Nicolet Wealth Management Market Update

Thank you for your continued confidence in Nicolet. As the COVID-19 pandemic continues to create uncertainty in our lives, we will work hard to provide you with timely insights on market and economic conditions.

An estimated 160 million Americans voted in the 2020 presidential election. With two out of every three voting-eligible Americans casting a ballot, this was the highest voter turnout in 120 years. Unfortunately, the final outcome of the election is not yet clear due to pending recounts, runoffs, and legal challenges.

However, the one clear verdict coming from this election is that no one party won, and we are headed for a divided government. The capital markets thus far have responded positively to the prospect of a Democrat in the White House, a Republican Senate and a Democrat House. A divided government likely leads to more fiscal stimulus and infrastructure spending, but no growth-impeding tax hikes and other progressive agenda items. The prospect of gridlock, and the reduced likelihood of sweeping regulatory and major policy changes including taxes, has driven the S&P 500 Equity Index, which includes nearly all of the largest publicly traded stocks in the U.S., up over 10% since shortly before the election.

Overwhelmed by the focus on the election was a strong third quarter corporate earnings season. Nearly 90% of the companies within the S&P 500 reported earnings that were higher than expected. Results continue to show sequential improvements, led by consumer staples, technology, health care, and utilities. The rebound in corporate profits coincides with the record high pace of growth seen in the economy.

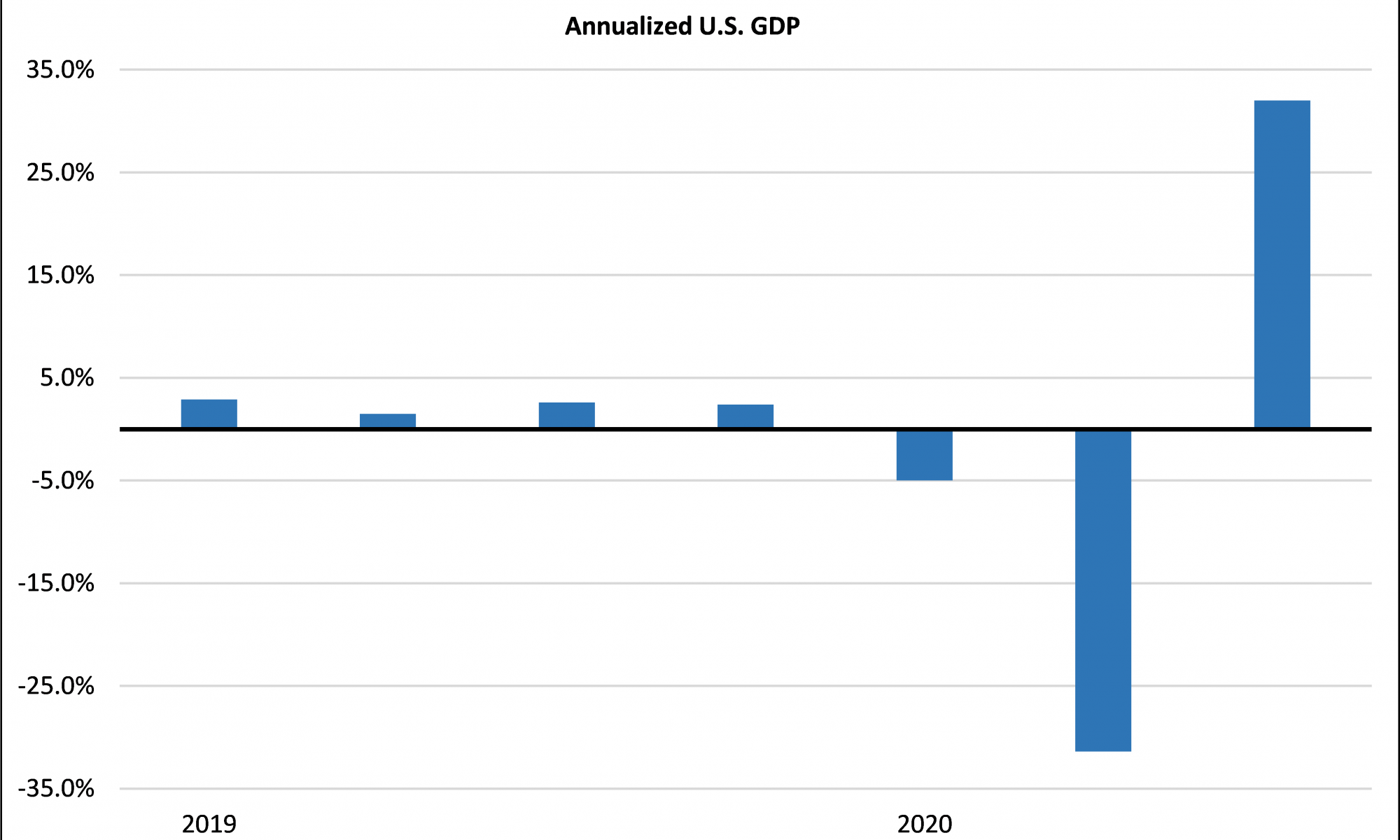

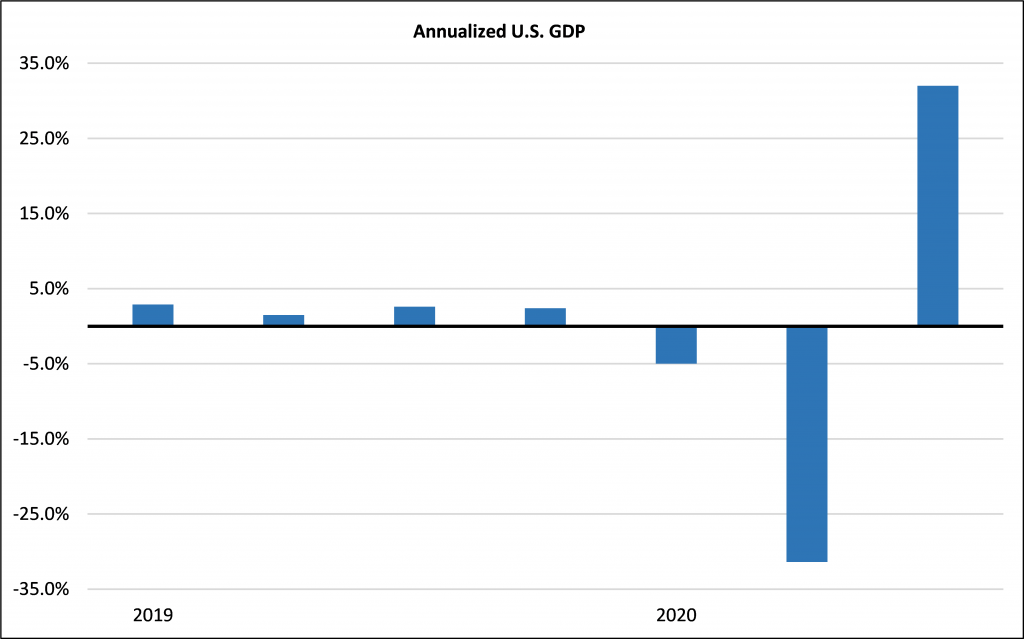

The U.S. economy grew at an annualized rate of 33% in the third quarter, following a sharp decline in activity during the first half of the year. The strong rebound in growth was driven by pent-up demand for consumer goods and better manufacturing activity, while the service sector remains weak.

Source: U.S. Department of Commerce

The U.S. employment market also continues to improve. Over the last six months, about half of the 22 million jobs lost due to the pandemic have been regained. The unemployment rate has dropped to 6.9%, down from 7.9% in September and well below the peak 14.7%, witnessed in April. Hopefully, with time and continued progress on the efforts to develop a vaccine, the remaining 10 million lost jobs will be regained.

While it remains impossible to know with certainty what the final 2020 election results will ultimately mean for the markets, especially amidst a global pandemic, Nicolet Wealth Management continues to maintain a disciplined long-term approach and is prepared for a range of potential outcomes. If you would like to discuss your account in more detail, please contact us at your convenience.

Nicolet Wealth Management

Investment and insurance products:

Are Not FDIC Insured

May Lose Value

Are Not Bank Guaranteed

Are Not Deposits

Are Not Guaranteed by Any Federal Government Entity

Are Not a Condition to Any Banking Service or Activity

Nicolet Wealth Management is a brand name that refers to Nicolet National Bank and certain of its departments and affiliates that provide investment advisory, trust, retirement planning and insurance services.

Nicolet Advisory Services, LLC, is an investment adviser, registered with the U.S. Securities and Exchange Commission, and an affiliate of Nicolet National Bank. Nicolet Advisory Services, LLC recommends the brokerage and custodial services of TD Ameritrade, Inc., member FINRA/SIPC. TD Ameritrade is not affiliated in any way with Nicolet National Bank or its affiliated companies.