The year 2022 proved to be a very challenging year for the capital markets. High and persistent inflation drove central banks around the world to quickly and significantly tighten financial conditions. In the U.S., the Federal Reserve executed one of the fastest set of rate hikes on record. Taking the benchmark Fed Funds rate from roughly 0% up to 4.5% in the span of nine months has put economic growth and corporate profits at risk of contraction in 2023.

Stocks were negatively impacted by the threat of recession and the impact of higher interest rates on valuations. Bonds also suffered from higher rates, as well as wider credit risk spreads. Unfortunately, because the greatest headwind to the markets was from rising interest rates, bonds failed to offer their typical diversification benefits and moved lower with stocks throughout the year.

The S&P 500 Equity Index finished the year down 18.1%, and the Bloomberg U.S. Aggregate Bond Index was down 13% in 2022. In the end, a balanced portfolio of both stocks and bonds experienced the worst total return since the late 1960s.

Looking forward to 2023, market participants differ on their outlook for the equity markets. The bull thesis is that economic growth will continue and could surprise to the upside in 2023. The bear thesis is that the effects of monetary policy tightening will be felt in 2023 dragging down corporate earnings, resulting in a recession and a bearish first half of 2023.

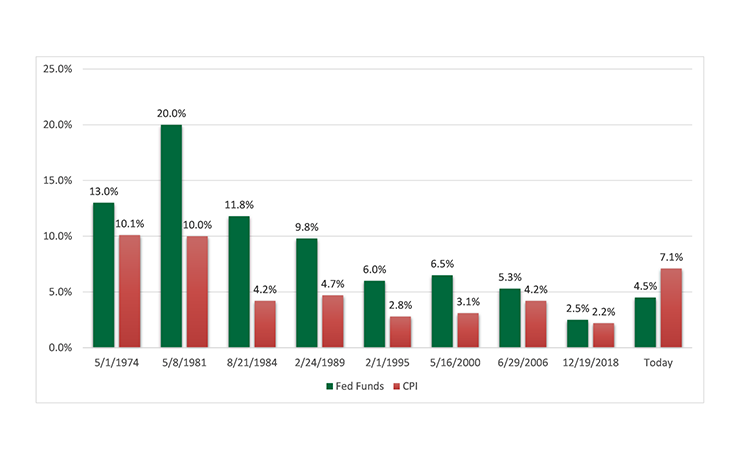

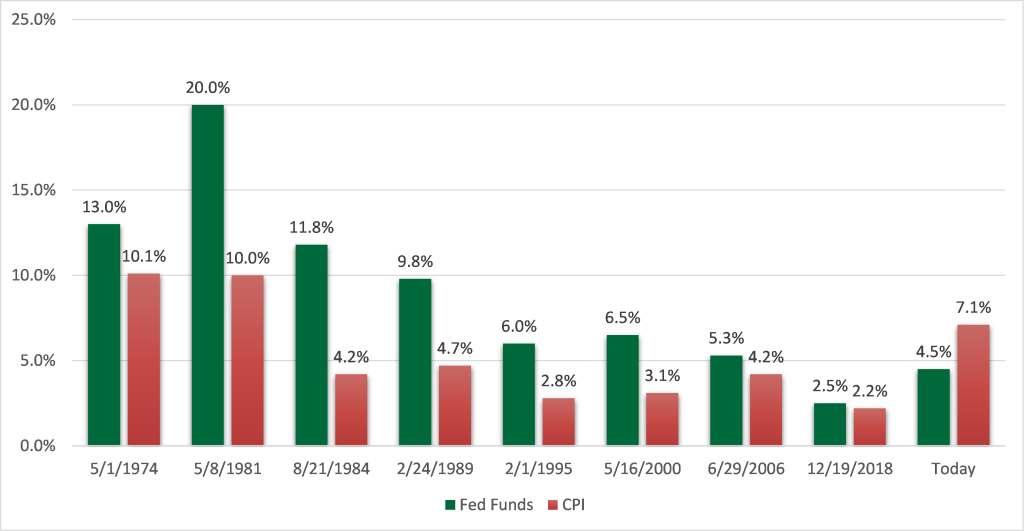

Regardless of the outlook, restrictive monetary policy will likely continue until the Fed Funds rate is positive in real terms and the labor market and subsequent wage inflation slows down. The minutes to the mid-December FOMC meeting indicate that additional rate increases are still needed to bring inflation back down to normal levels. Market expectations are for the FOMC to deliver a 25bps rate hike in February and an additional 25bps in March, followed by rate cuts later in the year. Considering the guidance given by the FOMC, a more conservative and reasonable assumption may be the FOMC delivers a series of 25bp rate hikes in February, March, and May, and then holds the Fed Funds rate at 5-5.25% for the rest of 2023.

Tightening cycles have historically not ended until the Fed Funds Rate is greater than CPI

Fed Funds Interest Rate (Green bar) & Consumer Price Inflation Index (Red bar)

In 2023, wage and employment data will become even more important to watch as they will likely continue to have a large impact on overall inflation. Over the last year, unit labor costs increased 6.1%, plus the economy experienced a significant decline in labor productivity. While Amazon and other large technology companies have been announcing layoffs and reducing headcount, small and medium-sized companies have been on a hiring spree. Overall hiring has continued to exceed expectations and applications for jobless benefits has continued to be modest. However, forward looking job openings and the jobs-to-workers gap has been contracting. Additionally, wage inflation has begun to moderate from peak levels. The most recent Labor Department’s nonfarm payrolls report showed that wages rose 4.6% in December from a year earlier. This compares favorably to the 4.8% increase in November and the market expectations for a 5% increase.

Overall consumer price inflation does seem to be comfortably past the peak levels experienced in mid-2022. The most recent November report was 7.1% well below the 9.1% reported in June. The November CPI report also showed a small 0.1% increase from the previous month. Excluding food and energy, the gain was also a modest 0.2%, half the increase that the market was expecting. This was the second consecutive month that actual inflation results were better than expected.

Looking past the near-term headwinds of high expectations, elevated inflation, and risk of a recession, our long-term view on equities very much remains positive. Following a two-year drawdown, the fixed income market now offers reasonable yields and potential upside if interest rates decline later in the year.

Nicolet Wealth Management continues to maintain a disciplined long-term approach and is prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Although we believe it to be reliable as of the publication date and have sought to take reasonable care in its preparation, all information provided is FOR INFORMATIONAL PURPOSES ONLY and we make no representations or warranties regarding its accuracy, reliability, or completeness and assume no duty to make any updates in the event of future changes. Past performance may not be indicative of future market results. Any examples used (including specific securities) are generic and meant for illustration purposes only and are not, and should not be interpreted as, offers to buy or sell such securities. To the extent indices are referenced, please note that you are not able to invest directly in an index.

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services. Investment advisory services offered through Nicolet Advisory Services, LLC (dba Nicolet Wealth Management), a registered investment advisor. Securities offered through Private Client Services, LLC (“PCS”), member FINRA/SIPC. PCS is not affiliated with Nicolet National Bank or Nicolet Wealth Management.

All investments are subject to risks, including possible loss of principal, and are: NOT FDIC INSURED; NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY; AND NEITHER DEPOSITS OR OTHER OBLIGATIONS OF, NOR GUARANTEED BY, Nicolet National Bank or any of its affiliates. Neither Nicolet Advisory Services nor its affiliates offer tax or legal advice. You should consult with your legal and tax professionals before making investment decisions.