief lull in 2022, while services consumption is rising and reverting to the long-term trajectory. These trends point to another busy summer driving season as consumers continue to spend. Gasoline prices have only marginally increased since early May according to the American Automobile Association, which should support increased travel. Gasoline demand is on pace this year to reach the highest average level since 2019.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.