Consumers Lose Momentum

A deluge of economic data delayed from the government shutdown were reported in November. One of the most important economic indicators, retail sales, was released last month and it provides critical insight into the condition of the consumer. Retail sales from September rose modestly, increasing 0.2% month-over-month after a 0.6% month-over-month gain in August, while excluding cars and gas, sales rose just 0.1% month-over-month (motor vehicle sales fell for the first time in four months). On a positive note, spending at restaurants and bars advanced 0.7% month-over-month, as 8 out of the 13 categories posted increases, particularly spending at gasoline stations, personal care stores and miscellaneous retailers.

Confidence Plunges During Shutdown

The Conference Board’s headline consumer confidence index declined to 88.7 in November, compared with 95.5 in the prior month and below the consensus expectation of 93.3. Future expectations of consumer confidence deteriorated by 8.6 points, while the present situation fell, too. Worsening consumer expectations were driven primarily by pessimism of business conditions six months ahead, although the level of concern about the labor market largely held steady. Given the report fully capturing the government shutdown in November before reopening, there should be a sharp recovery in the December consumer confidence data.

Business Activity Accelerates

Service and manufacturing expanded at the fastest rate in 4 months, as the S&P Global U.S. Composite Output Index, which tracks sentiment among purchasing managers at manufacturing, construction, and services firms, advanced 0.2 to 54.8 in November. Examining the components of the overall output index, expectations over the coming year increased 7.3 points, the largest monthly advance in five years. However, the composite gauge of prices paid for materials climbed to the highest level in three years, while costs for service providers increased to the highest level since the start of 2023. Service providers noted some ability to offset those higher costs by charging more.

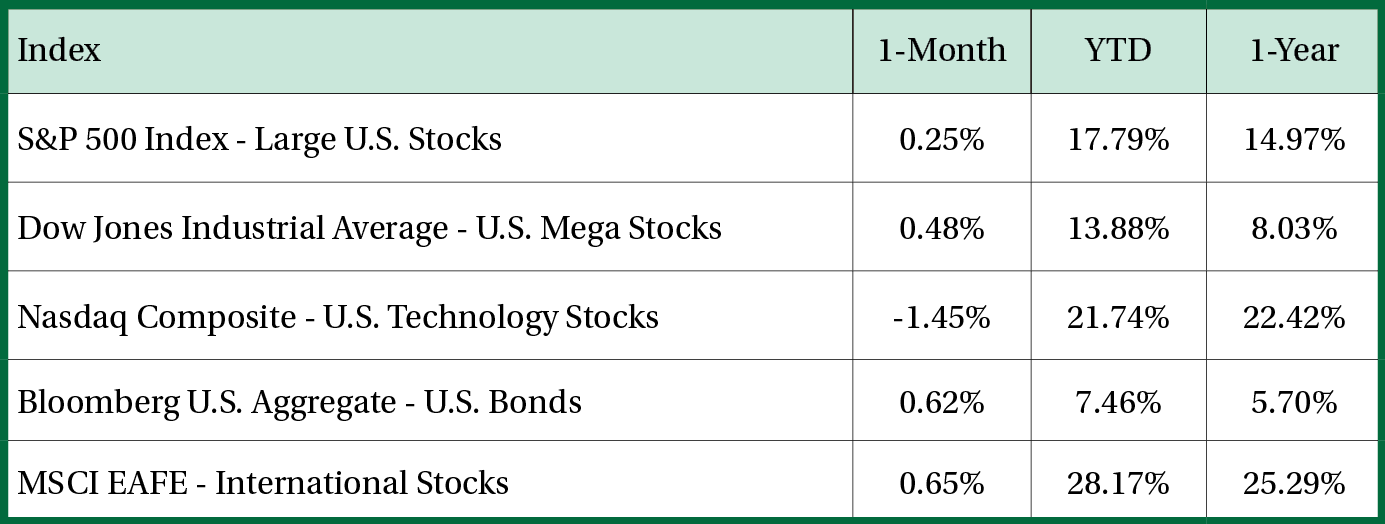

Technology Stocks Lag

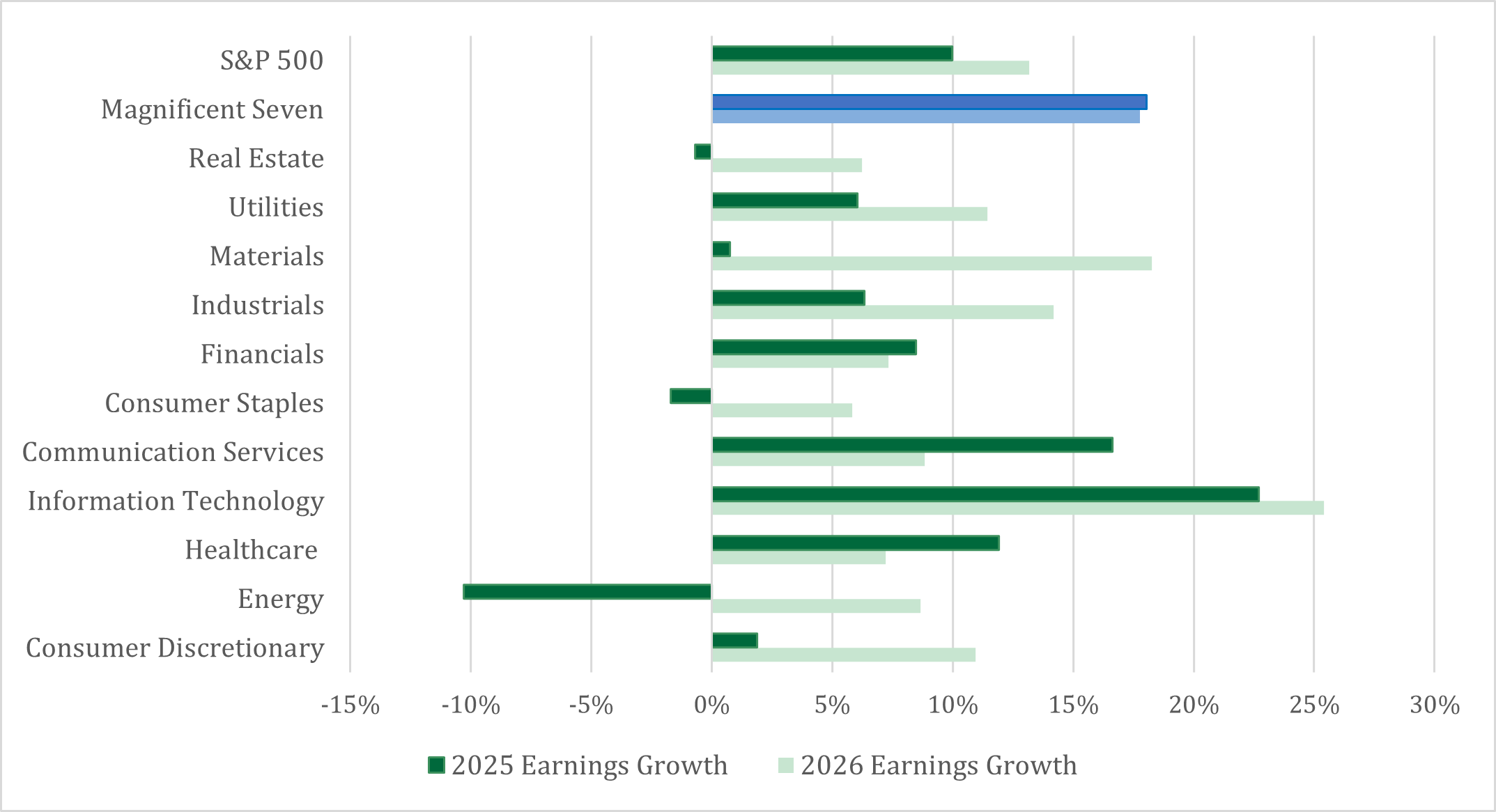

Investors became increasingly cognizant of stock valuations, particularly technology stocks that carry a high valuation relative to the rest of the market. For the past couple of years, technology stocks have carried a high valuation because of their earnings growth, margins, and stable earnings capacity. These features were in question last month as technology’s recent spending binge has drawn skepticism from the market whether it will be accretive to future growth. In November, the growth segment of the stock market, which includes technology, declined -0.6%, while the value segment rose 1.9%. For the entire year, growth stocks have advanced 17.8% and value stocks have advanced 12.8%. The earnings dispersion between growth and value stocks is expected to narrow in the upcoming year, which could draw investors’ attention away from the biggest technology stocks.

2025 Earnings Growth Being Led by Magnificent 7

Growth expected to be driven by Mag. 7 sectors – Information Technology, but signs of broadening into other segments of the market

Mag. 7: Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta Platforms, Tesla

Value Segment: Utilities, Consumer Staples, Healthcare, Financials

Rates Fall on Federal Reserve Expectations

The 10-year Treasury yield dropped below 4% in late November as expectations for another rate cut in December continue to oscillate. On November 19th, the probability for a 0.25% rate cut in December fell to 29%, only for the probability to rise above 80% at the end of November. Looking out to next year, the market expects a total of three, 0.25% rate cuts, which would leave the target range below 3% for the first time since 2022. The Federal Reserve will meet on December 10th to decide on the target policy rate, with rising inflation and labor market uncertainty complicating the rate decision.

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement plan level services, and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.