News & trends from Nicolet Insurance Services for crop farmers ~ Issue 1, 2023

Crop Insurance Enrollment Ends – 2023 Crop Year

March 15th is the deadline for farmers to make their crop insurance elections for the 2023 crop year. If you would like to add crops to your policy or change your current coverage, please let your insurance specialist know prior to March 15th. Existing

polices will automatically renew if you do not make changes.

April 29th, 2023 – Production Reporting Deadline

April 29th is the deadline for producers to report crop yields to their insurance specialist. If you insured your crops last year, and you have not reported your yields yet, please do so ASAP. Also, if you intend to add new crops to your policy for the 2023 crop year, we will need to build your actual production history (APH) for those new crops by April 29th. Please work with your insurance specialist to have all production reported by April 29th.

NEW 2023!! Oats Coverage Changes

Revenue coverage is now available for oats! The Actual Production History (APH) plan of insurance will no longer be available starting in 2023. Producers can now choose between Revenue Protection or Yield Protection plans of insurance. If you currently carry oats coverage, your coverage will automatically transition to Yield Protection for the 2023 crop year. New changes also allow for Enterprise Unit structure in 2023.

Scan for Oats Fact Sheet

NEW 2023!! Crop Insurance

Rebates for Planting Cover Crops

The Wisconsin Department of Agriculture Trade & Consumer Protection (DATCP) has partnered with USDA, to establish crop insurance rebates for planting cover crops. Producers may enroll acres planted to cover crops in the fall of 2022, which will be planted to an insurable crop in 2023. Eligible applicants will receive a $5 per acre insurance rebate on their 2023 crop insurance invoice for every acre of cover crop enrolled and verified in the program. Producers can apply online at the WI DATCP website. Enrollment ends 1/31/23.

Scan for more information WIDATCP

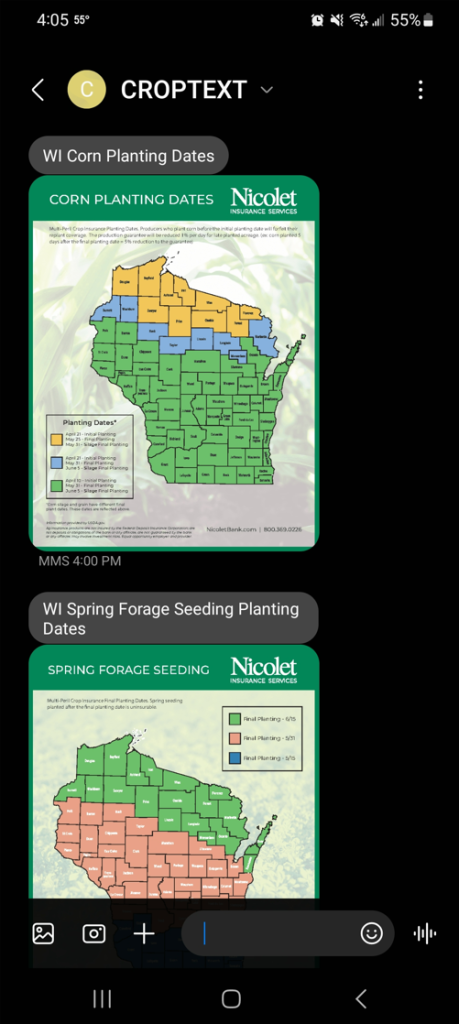

NEW 2023!! CROPTEXT

Crop farmers have a plethora of dates to remember every year. When is the earliest planting date for soybeans? When is the crop insurance acreage reporting deadline? When is the deadline to enroll in the crop insurance rebate program? When is the final planting date for corn? Keep things organized with CROPTEXT! CROPTEXT is a service designed to send text reminders to your cell phone, leading up to important crop insurance deadlines. To enroll, use your cell phone and text the keyword CROPTEXT to 920-313-4100. Or you can scan the QR code with your cell phone camera, wait for the text message to load, then hit send.

It’s that simple!

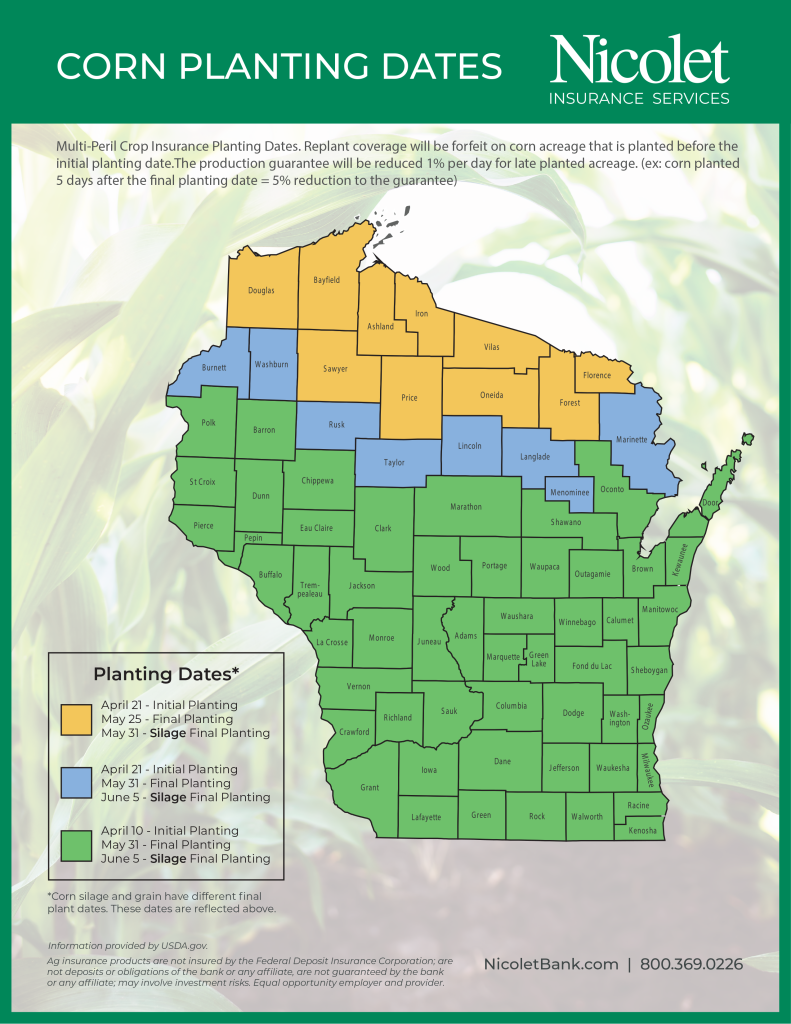

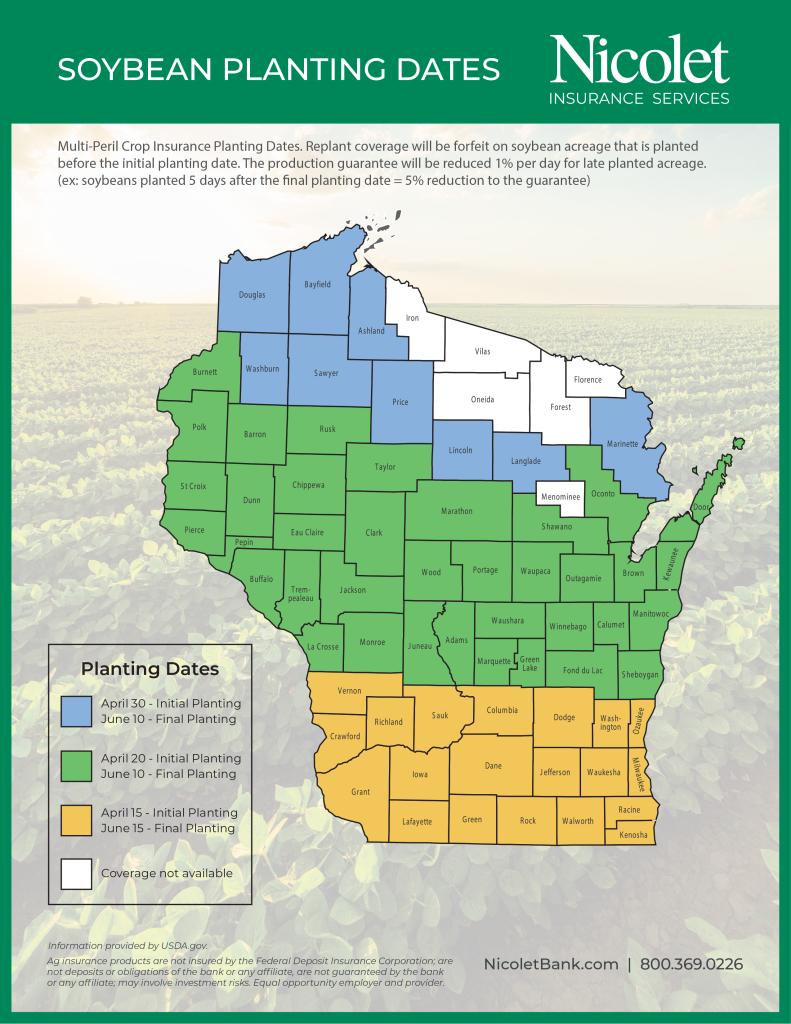

NEW 2023!! Initial Planting Date Changes – Corn & Soybeans

New initial planting dates have been created for the 2023 crop year. The initial planting date is the earliest date producers can plant a crop and still maintain replant coverage eligibility through their multi-peril crop insurance policy. Acreage planted before the initial planting date can still be insured in most cases; however, should you need to replant the crop for any reason, no replanting payment will be made.

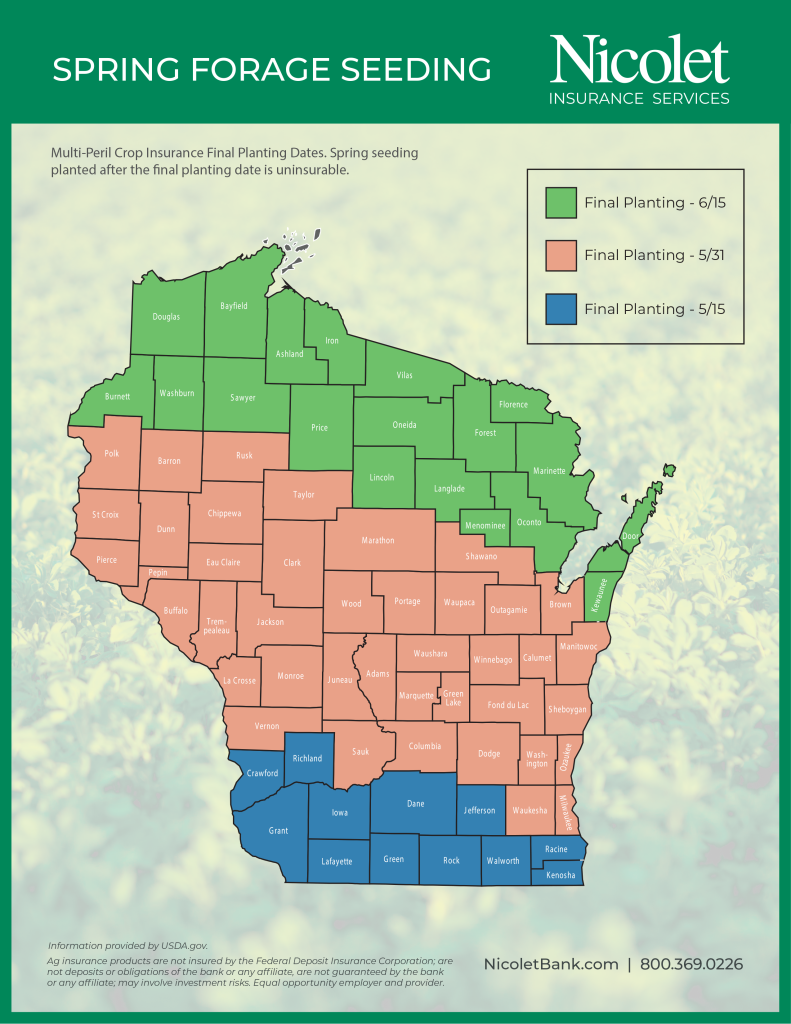

NEW 2023!! Final Planting Date Changes – Forage Seeding

The final planting dates for forage seeding have changed for the 2023 crop year. The final planting date is the last date producers can plant a crop and still maintain 100% of the production guarantee on their multi-peril crop insurance policy. Spring forage seeding planted after the final planting date is uninsurable. Fall forage seeding planted outside the insurable planting window for your county is uninsurable.

SEE PLANTING MAPS BELOW

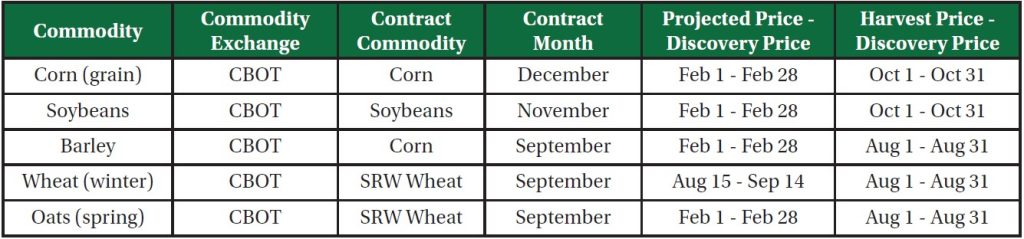

Projected Prices & Harvest Prices

The “projected price” is essentially an estimate of the future value of a commodity. The “harvest price” can be thought of as the actual value of the commodity at harvest. Projected prices are used to set crop insurance guarantees for crops in which revenue protection is available. Harvest prices are used in the determination of indemnities (revenue policies only). Projected prices & harvest prices are determined by averaging the daily settlement prices for the underlying commodity during the price discovery period. Shown below are the price discovery periods for crops in our area.

Crop Hail Coverage

The question is not IF it’s going to hail but when, where, and how bad? Often times when hail hits, it causes severe damage to isolated pockets of the crop. This damage may not be widespread enough to trigger a payment on your underlying multi-peril crop insurance policy. This is where crop hail coverage can fill the gap.

Crop hail policies provide extra coverage for that specific peril – Hail. Crop hail policies cover your crop on an acre-by-acre basis, and payments can be triggered with as little as 1% damage to your crop. Crop hail policies can be purchased as a “stand-alone” policy, or they can be coupled with your underlying multi-peril policy. Additional endorsements can be added to protect against wind damage, green snap, and extra harvest allowances that are incurred from harvesting damaged crops.

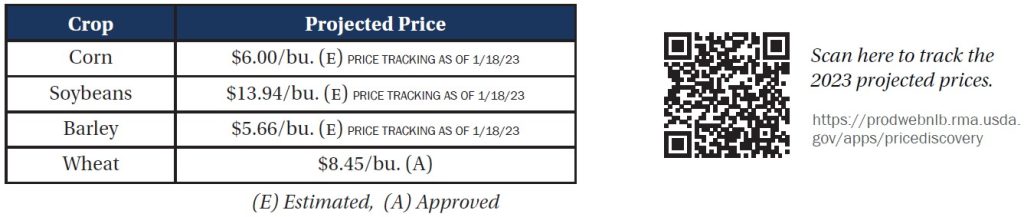

Post Application Coverage Endorsement- PACE: Corn

Corn farmers who “split-apply” nitrogen now have another option for insurance coverage. PACE provides payments for yield lost when producers are unable to apply the post-nitrogen application during the V3-V10 corn growth stages due to field conditions created by weather. PACE is now available in the following counties for the 2023 crop year.

Scan to view a USDA Fact Sheet on PACE.

ARC-County/PLC – 2023 Crop Year

Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) provide financial protections to farmers when crop prices or revenues drop substantially. ARC-County establishes an expected revenue for your county using historical yields & prices. ARC payments can be triggered if there is a substantial decline in the commodity price, or if your county experiences low yields. PLC on the other hand establishes a price floor, and payments are triggered if the national marketing year average price of the commodity falls below that price floor.

Producers can make their 2023 ARC/PLC elections at FSA now through March 15th, 2023. One thing to consider before going into FSA is, do you want to add Supplemental Coverage Option (SCO) to your crop insurance policy? SCO is a crop insurance option that has similarities to ARC-County. This is important because producers who sign up for SCO cannot elect ARC-County. We encourage all producers to talk with their crop insurance specialist before signing up for these FSA programs.

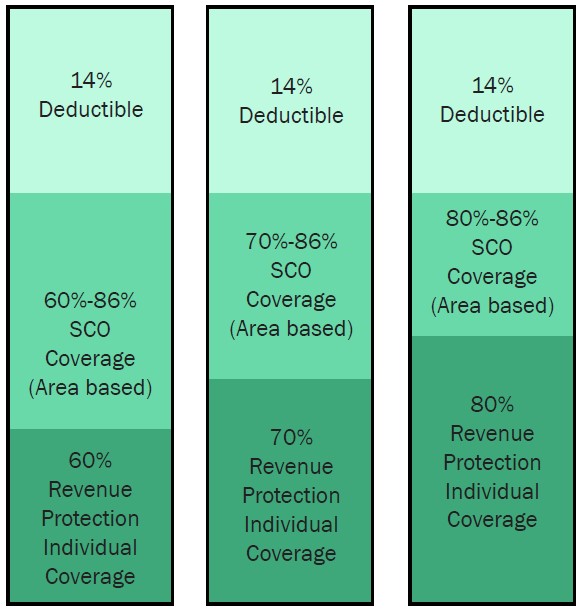

Supplemental Coverage Option (SCO)

Supplemental Coverage Option (SCO) is a crop insurance policy that triggers payments when the yield or crop revenue for your county drops below the county guarantees. SCO is designed to work in conjunction with your individual underlying policy. Your individual policy covers your farm specifically, while SCO provides higher levels of coverage on a county level basis.

The SCO band of coverage begins where your underlying MPCI coverage ends, and covers you up to 86%. If the final county yield or the final county revenue falls below the 86% guarantee, then your SCO policy triggers a payment. Producers looking to attain higher levels of coverage using a less costly insurance product may want to consider SCO.

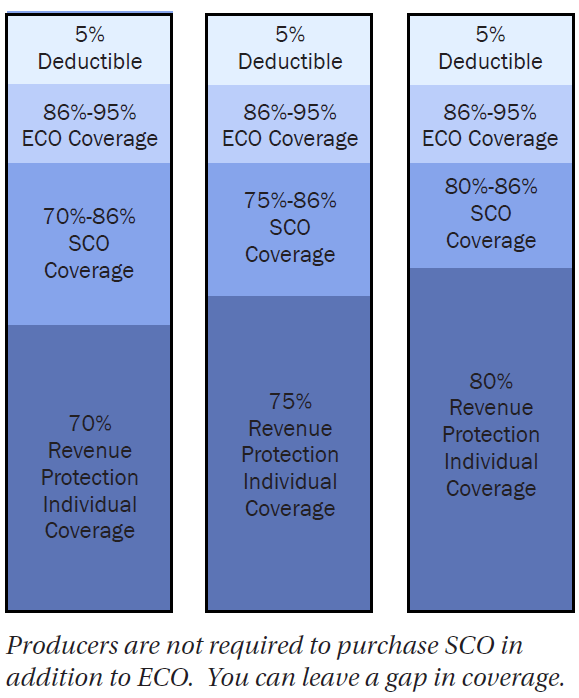

Enhanced Coverage Option (ECO)

Enhanced Coverage Option (ECO) is a crop insurance policy that goes one step beyond Supplemental Coverage Option (SCO), by allowing farmers to cover up to 90% or 95% of the expected county yield or revenue. ECO works in conjunction with your individual policy by adding county-based coverage on top beginning at 86%. ECO triggers payments when your county yield or county revenue falls below the 90% or 95% county guarantee. Below are examples of ways to use ECO with your underlying policy.

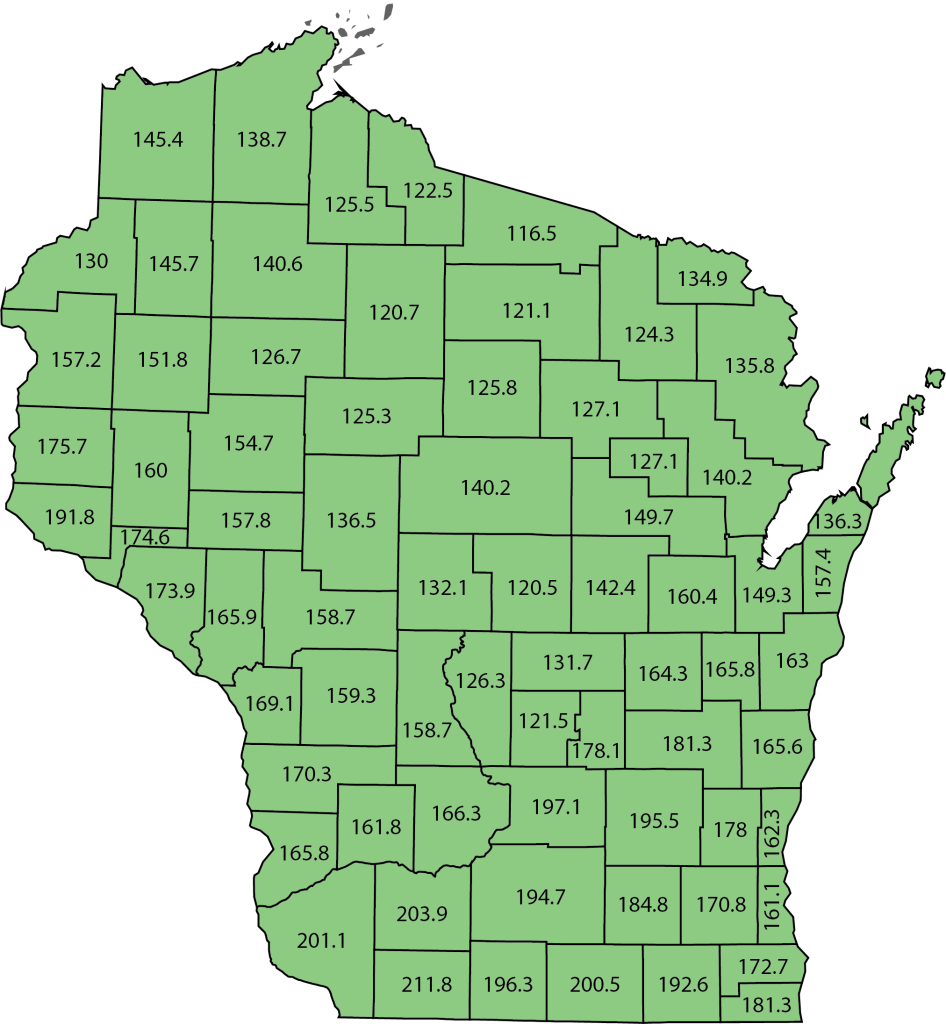

CORN

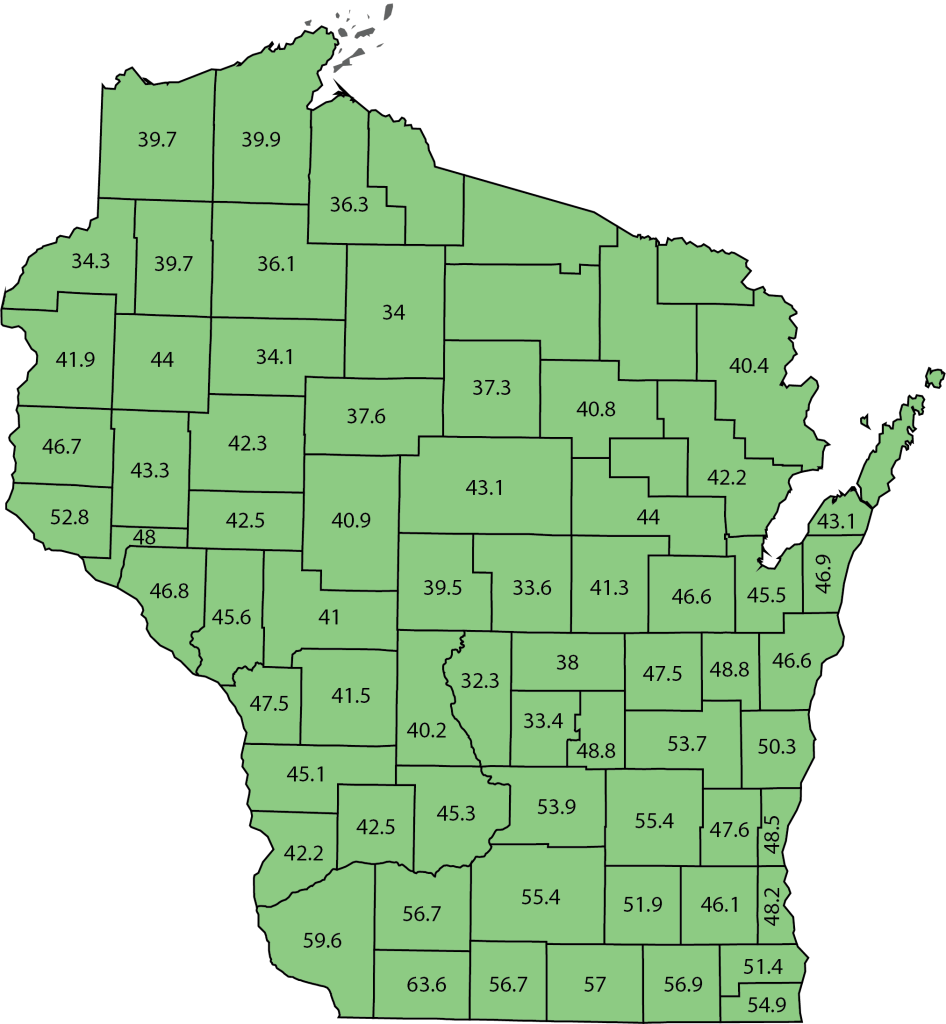

SOYBEANS

Ag Insurance products are not insured by the Federal Deposit Insurance Corporation; are not deposits or obligations of the bank or any affiliate; are not guaranteed by the bank or any affiliate; may involve investment risks. Equal opportunity employer and provider.