News & trends from Nicolet Insurance Services for crop farmers ~ Issue 3, 2023

Winter Wheat Sales Closing Date – September 30th

The open enrollment period is underway to add wheat coverage for the 2024 crop year. The deadline to sign up for coverage is September 30th, 2023. Current policyholders who wish to change their wheat coverage can do so now through September 30th, 2023. Existing policies will automatically renew if you do not make any changes.

Forage Production Sales Closing Date – September 30th

Forage production policies provide crop insurance coverage on established hay fields. Coverage applies to alfalfa, alfalfa/grass mixes, & red clover. Producers are provided a tonnage/acre guarantee based on dry hay equivalent (13% moisture hay). Farmers who wish to insure their established hay for the 2024 crop year, can sign up for coverage now through September 30th, 2023. Current policyholders can make changes to their existing policies now through September 30th. Existing policies will automatically renew if you do not make any changes.

Margin Protection Sales Closing Date – September 30th

Margin Protection is an area-based plan of insurance that guarantees producers a margin between expected revenue and expected input costs. Margin Protection can trigger payments if commodity prices fall, if your county experiences low yields, or if input costs increase. Margin Protection can be purchased as a stand-alone policy, or you can piggyback it with your underlying individual policy. Producers who use Margin Protection in combination with their underlying policy, will receive a premium credit on their individual policy. Margin Protection is available in our area for corn and soybeans. The deadline to sign up for Margin Protection for the 2024 crop year is September 30th, 2023.

Production Reporting Deadlines – 2023 Forage Production & Wheat

Did you insure your forage production or wheat in 2023? If so, the deadlines to report your production to your agent are:

• Forage Production - November 14th

• Wheat - November 15th

If you experienced a loss on either crops this year, please let your agent know asap so they can file a notice of loss for you. No claim will be paid without a timely filed notice of loss.

Acreage Reporting Deadlines – 2024 Wheat, Forage Production, Fall Forage Seeding

Acreage reports for the following crops must be submitted to your crop insurance agent by:

• October 16th - Forage Production - Forage Underwriting Reports Due

• November 15th - Wheat, Forage Production, Fall Seeding - Acreage Reports Due

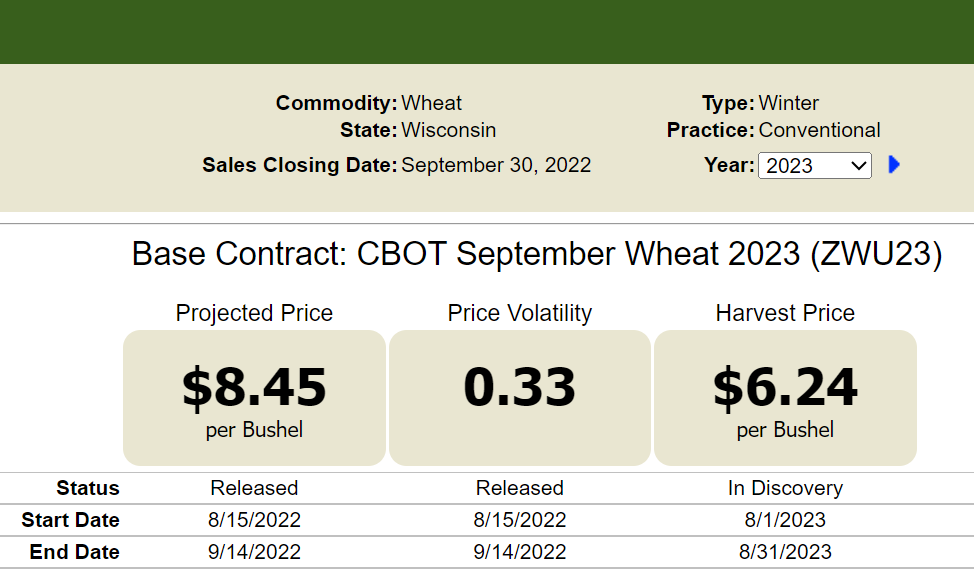

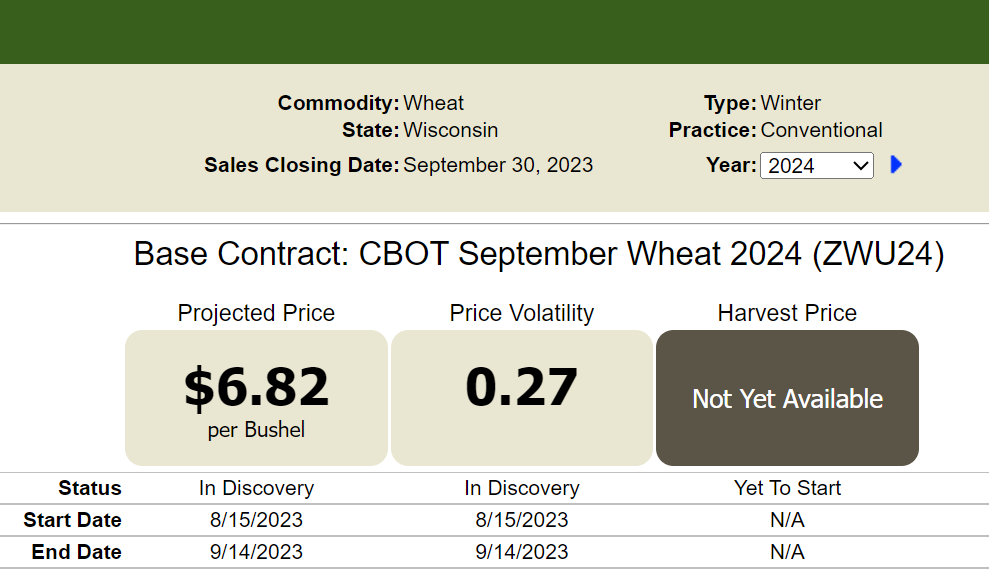

WHEAT PRICE DISCOVERY

Projected Price - Projected prices are used to establish crop insurance guarantees and premiums for commodities that trade on commodity exchanges (Chicago Board of Trade). The projected price for a commodity is an estimate of the future value of the crop at harvest. Daily futures settlement prices for these crops are averaged at the end of their discovery period.

Harvest Price - For revenue policies only. The harvest price is the average value of the commodity measured during the harvest season. Daily futures settlement prices for these crops are averaged at the end of the harvest price discovery period.

Shown below are the estimated base prices for 2023 & 2024 wheat at the time of this publication.

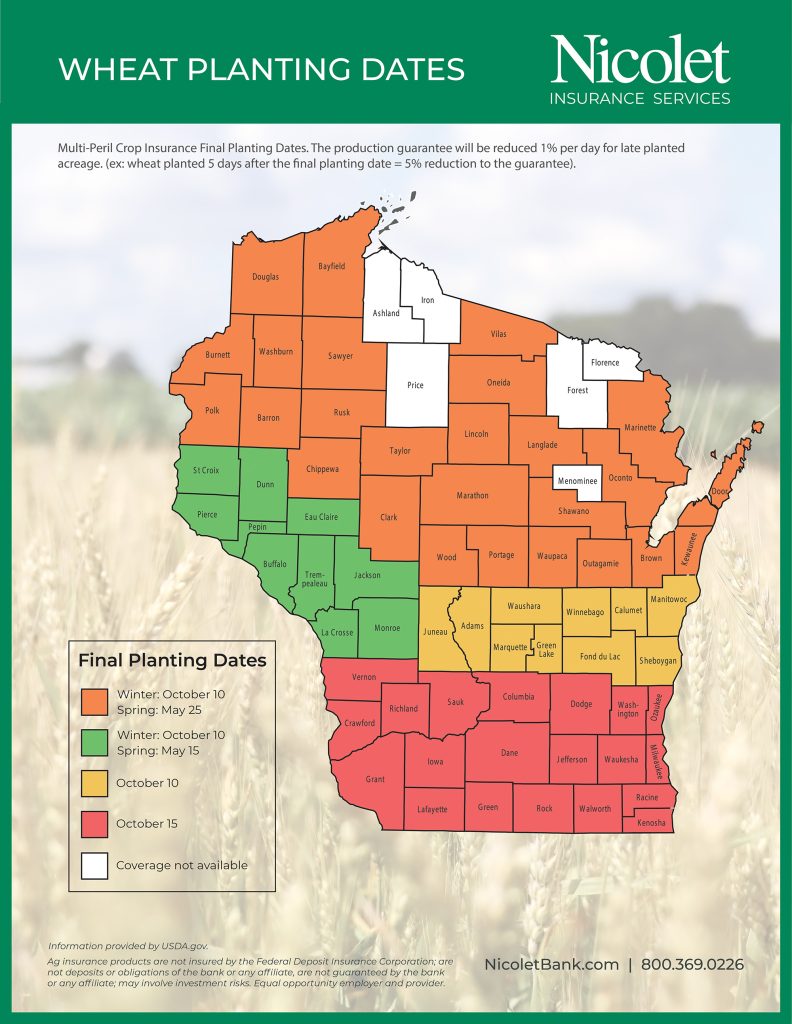

NEW 2024!! Winter Wheat Final Planting Date Changes

Changes to the final planting dates for winter wheat now allow producers more time to plant the crop before coverage is reduced. See the new final planting dates on the last section below.

2024 FORAGE PRODUCTION ESTABLISHED PRICES

Hay prices used to determine forage production guarantees are established annually by the Risk Management Agency (RMA). The following prices have been established for the 2024 crop year:

• Alfalfa - $177/Ton

• Red Clover - $128/Ton

NEW 2024!! Enterprise Units Available for Forage Production

Insureds now have the option to elect enterprise unit structure on their forage production policy. Why is this important? Enterprise unit structure includes higher subsidy amounts, therefore lowering the farmer paid portion of the premium. Insureds who wish to switch to enterprise unit structure must do so by September 30th.

SILAGE APPRAISALS

Farmers who will harvest their corn for silage, snaplage, or high moisture, must have appraisals taken by a crop adjuster prior to harvest. Insureds should contact their crop insurance specialist prior to harvest and ask them to file a notice of inspection (the customer must initiate this

process). A crop adjuster will call you within 24 hours to coordinate a time to do the appraisals.

You can make the appraisal process go smoother by opening multiple fields before the adjuster arrives. If the adjuster cannot make it to your farm before you harvest your crop, you may be asked to leave sample strips in your fields to be appraised later. No claim will be paid on any acreage without an appraisal.

Pasture, Rangeland, Forage (PRF) Sales End- December 1st

PRF is designed to protect your operation from the risks of forage loss due to the lack

of precipitation. The PRF program utilizes a grid system and a rainfall index to determine

precipitation amounts within an area. If you experience a lack of rainfall in the grid, you

are paid an indemnity. Producers are not required to insure all their forage acres- you pick and choose the acres you want covered.

Welcome Marcus Birschbach!

Marcus Birschbach is the newest member of the crop

insurance team here at Nicolet! Marcus is originally

from Eden, WI. He graduated from UW – Platteville in

2020, with a bachelor’s degree in Agribusiness and an emphasis in Marketing & Communications. He

currently resides in Lomira, WI. Marcus enjoys travelling, spending time with family and friends, being on the farm, and working outside.

Ag Insurance products are not insured by the Federal Deposit Insurance Corporation; are not deposits or obligations of the bank or any affiliate; are not guaranteed by the bank or any affiliate; may involve investment risks. Equal opportunity employer and provider.