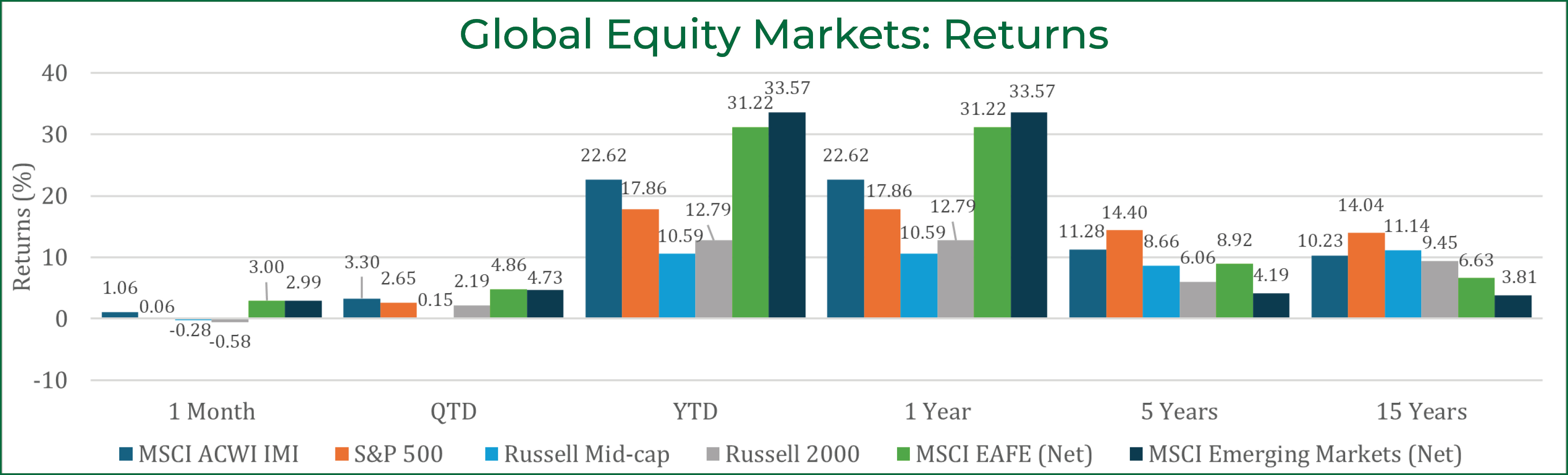

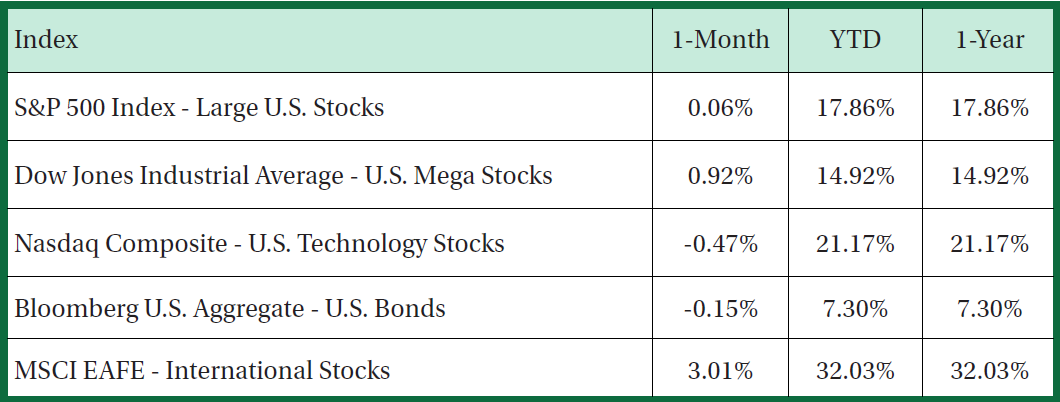

U.S. Stocks Unchanged in December

The S&P 500 index, a benchmark for the largest U.S. stocks, was essentially flat for the month, rising only 0.06% with returns being led by value stocks. In December 2025, the S&P 500 value index rose 0.4%, while the S&P 500 growth index declined -0.2%. The minimal return in the U.S. was not consistent with international stocks, as the MSCI ACWI ex USA jumped 3% in December. The main catalyst behind the divergence of returns with U.S. and international stocks was the big move in the U.S. dollar, which declined -1.1%. Typically, dollar weakness is positive for international stocks as the earnings of companies outside the U.S. become more valuable.

Federal Reserve Closes the Year with Another Rate Cut

The Federal Open Market Committee (FOMC) voted to cut its target policy rate by 0.25% to a range of 3.5%-3.75%, its third consecutive interest-rate reduction. Interesting to note, gone are the days of 100% consensus amongst FOMC members as three members dissented against the quarter-point rate reduction. Two members voted for no rate cut, citing unreliable data from the government shutdown for taking a more prudent approach to monetary policy changes and one member voted for a larger 0.5% rate cut. Looking forward, the FOMC maintained an outlook of just one 0.25% cut each in 2026 and in 2027 as persistent inflation and a weakening labor market provides a conflicting viewpoint for policymakers.

Job Growth Choppiness

The labor market saw an improvement in November, with 64,000 jobs added during the month after 105,000 jobs were lost in October. The decline in the October payrolls was the largest since the end of 2020 and was a result of a 162,000 contraction in federal government employment as the deferred resignation program dropped off the payrolls. While the job market recovered in November, the unemployment rate ticked up to 4.6%, the highest since 2021, and up from 4.4% in September. The jump in unemployment was a result of people re-entering the workforce and workers placed in temporary layoffs. Looking under the hood, hiring in November was mostly concentrated in education, health services, and construction.

Economic Growth Surprises Higher

U.S. economic growth in the third quarter increased at a 4.3% annualized pace as business and consumer spending remained resilient. Business investment expanded by a 2.8% rate, led by outlays on computer equipment as investment in data centers climbed to record levels. Consumer spending advanced at a 3.5% annualized pace on purchases of services, which includes healthcare and international travel. In addition to business and consumer spending, net exports also contributed positively to growth as the U.S. economy exported more. Stronger economic activity, despite choppiness in the job market, supports rising productivity.

Bond Yields Rise

The 10-year Treasury yield advanced 0.16% in December 2025, finishing the year at 4.17% but down from the 2025’s peak of 4.8%. Some of the catalysts behind lower yields in 2025 were the Federal Reserve cutting its target policy rate, slower economic growth and declining inflation expectations. Overall risk sentiment was positive in bond markets last month as high yield bonds advanced 0.6%, which surpassed U.S. investment grade bonds by about 0.8%. Also supporting the performance of high yield bonds was lower interest rate sensitivity given their shorter maturities relative to investment grade bonds.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.