Nicolet Wealth Management Monthly Newsletter 5.3.24

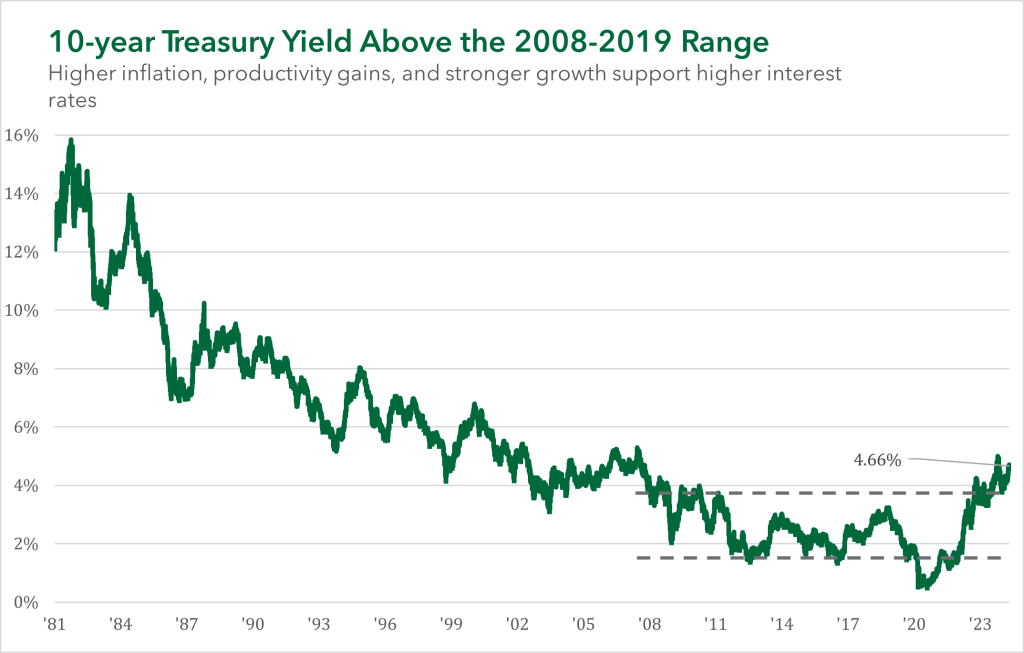

Rates Accelerate Higher

Consistent with the trend year-to-date, an upward trajectory of interest rates continues to be the path of least resistance. In April, the 10-year Treasury yield advanced about 0.50%, while the 2-year Treasury yield topped 5% for the first time since November 2023. Higher interest rates are reflecting strong economic activity and sticky inflation. As a result, the expectation for the Federal Reserve target policy went from six, 0.25% cuts in 2024 expected at the beginning of year to just one occurring in December 2024. A pivot in interest rate expectations has been a headwind for fixed income markets this year: the Bloomberg Aggregate index (a proxy for the bond market) has declined -3.3%.

Slower, But Solid Q1 U.S. Growth Print

U.S. Gross Domestic Product (GDP), a quarterly measurement of U.S. economic growth, slowed in the first quarter of 2024. Overall, GDP increased at an 1.6% annualized rate, below the consensus estimate and last quarter’s growth of 3.4%. The largest component of U.S. growth, personal spending, only expanded by 2.5%, slowing from 3.3% the previous quarter. In addition, a wider trade deficit subtracted the most growth since 2022, as goods imports surpassed exports by a wide margin. On a positive note, investment spending was a positive contributor on an expansion of residential construction and non-residential investment being powered by intellectual property spending – artificial intelligence.

Resilient Inflationary Pressure

The Consumer Price Index (CPI), a calculation of price growth, has defied expectations and reflected higher. CPI advanced 3.5% year-over-year in March and 0.4% from a month earlier, with both topping the consensus estimate. Most concerning, inflation not subject to the cyclicality of energy and food led the way. Services inflation accelerated on categories tied to transportation (auto insurance and repairs) and healthcare. The higher-than-expected services inflation print was also supported by shelter prices advancing 0.4%. However, new market rents suggest rents and primary housing should slow during 2024.

Oil Prices Stabilize in April

The international benchmark for oil, Brent crude, was up only modestly in April to a level of $88 per barrel despite rising geopolitical tensions in the Mideast between Israel and Iran. However, much of the price action occurred prior to the escalation of tensions on April 13. Brent crude prices touched a low of $73 a barrel in December 2023, rising to a 2024 high of $91 a barrel on April 5th, with a significant segment of the rally occurring in March. While an expectation of geopolitical tension partly explains the upside in oil prices, the real catalyst behind oil since last year has been improving economic conditions. A broad indicator of manufacturing activity quickly pivoted from contractionary economic growth in November 2023 to an expansionary level in March 2024.

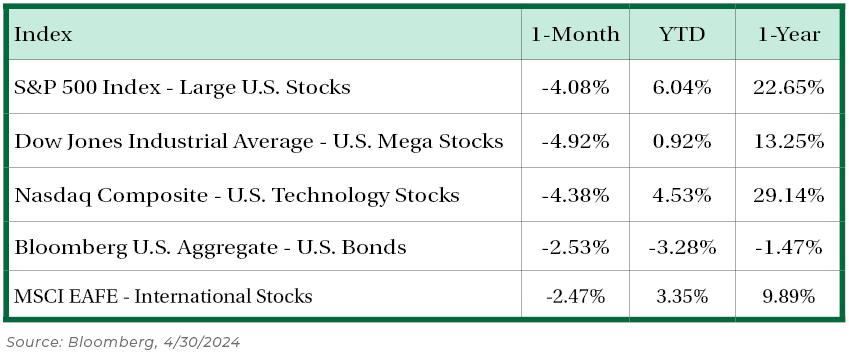

Equity Markets Fall from All-Time Highs

U.S. equity markets quickly reversed after ending the 1st quarter at an all-time high. Large companies declined by -4.1% (S&P 500 index), medium companies dropped by -5.4% (Russell Mid-cap index), and small companies fell by -7% (Russell 2000 index). At one point, the small company index exhibited a decline of more than 8% in April. Stocks reacted negatively to the higher-than-expected inflation data, which changed the expectation of future interest rates. Small companies are more sensitive to a change in interest rates because of a greater reliance on bank loans that reset dependent on the market level of rates. However, higher for longer interest rates typically indicates a strong U.S. economy, which is positive for small companies.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.