Nicolet Wealth Management Market Update.

Thank you for your continued confidence and trust in Nicolet. The S&P 500 Equity Index has once again returned to record high levels. The recent strength follows an earlier setback in September when the equity market experienced a 5% correction for the first time in 11 months. Strong company fundamentals continue to support the equity market as third quarter corporate earnings again surprised to the upside and exceeded market expectations.

Companies on average over the past six quarters have reported earnings that are nearly 20% above expectations. Outstanding third quarter results included nearly 40% earnings growth, and expectations are that next quarter earnings will grow by more than 20%. While the growth witnessed in 2021 is likely to be the high point in this cycle, growth next year could still potentially be above average.

Earnings growth continues to outpace sales growth as operating margins continue to expand despite cost inflation running at levels not seen in over 30 years. The majority of large publicly traded companies have higher operating margins today than pre-Covid, as corporate pricing power remains strong. Going forward, the ability to maintain high margins amid rising wage and input costs remains key to the corporate earnings outlook.

The labor market continues to gradually improve as the number of Americans filing claims for unemployment benefits fell to a 20-month low. The unemployment rate has fallen nearly a percentage point over the last three months to the current 4.2% rate, according to the labor department. The current level of unemployment is now in the 3.8% to 4.3% range that Federal Reserve officials consider consistent with full employment, and near the pre-pandemic low of 3.5%. However, the current labor participation rate is at its lowest level since the 1970s as several million people have dropped out of the labor force.

Encouragingly, the uneven recovery in employment to date has begun to show signs of improvement as the unemployment rate for low-wage individuals improved to 5.7% from 7.4% last month. While the unemployment rate for high-paid workers remained flat near 2.3%

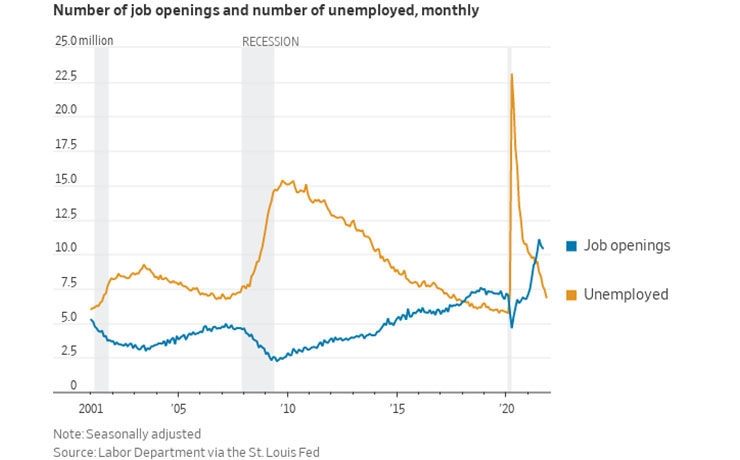

U.S. job openings continue to greatly exceed the number of available workers. There are over 11 million job openings in the U.S. compared to the 6.9 million people that are without jobs and actively seeking work. A simple ratio of job openings-to-job seekers shows a record mismatch.

As the labor market approaches levels considered to be tight, employers across the U.S. are having to increase wages and benefits to attract workers. The Labor Department reported that the employment cost index, a widely watched measure of worker compensation that includes both wages and benefits, rose 1.3% in the third quarter from the second, the fastest pace in at least two decades. Average hourly earnings rose 4.8% year-over-year. Over the last eight months, wages have surged at an annualized rate of 5.6%. With record-high job openings and quit rates, more wage inflation is likely in 2022.

Although high inflation and the risks that it brings will likely persist, the near-term outlook for the capital markets remains positive, based on strong company fundamentals, continued fiscal stimulus, supportive monetary policy, and a successful vaccine distribution effort. However, our optimism is tempered by the potential for higher sustained inflation, increased risk of the omicron variant, and potentially adverse policy impacts on the financial markets.

As a result, Nicolet Wealth Management continues to maintain a disciplined long-term approach and is prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products:

– Are Not FDIC Insured

– May Lose Value

– Are Not Bank Guaranteed

– Are Not Deposits

– Are Not Guaranteed by Any Federal Government Entity

– Are Not a Condition to Any Banking Service or Activity

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank.

Past market activity is not indicative of future results, and changes in any assumptions may have a material effect on projected outcomes. Investing in securities entails risk, and the potential for losing money always exists when investing in securities. Asset allocation, rebalancing, and asset diversification will not ensure account protection in a declining market, and cannot be relied upon to enhance gains in a rising market.

Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice.