Nicolet Wealth Management Market Update.

Thank you for your continued confidence and trust in Nicolet. The S&P 500 has now doubled, up 100% including dividends, since the March 2020 pandemic low point. The S&P 500 Equity Index, which measures the stock performance of 500 large US companies, started the third quarter up around 2.5% for the month of July, and is now up over 17% year-to-date.

As the economy has recovered rapidly, corporate earnings have followed. Strong earnings, and expectations for the strength to continue, together have driven equity markets to all-time highs. In fact, earnings expectations recovered to their pre-crisis levels a full 11 months quicker than any of the previous four recessions, despite experiencing the second largest decline.

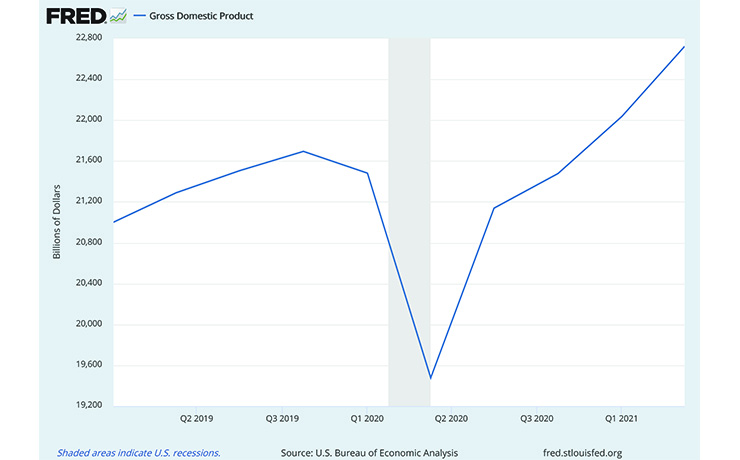

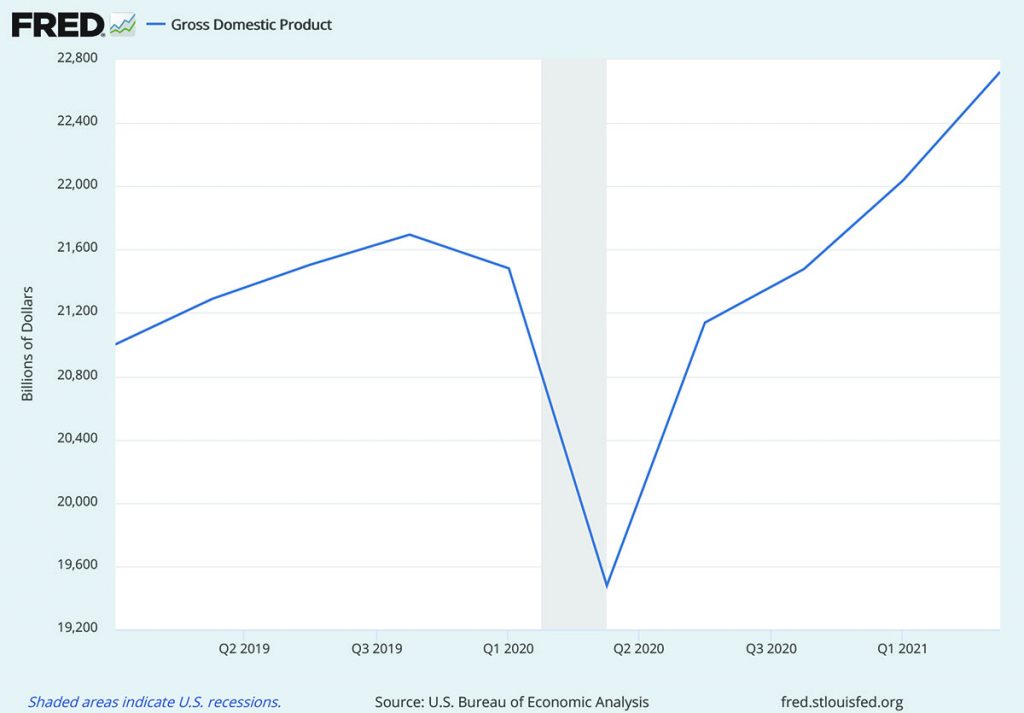

The size of our economy has now surpassed its pre-pandemic level. Recent growth has been driven by strong consumer spending. Stimulus checks, reopened businesses, and vaccines have fueled the high level of consumer activity. Spending by businesses on productivity-enhancing projects and intellectual property has also been an important contributor to the strong growth experienced this year.

Source: U.S. Bureau of Economic Analysis.

Recent data points suggest that growth rates may have peaked and will now begin to moderate back to more normal levels. Most recently, U.S. gross domestic product (GDP), which measures the annualized change in the value of all goods and services produced by the economy, showed the economy was currently growing by over 6%. However, forecasts for 2022, predict a more moderate 4% growth rate. More moderation is expected in 2023, with forecasts estimated 2-3% growth.

Supply-chain problems and various product and labor shortages continue to push prices higher across a variety of goods and services. Consumer inflation, as measured by the Consumer Price Index, accelerated in June at the fastest pace in over a decade at 5.4% compared to a year ago. Although inflation is now tracking well above the Fed’s 2% target, the Fed continues to indicate that it will look past transitory inflationary pressures and remain accommodative to allow the employment market to continue to recover.

After several months of disappointing data, the employment market has begun to show some material improvement. In July, U.S. employers added nearly one million jobs to their payrolls. This was the best month in nearly a year and brought the current 5.4% unemployment rate to its lowest level since the pandemic began. Hiring was broad based, but leisure and hospitality continued to lead again this month accounting for about a third of all job gains.

The near-term outlook for the capital markets remains positive, based on continued aggressive fiscal stimulus, highly supportive monetary policy, and a successful vaccine distribution effort. However, our optimism is tempered by the potential for higher sustained inflation, increased risk of the Delta variant, and potentially adverse policy impacts on the financial markets. As a result, Nicolet Wealth Management continues to maintain a disciplined long-term approach and is prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products:

– Are Not FDIC Insured

– May Lose Value

– Are Not Bank Guaranteed

– Are Not Deposits

– Are Not Guaranteed by Any Federal Government Entity

– Are Not a Condition to Any Banking Service or Activity

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank.

Past market activity is not indicative of future results, and changes in any assumptions may have a material effect on projected outcomes. Investing in securities entails risk, and the potential for losing money always exists when investing in securities. Asset allocation, rebalancing, and asset diversification will not ensure account protection in a declining market, and cannot be relied upon to enhance gains in a rising market.

Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. Investors should consult with their legal and tax professionals before making investment decisions.