Nicolet Wealth Management Monthly Newsletter 3.5.24

NVIDIA’s Market Dominance

NVIDIA’s stock market and industry exceptionalism has been on full display this year, returning about 60% in two months after a 239% advance last year. Putting this return into context, over the last two years, NVIDIA has contributed about 20% of returns to the market. The performance of NVIDIA’s stock has come alongside a rapid increase of revenue, rising 265% from a year ago on strong sales for artificial intelligence (AI) chips. Investors believe NVIDIA is uniquely positioned to take advantage of the recent surge in technology hardware spending because its chips are better suited to crunch data necessary for AI programs. Over half of demand for its AI chips has come from large cloud providers.

Q4 2023 Earnings Season Nearing an End

By the end of February, almost every company in the S&P 500 index reported fourth quarter, 2023 earnings. Last quarter’s reporting season confirmed the notable improvement in the economy. After bottoming in early 2023, revenue growth has advanced to a level of 3.9% from 0.9% in the second quarter of 2023. The catalyst remains centered around the select magnificent 7 stocks exhibiting a revenue growth rate of 15% in the quarter, led by Nvidia, Amazon, Meta and Microsoft all announcing revenue growth exceeding 15%. It is worth noting that earnings growth has been negative without the magnificent 7 stocks, underlying the importance of the highest weighted stocks.

Inflation Growth Persistence

The much-anticipated indicator on inflation added to near-term interest rate uncertainty. The January Consumer Price Index (CPI) from the Bureau of Labor Statistics (BLS) increased 0.3% month-over-month, topping the consensus estimate and December’s downwardly revised advance of 0.2%. When excluding food and energy from the headline CPI number, inflation rose 0.4% month-over-month and 3.9% year-over-year, exceeding expectations.

Signs of moderating can be seen in goods prices, but there are pockets of persistent inflation, particularly in services. Core services inflation advanced 0.7% in January, compared to a 0.4% increase in December with non-housing sectors accounting for much of the expansion. There were three notable categories that led to higher services inflation: transportation services (airfare), vehicle insurance and repairs, and medical-care services. Most notably, these segments are closely followed by the Federal Reserve (Fed) because of its link to resilient wage growth.

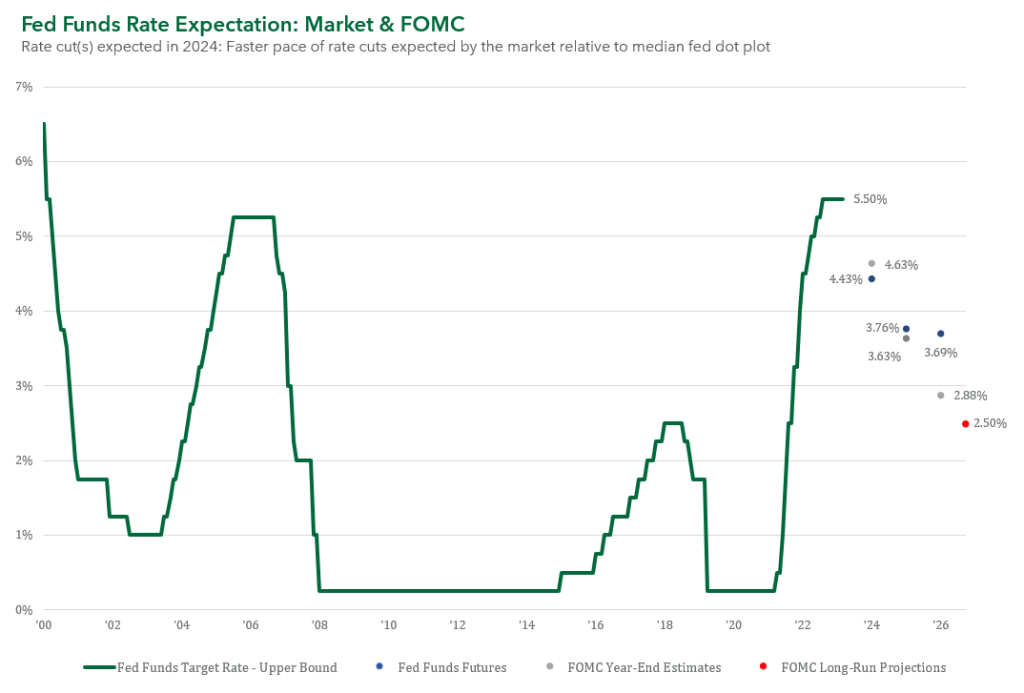

Rates Spike on Higher for Longer Monetary Policy

Market expectations for a Fed policy rate cut in the first half of 2024 was tempered following commentary from Fed chair Jay Powell at the last FOMC meeting and a stubborn inflation print. Long-term interest rates, benchmarked by the 10-year Treasury yield, increased 0.34%, while shorter-term interest rates (commonly a guide for the Fed’s policy rate) rose 0.41%. Two months into the year, investors expect three 0.25% rate cuts in 2024 to a target rate of 4.425%, a significant change from six rate cuts at the end of 2023 and slightly less than the Fed’s projection of 4.625%. Inflation returning to the Fed’s preferred level of 2% and the employment trajectory are two indicators that will determine the path of policy rates as we progress through 2024.

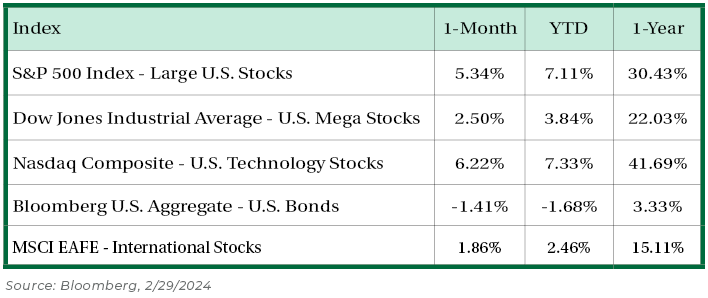

Global Equity Markets Rally

The U.S. stock market returned 5.34% in February, only marginally outperforming Emerging Market stocks. Unlike last year, China’s stock market turned into a contributor of positive returns last month, advancing nearly 8.55%. Support for a weakening real estate sector and an emphasis on technology innovation is expected to be communicated by China’s much anticipated “Two Sessions” policy meeting. Other strong performing international stock markets include Japan’s Nikkei 225 index, which reached an all-time high after surpassing its last peak 34 years ago. The Nikkei 225 Index is also benefiting from a surge in AI technology spend.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.